Hershey (HSY) Fuels Innovation With Vegan Chocolate in Canada

The Hershey Company HSY has solidified its brand position through regular innovation and prudent acquisitions. The company has been focused on catering to consumers’ evolving needs and preferences, both domestic and international. Incidentally, Hershey Canada (a wholly owned subsidiary of The Hershey Company) unveiled the launch of HERSHEY'S OAT MADE — its first plant-based chocolate.

Consumers’ growing inclination toward health and wellness has spiked up the demand for plant-based food options such as plant-based protein and now even plant-based chocolate. One among every four Canadians has been looking to include plant-based alternatives in their diet.

HERSHEY'S OAT MADE bars are a suitable yet tasty solution in response to the rising demand for plant-based food. These bars, which will be available in Creamy and Almond & Sea Salt flavors, will come in a totally vegan format while retaining Hershey’s classic, smooth and creamy palate. This innovation is likely to bolster revenues of Hershey Canada, which works well for the company on the whole.

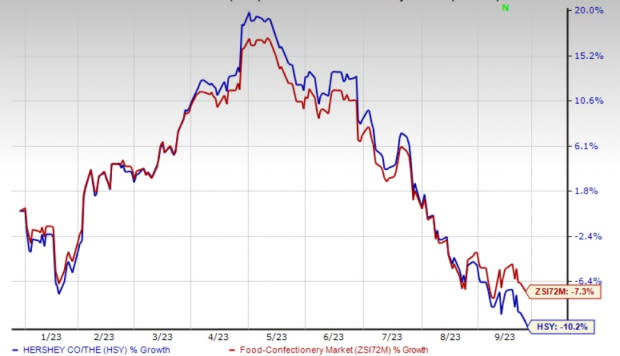

Image Source: Zacks Investment Research

Brand Strength, a Key Catalyst

Hershey is the largest producer of quality chocolate products in the United States. It markets some of the world’s leading brands, which enjoy widespread consumer acceptance. The company is also a global leader in sugar confectionery products, which is an attractive category as confectionery products are easily available, affordable and highly indulgent.

Hershey’s core brands — Hershey’s, Reese’s, Hershey’s Kisses, Jolly Rancher, Brookside, Sofit and Ice Breakers — have been growing strongly due to advertising investments, in-store merchandising, and programming and innovation. Hershey regularly brings innovation to its core brands to meet consumer demand and needs that are not addressed by its current portfolio.

Moreover, HSY is committed to supporting brands through solid media marketing. An important strategy of the company is to create a unique and holistic portfolio for every season, which can meet consumers’ seasonal shopping needs.

Hershey has also been undertaking buyouts to augment portfolio strength and boost revenues. In April 2023, the company signed an agreement to acquire two production facilities from Weaver Popcorn Manufacturing — a well-known leader in popcorn production and co-packing and a co-manufacturer of Hershey’s SkinnyPop brand.

SkinnyPop has been witnessing impressive retail sales growth for ready-to-eat popcorn in the past three years. The move is likely to help Hershey sustain its robust growth in the SkinnyPop brand through supply-chain expansion. In December 2021, Hershey acquired Dot’s Pretzels LLC — the owner of Dot’s Homestyle Pretzels, a leading brand in the pretzel category. The addition of Dot’s Pretzels is a perfect match for Hershey’s growing salty snacking portfolio.

The company also purchased Pretzels Inc. from an affiliate of Peak Rock Capital. The acquisition further expands Hershey’s snacking and production capabilities. Dot’s Pretzel’s performance remained solid, with retail sales growth of 23.6% in the second quarter of 2023, resulting in a pretzel category share gain of 120 basis points.

Wrapping Up

A focus on innovation, together with efficient pricing, is likely to work well for this Zacks Rank #3 (Hold) company amid high selling, marketing and administrative expenses. For 2023, Hershey anticipates net sales growth of nearly 8% and adjusted EPS growth of 11-12%.

Shares of HSY have tumbled 10.2% year to date compared with the industry’s decline of 7.3%.

Solid Consumer Staple Picks

e.l.f. Beauty ELF, a cosmetic and skin care product company, currently sports a Zacks Rank #1 (Strong Buy. ELF has a trailing four-quarter earnings surprise of 108.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here

The Zacks Consensus Estimate for e.l.f. Beauty’s current fiscal-year sales suggests growth of 64.6% from the corresponding year-ago reported figure.

Flowers Foods FLO, a packaged bakery food product company, currently has a Zacks Rank #2 (Buy). FLO has a trailing four-quarter earnings surprise of 7.6%, on average.

The Zacks Consensus Estimate for Flowers Foods’ current fiscal-year sales suggests growth of 6.7% from the year-ago reported number.

Inter Parfums IPAR, which manufactures, markets and distributes a range of fragrances and fragrance-related products, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales indicates 19.7% growth from the year-ago reported figure. IPAR has a trailing four-quarter earnings surprise of 45.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance