High Insider Ownership Growth Companies On Chinese Exchange June 2024

As of June 2024, the Chinese stock market is experiencing a slight downturn, with key indices like the Shanghai Composite and the CSI 300 facing declines amid economic slowdown concerns. This backdrop makes it particularly interesting to explore companies with high insider ownership, as such stakes can signal confidence from those most familiar with the enterprises' inner workings and prospects.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 28.5% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Let's explore several standout options from the results in the screener.

Suning.com

Simply Wall St Growth Rating: ★★★★☆☆

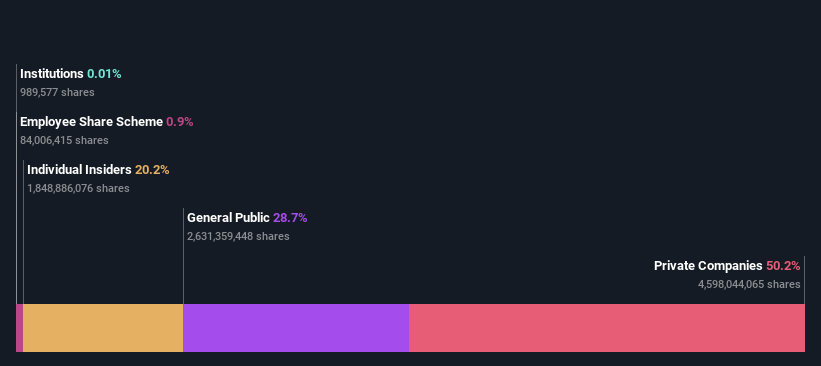

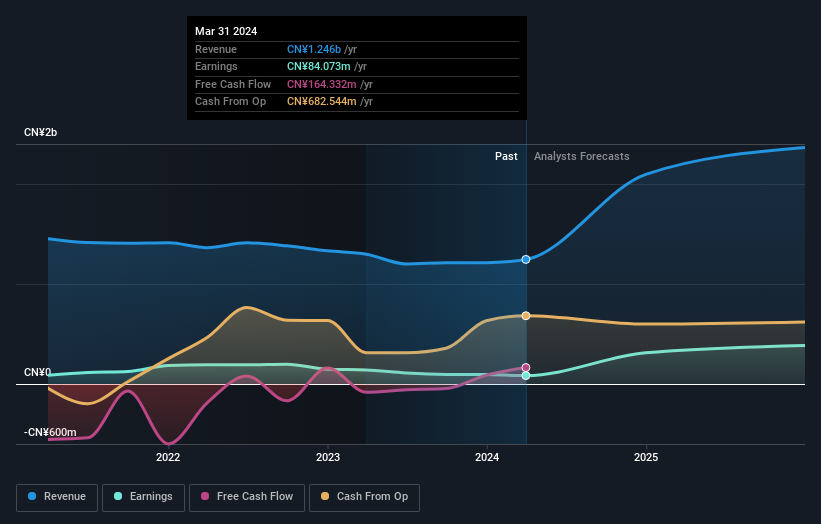

Overview: Suning.com Co., Ltd. operates as a retail company in China, with a market capitalization of approximately CN¥11.82 billion.

Operations: The company generates its revenue through retail operations in China.

Insider Ownership: 20.2%

Suning.com is valued significantly below its estimated fair value, suggesting potential for growth. Despite a recent net loss reported in Q1 2024, with sales down from the previous year, the company's earnings are expected to grow substantially at an annual rate of 105.42%. Additionally, Suning.com's revenue is projected to increase by 15% annually, outpacing the Chinese market average. However, its forecasted return on equity remains low at 5.6%, indicating potential challenges in generating shareholder returns efficiently.

Unlock comprehensive insights into our analysis of Suning.com stock in this growth report.

Upon reviewing our latest valuation report, Suning.com's share price might be too pessimistic.

Harbin Jiuzhou GroupLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harbin Jiuzhou Group Ltd, operating under the ticker SZSE:300040, is a company that specializes in manufacturing and supplying electrical equipment and energy efficiency management solutions both domestically and internationally, with a market capitalization of approximately CN¥3.61 billion.

Operations: The company generates revenue primarily through the manufacture and supply of electrical equipment and energy efficiency management solutions.

Insider Ownership: 29.0%

Harbin Jiuzhou Group Ltd., a Chinese company with substantial insider ownership, is poised for significant growth with earnings forecasted to increase by 63.8% annually. Despite this, it faces challenges such as a high debt level and recent declines in profit margins, from 10.8% to 6.7%. Recent shareholder meetings have focused on strategic financial maneuvers including dividends and share buybacks, indicating active management engagement in enhancing shareholder value amidst a volatile share price environment.

Wuxi Longsheng TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

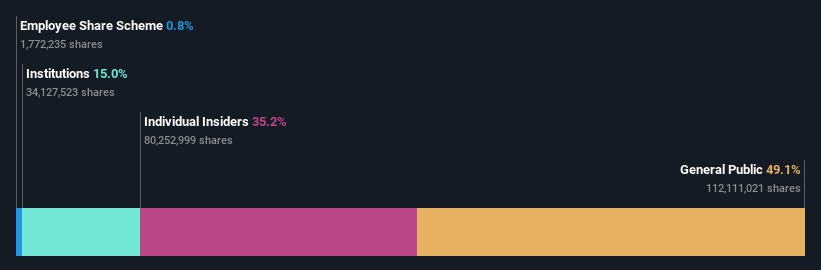

Overview: Wuxi Longsheng Technology Co., Ltd specializes in the manufacturing of auto parts in China, with a market capitalization of approximately CN¥4.35 billion.

Operations: The company primarily generates revenue through the production of automobile components.

Insider Ownership: 35.2%

Wuxi Longsheng Technology Co.,Ltd, a growth-oriented firm in China with high insider ownership, is set to outpace the market with its revenue and earnings projected to grow by 25% and 31.24% per year respectively. Despite its recent exclusion from the S&P Global BMI Index, the company has demonstrated robust financial performance with significant earnings growth of 82.8% over the past year and a stable P/E ratio at 27.4x, below market average. However, its dividend coverage remains weak amidst these gains.

Seize The Opportunity

Embark on your investment journey to our 365 Fast Growing Chinese Companies With High Insider Ownership selection here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:002024 SZSE:300040 and SZSE:300680.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance