High Insider Ownership Growth Companies On KRX To Watch In June 2024

The South Korean market has shown modest growth, rising 5.7% over the past year, with a flat performance in the last week and expectations of a robust 29% annual earnings growth. In this context, stocks with high insider ownership can be particularly compelling, as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

SamyoungLtd (KOSE:A003720) | 25.1% | 30.4% |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's take a closer look at a couple of our picks from the screened companies.

ADTechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: ADTechnology Co., Ltd., based in South Korea, specializes in the design and development of semiconductor devices, with a market capitalization of approximately ₩361.64 billion.

Operations: The company generates its revenue primarily from the design and development of semiconductor devices.

Insider Ownership: 18.5%

ADTechnologyLtd, amidst a landscape of high insider ownership growth companies in South Korea, showcases promising prospects with its anticipated profitability within three years. Notably, the company's revenue is expected to surge at 37.4% annually, significantly outpacing the Korean market average of 10.5%. Despite a lack of recent insider trading activity, ADTechnologyLtd's robust forecasted earnings growth rate of 167.82% annually underscores its potential as an emerging leader in its sector.

Click to explore a detailed breakdown of our findings in ADTechnologyLtd's earnings growth report.

The valuation report we've compiled suggests that ADTechnologyLtd's current price could be inflated.

PharmaResearch

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company based in South Korea, with operations primarily focused on the development and manufacturing of pharmaceutical products, and a market capitalization of approximately ₩1.53 trillion.

Operations: The company generates its revenue primarily from the development and manufacturing of pharmaceutical products in South Korea.

Insider Ownership: 39.1%

PharmaResearch, a growth-oriented firm in South Korea with high insider ownership, is poised for notable expansion. Analysts predict a 23.5% potential increase in its stock price, currently trading at 62.1% below its estimated fair value. Despite experiencing share dilution over the past year and having a highly volatile share price recently, the company's revenue is expected to grow by 16.6% annually, outperforming the Korean market forecast of 10.5%. Moreover, PharmaResearch's earnings are set to rise by 20.86% per year with an anticipated strong return on equity of 21.1% in three years.

Jahwa Electronics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jahwa Electronics Co., Ltd specializes in manufacturing and selling precision electronic components, operating both in South Korea and internationally, with a market capitalization of approximately ₩522.90 billion.

Operations: The company generates revenue through the manufacture and sale of precision electronic components across domestic and international markets.

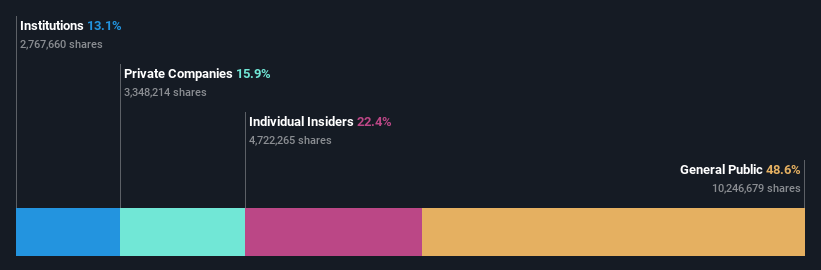

Insider Ownership: 22.4%

Jahwa Electronics, a South Korean company with significant insider ownership, has recently turned profitable. Its earnings are projected to increase by 39.9% annually, outpacing the local market's forecast of 28.9%. Despite this robust growth, its revenue growth at 17% per year is below the high-growth benchmark of 20% but still exceeds Korea's average market growth rate of 10.5%. However, its financial leverage is concerning as earnings do not adequately cover interest payments.

Next Steps

Unlock our comprehensive list of 86 Fast Growing KRX Companies With High Insider Ownership by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A200710 KOSDAQ:A214450 and KOSE:A033240.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance