Here's Why Shareholders May Want To Be Cautious With Increasing Atomera Incorporated's (NASDAQ:ATOM) CEO Pay Packet

Key Insights

Atomera will host its Annual General Meeting on 1st of May

Salary of US$417.7k is part of CEO Scott Bibaud's total remuneration

The total compensation is similar to the average for the industry

Over the past three years, Atomera's EPS fell by 3.4% and over the past three years, the total loss to shareholders 74%

The underwhelming share price performance of Atomera Incorporated (NASDAQ:ATOM) in the past three years would have disappointed many shareholders. Per share earnings growth is also lacking, despite revenue growth. The AGM coming up on 1st of May will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Atomera

Comparing Atomera Incorporated's CEO Compensation With The Industry

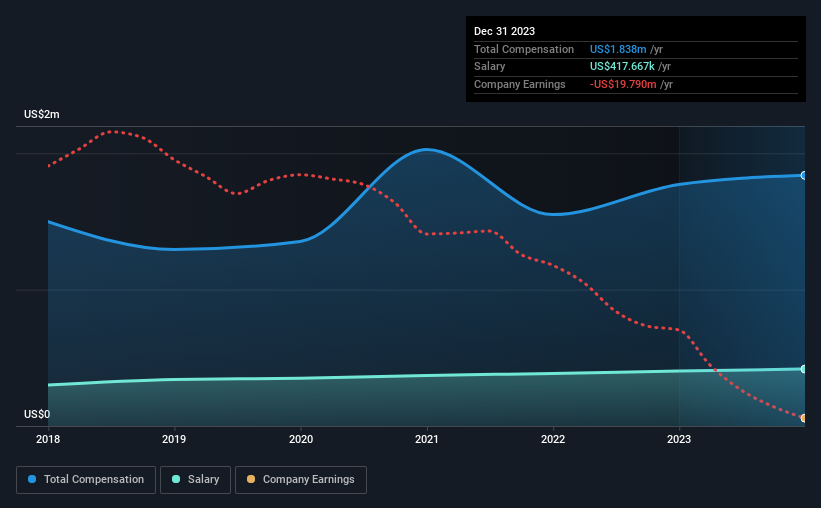

At the time of writing, our data shows that Atomera Incorporated has a market capitalization of US$151m, and reported total annual CEO compensation of US$1.8m for the year to December 2023. That's just a smallish increase of 3.8% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$418k.

On examining similar-sized companies in the American Semiconductor industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$1.5m. So it looks like Atomera compensates Scott Bibaud in line with the median for the industry. Furthermore, Scott Bibaud directly owns US$2.0m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$418k | US$403k | 23% |

Other | US$1.4m | US$1.4m | 77% |

Total Compensation | US$1.8m | US$1.8m | 100% |

Talking in terms of the industry, salary represented approximately 11% of total compensation out of all the companies we analyzed, while other remuneration made up 89% of the pie. Atomera is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Atomera Incorporated's Growth Numbers

Over the last three years, Atomera Incorporated has shrunk its earnings per share by 3.4% per year. It achieved revenue growth of 44% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Atomera Incorporated Been A Good Investment?

The return of -74% over three years would not have pleased Atomera Incorporated shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 5 warning signs for Atomera (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance