Here's Why You Should Retain Inari Medical (NARI) for Now

Inari Medical, Inc. NARI is well-poised for growth, backed by a huge market opportunity for its products and its commitment to understanding the venous system. However, its dependency on the adoption of products is concerning.

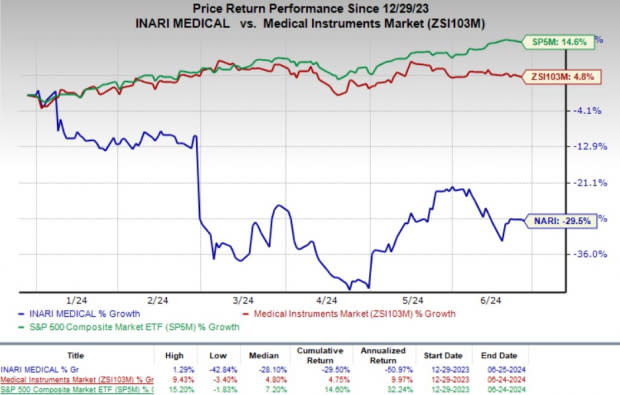

Shares of this Zacks Rank #3 (Hold) company have lost 29.5% year to date against the industry’s 4.8% growth. The S&P 500 Index has risen 14.6% in the same time frame.

NARI, with a market capitalization of $2.67 billion, is a commercial-stage medical device company. It seeks to develop products for treating and changing the lives of patients suffering from venous diseases.

Image Source: Zacks Investment Research

The company’s negative earnings yield of 0.9% compares favorably with the industry’s (-6.9%). It delivered a trailing four-quarter average earnings surprise of 130.74%.

What’s Driving NARI’s Performance?

Inari Medical’s top-line growth is primarily driven by its ClotTriever and FlowTriever products that target the venous thromboembolism (VTE) markets, which represent significant growth opportunities going forward. The significant growth prospect in the market for Inari’s VTE products should help drive the company’s revenues. Currently, conservative medical management with anticoagulants is the standard of care for VTE. However, new therapies like ClotTriever and FlowTriever products are demonstrating rising adoption as they lead to lower treatment-related risk. Inari focuses on establishing its treatments as the standard of care for VTE, whichis significantly underpenetrated.

Per Inari Medical’s estimate, there are approximately 1.9 million people with VTE in the United States each year, with approximately 1 million diagnosed with DVT and 900,000 with PE. Among this patient population, there are around 430,000 DVT and 280,000 PE patients every year in the United States who could benefit from treatment through ClotTriever and FlowTriever products, respectively.

xStrong procedural growth across both its product lines, ClotTriever and FlowTriever, drove the company’s top line in the first quarter, a trend that is likely to be reflected in the rest of 2024. Continued expansion of its product portfolio, with new introductions like Protrieve, InThrill and FlowSaver, among others, is driving the adoption of Inari Medical’s products.

Apart from the effectiveness of products, an attractive procedural reimbursement is also fueling their adoption. Per Inari Medical, reimbursement for ClotTriever and FlowTriever is higher than the cost incurred by hospitals for mechanical thrombectomy in DVT and PE patients, thereby generating an income, while costs for conventional methods are higher than reimbursements.

The company’s commercial expansion and market development plans have been driving the global Venous Thromboembolism (“VTE”) business, its major revenue generator. Moreover, rising demand for emerging therapies like RevCore should bring additional revenues in the upcoming quarters, thereby boosting top-line growth. The company is currently engaged in the limited market release of Venacore, the second purpose-built tool within the CBD toolkit, expanding NARI’s emerging therapies category.

Increased adoption of Inari Medical’s products in Western Europe and case growth in its early-stage markets in Latin America, Canada and the Asia-Pacific region look promising. The company expects to start treating patients in China and Japan in 2024. International markets present a significant opportunity for NARI’s long-term growth. Management expects the international business to represent more than 20% of its future revenues on the back of unmet needs.

What’s Weighing on the Stock?

Although ClotTriever and FlowTriever have attractive reimbursement coverages, these are determined by government agencies, private insurers and other payors for a particular procedure, irrespective of the devices used for it. Meanwhile, third-party payors are increasingly limiting coverage and reducing reimbursements for medical products and services. In addition, the U.S. government, state legislatures and foreign governments have continued implementing cost-containment programs, including price controls, restrictions on coverage and reimbursement. Any unfavorable change in coverage for Inari Medical’s products will likely hurt their adoption, thereby affecting top-line growth. Moreover, expansion in international markets is a greater risk as multiple countries are unlikely to have extensive reimbursement coverage, which may adversely impact adoption.

Inari Medical is currently facing a civil investigative demand (CID) from the U.S. Department of Justice, Civil Division, in connection with an investigation under the federal Anti-Kickback Statute and Civil False Claims Act, stating that the company may have been involved in influencing health care professionals to prescribe its products. Any unfavorable ruling should be a setback for the company that may lead to lower demand for its products, hurting sales growth.

Estimates Trend

The Zacks Consensus Estimate for the company’s 2024 revenues is pegged at $598.9 million, indicating a 21.3% increase from the previous year’s reported number. The consensus estimate for the bottom line is pinned at a loss of 41 cents, implying a 415% decline from that recorded a year ago. However, earnings are expected to improve 150% in 2025.

Inari Medical, Inc. Price

Inari Medical, Inc. price | Inari Medical, Inc. Quote

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, ResMed RMD and Hologic HOLX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 36.4% compared with the industry’s 9.3% growth year to date.

ResMed, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 13.2% in 2024. Its earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 2.81%.

RMD’s shares have risen 6.9% year to date compared with the industry’s 2.8% growth.

Hologic, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 7.4%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 4.94%.

Hologic’s shares have risen 0.3% year to date compared with the industry’s 4.7% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance