High Insider Ownership Growth Companies On US Exchange In June 2024

As of June 2024, the U.S. stock market presents a mixed landscape, with sectors like technology experiencing some volatility while overall economic indicators suggest robust business activity. In this environment, growth companies with high insider ownership might offer a compelling narrative as these insiders often have a deep commitment to their companies' long-term success.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Here we highlight a subset of our preferred stocks from the screener.

AerSale

Simply Wall St Growth Rating: ★★★★☆☆

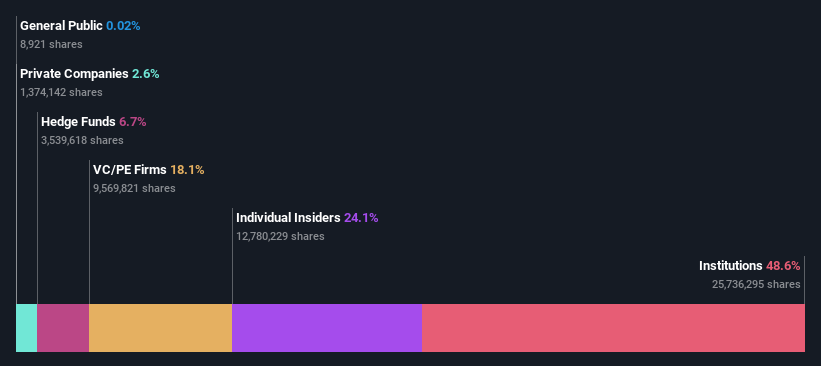

Overview: AerSale Corporation specializes in supplying aftermarket commercial aircraft, engines, and components, along with maintenance services to a global clientele including airlines, leasing entities, manufacturers, and government bodies; it has a market capitalization of approximately $349.86 million.

Operations: AerSale's revenue streams include Tech Ops - MRO Services at $101.23 million, Tech Ops - Product Sales at $19.33 million, Asset Management Solutions - Engine at $153.68 million, and Asset Management Solutions - Aircraft at $72.32 million.

Insider Ownership: 24.1%

AerSale, a company focused on the aviation industry, recently expanded its operations by opening a new facility in Millington, Tennessee. This move is set to enhance its MRO capabilities significantly. Despite experiencing a dip in net profit margins from 7.3% to 0.2%, AerSale's insider activity remains robust with substantial buying over the past three months and no significant selling, reflecting strong internal confidence. The company trades at a value perceived as significantly below its fair value and forecasts suggest an aggressive earnings growth of 106.1% annually, outpacing the US market prediction of 14.9%.

Amazon.com

Simply Wall St Growth Rating: ★★★★☆☆

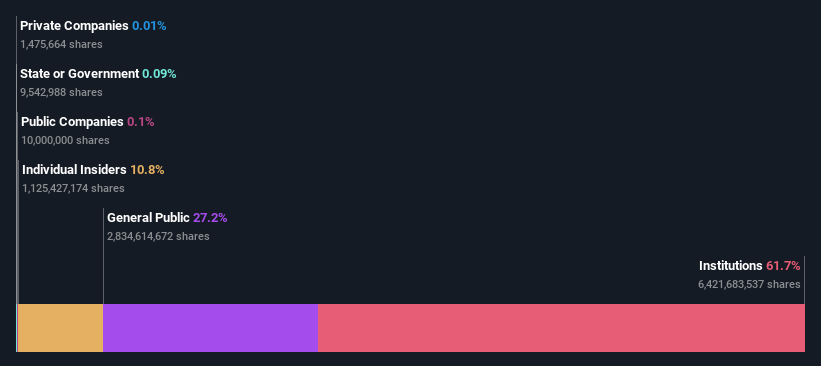

Overview: Amazon.com, Inc. operates as a global online retailer and provides advertising and subscription services through both online and physical stores, with a market capitalization of approximately $1.90 trillion.

Operations: The company generates revenue primarily through three segments: North America ($362.29 billion), International ($134.01 billion), and Amazon Web Services (AWS) ($94.44 billion).

Insider Ownership: 10.8%

Amazon.com, a notable entity in the e-commerce and cloud computing sectors, is anticipated to experience robust growth with earnings forecasted to increase by 21.4% annually. Despite low projected returns on equity at 18.1% in three years, Amazon's revenue growth is expected to surpass the US market average, expanding at a rate of 9.8% per year. The company's recent technological innovations aim to streamline procurement processes for businesses through new features like the Amazon Business App Center and integrated quoting systems, enhancing its appeal to large-scale enterprises and potentially driving further growth.

Click here to discover the nuances of Amazon.com with our detailed analytical future growth report.

The valuation report we've compiled suggests that Amazon.com's current price could be inflated.

Canadian Solar

Simply Wall St Growth Rating: ★★★★☆☆

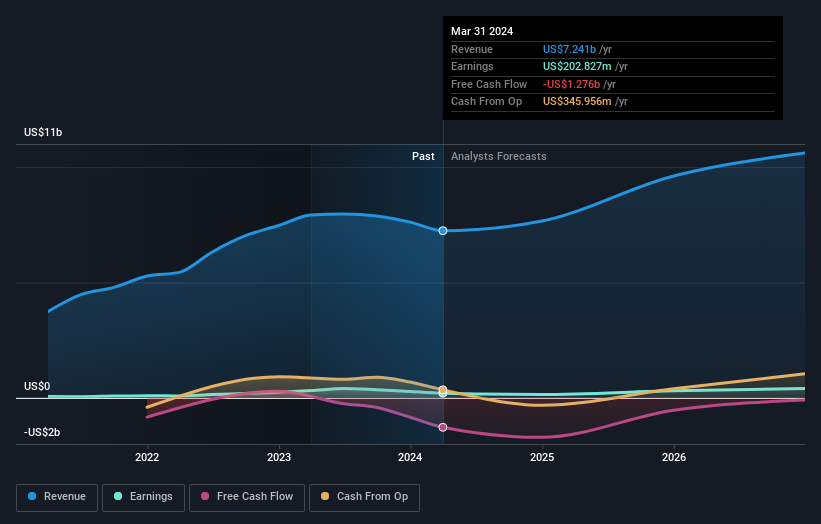

Overview: Canadian Solar Inc. operates globally, offering solar energy and battery storage solutions across Asia, the Americas, and Europe, with a market capitalization of approximately $1.07 billion.

Operations: The company generates revenue primarily through its CSi Solar segment, which brought in $6.86 billion, and its Recurrent Energy segment, contributing $0.52 billion.

Insider Ownership: 21.2%

Canadian Solar, amidst a challenging financial landscape with a recent downturn in net income and revised lower revenue forecasts, continues to innovate and expand its market presence. Recent strategic partnerships in California and Japan, alongside the launch of new residential energy storage solutions like the EP Cube, underscore its commitment to growth in renewable energy sectors. Despite these promising developments, concerns about shareholder dilution and debt levels persist. The company's earnings are expected to grow by 23.33% annually, outpacing the US market forecast.

Turning Ideas Into Actions

Explore the 184 names from our Fast Growing US Companies With High Insider Ownership screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:ASLE NasdaqGS:AMZN and NasdaqGS:CSIQ.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance