High Insider Ownership Growth Companies On Chinese Exchanges In June 2024

As of June 2024, Chinese markets are experiencing a mix of challenges and opportunities, with industrial production slowing and retail sales showing stronger growth. This complex economic backdrop makes it particularly interesting to examine growth companies in China, especially those with high insider ownership which can signal strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Here's a peek at a few of the choices from the screener.

Tongqinglou Catering

Simply Wall St Growth Rating: ★★★★★☆

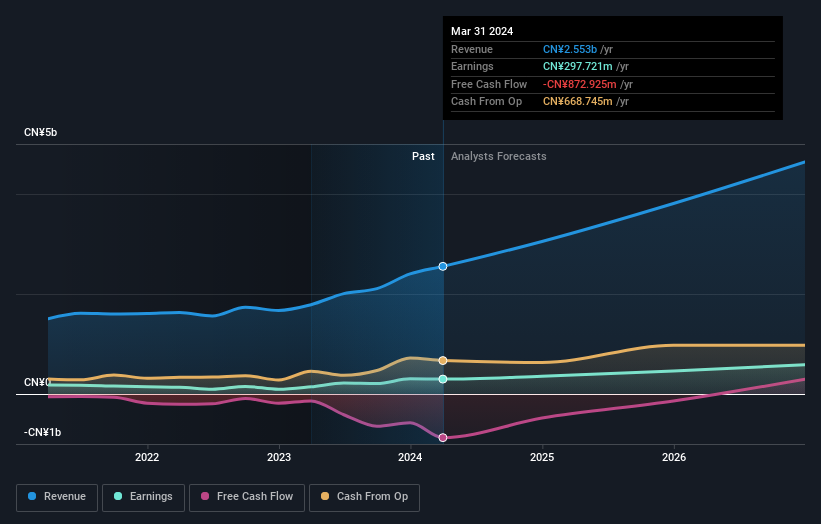

Overview: Tongqinglou Catering Co., Ltd. is a company based in China that offers catering services, with a market capitalization of approximately CN¥6.07 billion.

Operations: Tongqinglou Catering generates revenue primarily through its catering and accommodation services, totaling CN¥2.11 billion.

Insider Ownership: 24.5%

Revenue Growth Forecast: 21.6% p.a.

Tongqinglou Catering, a company with high insider ownership, demonstrated robust first-quarter sales growth, reporting CNY 690.99 million in revenue, up from CNY 539.79 million year-over-year. Despite a slight dip in net income to CNY 65.9 million, the firm is positioned for significant future growth with expected annual earnings increases of 24.7% and revenue growth of 21.6%. Trading at 52.1% below estimated fair value suggests potential undervaluation relative to its financial trajectory and market peers.

Bozhon Precision Industry TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

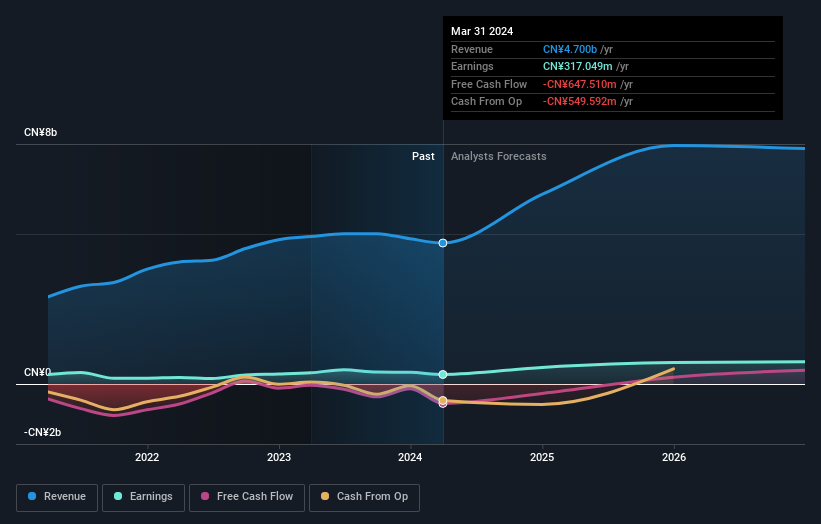

Overview: BOZHON Precision Industry Technology Co., Ltd specializes in the development, design, production, and sale of automation equipment and components both domestically and internationally, with a market capitalization of approximately CN¥9.37 billion.

Operations: The company generates CN¥4.70 billion in revenue from its industrial automation and controls segment.

Insider Ownership: 29.3%

Revenue Growth Forecast: 21.1% p.a.

Bozhon Precision Industry Technology Co., Ltd. has experienced a challenging quarter with a reported net loss of CNY 21.28 million, contrasting sharply with the previous year's net income of CNY 52.08 million. Despite this setback, the company's revenue and earnings growth forecasts remain optimistic, expected to outpace the broader Chinese market significantly. Insider ownership remains stable with no substantial buying or selling reported recently, aligning interests with long-term shareholders even as short-term challenges persist.

Jiangsu Aisen Semiconductor MaterialLtd

Simply Wall St Growth Rating: ★★★★★☆

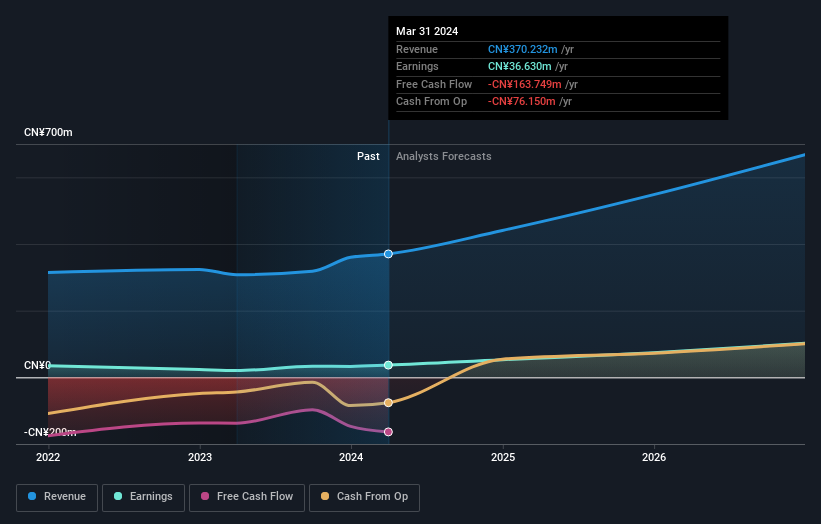

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. operates in the semiconductor industry and has a market capitalization of approximately CN¥3.92 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 33.6%

Revenue Growth Forecast: 21.1% p.a.

Jiangsu Aisen Semiconductor Material Co.,Ltd. has demonstrated robust growth, with earnings increasing by 81% over the past year and revenue growth projected at 21.1% annually, outpacing the broader Chinese market. Despite a forecast of low return on equity in three years and a highly volatile share price recently, the company's financial performance remains strong with significant expected earnings growth and high-quality non-cash earnings. Recent corporate activities include a shareholder meeting scheduled for June 12, 2024, and completion of a stock buyback program in March.

Turning Ideas Into Actions

Gain an insight into the universe of 363 Fast Growing Chinese Companies With High Insider Ownership by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:605108 SHSE:688097 and SHSE:688720.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance