High Insider Ownership Growth Stocks On The Indian Exchange For May 2024

The Indian stock market has shown robust growth, climbing 1.7% in the past week and an impressive 45% over the last twelve months, with earnings expected to grow by 16% annually. In such a flourishing market, stocks with high insider ownership can be particularly appealing as they often indicate that company leaders have a vested interest in the business's success.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 27.9% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | 46.2% |

Aether Industries (NSEI:AETHER) | 31.1% | 32% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35.5% |

Let's explore several standout options from the results in the screener.

Dixon Technologies (India)

Simply Wall St Growth Rating: ★★★★★★

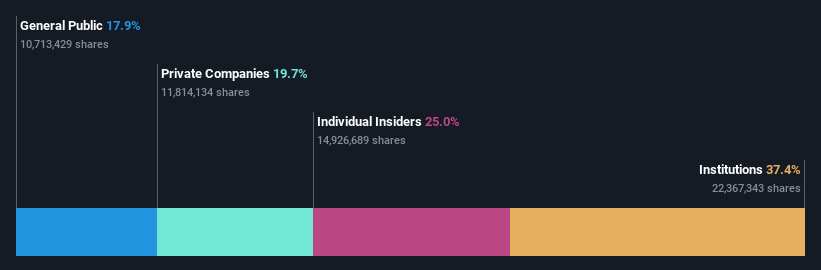

Overview: Dixon Technologies (India) Limited specializes in providing electronic manufacturing services across India, with a market capitalization of approximately ₹554.35 billion.

Operations: The company's revenue is generated from various segments including home appliances (₹12.05 billion), security systems (₹6.33 billion), lighting products (₹7.87 billion), mobile and EMS division (₹109.19 billion), and consumer electronics & appliances (₹41.48 billion).

Insider Ownership: 24.9%

Revenue Growth Forecast: 22.2% p.a.

Dixon Technologies (India) Limited, a key manufacturer in the consumer electronics sector, has shown robust growth with a 43.9% increase in earnings over the past year and is expected to continue this trend with forecasted annual earnings growth of 27.91% and revenue growth of 22.2%. Recently, Dixon entered into an MOU with Acerpure India for manufacturing consumer appliances, expanding its production capabilities. Despite substantial insider ownership not highlighted, these factors affirm Dixon's strong position in the market.

Dive into the specifics of Dixon Technologies (India) here with our thorough growth forecast report.

Jupiter Wagons

Simply Wall St Growth Rating: ★★★★★★

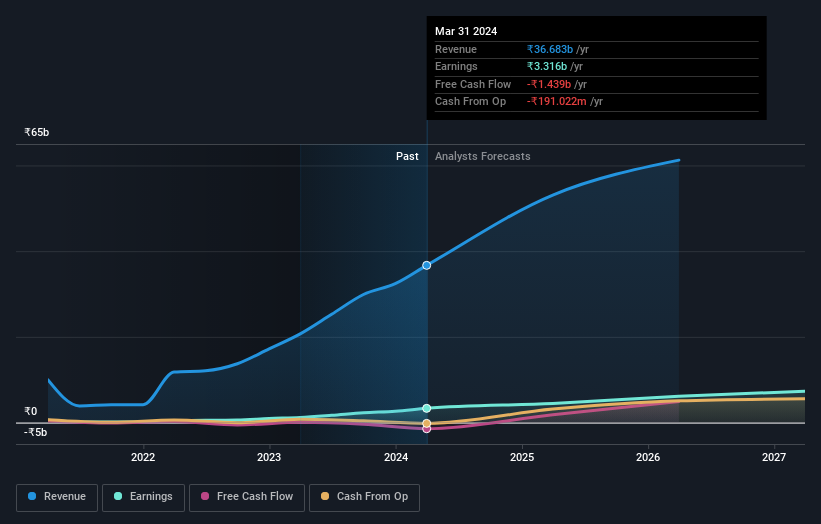

Overview: Jupiter Wagons Limited is a company that manufactures and sells mobility solutions both in India and internationally, with a market capitalization of approximately ₹232.74 billion.

Operations: The firm's revenue from auto manufacturers totals ₹36.44 billion.

Insider Ownership: 11.1%

Revenue Growth Forecast: 21.6% p.a.

Jupiter Wagons Limited, an Indian railcar manufacturer, has demonstrated significant growth with a recent earnings surge of 174.5% over the past year and is forecasted to continue expanding at a rate of 27.21% annually. Despite high insider ownership typically signaling confidence, the company's share price has been highly volatile recently. Additionally, Jupiter Wagons secured a substantial INR 9.57 billion contract from the Ministry of Railways, reinforcing its strong market position and operational capabilities.

Persistent Systems

Simply Wall St Growth Rating: ★★★★☆☆

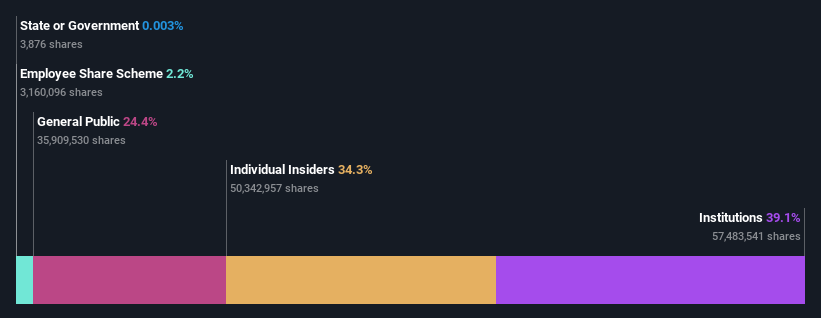

Overview: Persistent Systems Limited operates globally, offering software products, services, and technology solutions with a market capitalization of approximately ₹548.92 billion.

Operations: Persistent Systems generates revenue from three primary segments: Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

Insider Ownership: 34.3%

Revenue Growth Forecast: 13.2% p.a.

Persistent Systems, a key player in India's tech sector, has shown robust growth with earnings increasing by 27% annually over the past five years. Despite recent executive reshuffles, including CFO and Chief Growth Officer appointments, the company maintains high insider ownership and is expected to outpace the Indian market with a 13.2% annual revenue increase. However, its earnings growth forecast at 17.9% per year is below the significant 20% threshold.

Click to explore a detailed breakdown of our findings in Persistent Systems' earnings growth report.

Turning Ideas Into Actions

Dive into all 79 of the Fast Growing Indian Companies With High Insider Ownership we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:DIXON NSEI:JWL and NSEI:PERSISTENT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance