Here's Why Investors Must Retain Hyatt (H) Stock for Now

Hyatt Hotels Corporation’s H performance is benefiting from the consistent focus on an asset-light model initiative and footprint expansion plans in new and existing markets accompanied by strategic partnerships.

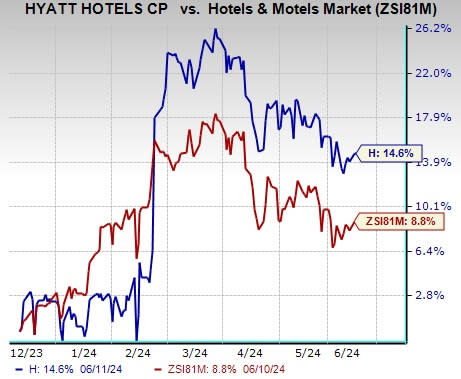

Shares of this Zacks Rank #3 (Hold) company gained 14.6% in the past six months, outperforming the Zacks Hotels and Motels industry’s 8.8% growth. The uptrend is most likely attributable to the solid leisure and business travel demand, especially strong outbound travel from Greater China, which resulted in the increase in occupancy and average daily rate.

The company’s earnings estimate for second-quarter 2024 has moved north in the past seven days to 96 cents per share from 93 cents, indicating a growth rate of 17.1% year over year. Hyatt also delivered a trailing four-quarter earnings surprise of 20.3%, on average. The positive trend signifies bullish analysts’ sentiments, robust fundamentals and the chances of an outperformance in the near term.

Image Source: Zacks Investment Research

However, rising costs and expenses, along with macroeconomic uncertainties, are marring the prospects of the company.

What’s Driving the Stock?

Asset-Light Business Model: Hyatt intently focuses on an asset-light program to increase its fees from all its business areas and further reduce owned real estate. The company’s asset-light earnings mix was 76% in 2023, significantly up from 47% in 2017. As of the first quarter of 2024, the company stated to have made significant progress on asset dispositions, which further expanded its asset-light earnings mix, thus reflecting its desire to permanently reduce owned real estate.

Regarding its asset-light model, in April 2024, Hyatt sold Park Hyatt Zurich and Hyatt Regency San Antonio Riverwalk along with Hyatt Regency Green Bay in May to unrelated third parties for combined proceeds of $535 million. It thus entered into long-term management agreements for Park Hyatt Zurich and Hyatt Regency San Antonio Riverwalk and a long-term franchise agreement for Hyatt Regency Green Bay. Furthermore, during the first quarter, Hyatt signed a purchase and sale agreement for an asset, which is expected to generate gross proceeds exceeding the remaining portion of the company's $2.0 billion asset sell-down commitment upon closure.

Footprint Expansion Plans: Hyatt is consistently trying to expand its presence worldwide and has further expansion plans in Asia-Pacific, Europe, Africa, the Middle East and Latin America. Expansion in these markets would help the company gain market share in the hospitality industry, thereby boosting business.

During the first quarter, Hyatt added 12 new hotels (or 2,425 rooms) to its portfolio. Notable openings included Thompson Houston, Secrets Tides Punta Cana, Secrets Playa Blanca Costa Mujeres, five UrCove properties in China, and Hyatt Regency Nairobi Westlands, which marked the company’s first hotel in Kenya. As of Mar 31, 2024, Hyatt had a pipeline of executed management or franchise contracts for approximately 670 hotels (or about 129,000 rooms). The company anticipates net room growth in the range of 5.5-6% year over year in 2024.

Accretive Partnerships: Apart from focusing on expanding and enhancing its business organically, Hyatt also engages in strategic collaborations to expand its market presence and diversify its product portfolio. On May 27, the previously announced joint venture of Hyatt with Kiraku stated that ATONA, the modern hot spring ryokan (Japanese-style inn) brand, is set to open properties in Yufu, Yakushima and Hakone. The debut of ATONA ryokans is slated to take place in 2026.

Furthermore, the acquisition of Mr & Mrs Smith at the end of Dec 31, 2023, bodes well for the company’s profile. As of Mar 31, more than 700 Mr & Mrs Smith boutiques and luxury hotels and villas around the world were available through Hyatt channels, including World of Hyatt. The company proposes to enhance the value offers for the owners of hotels represented on this platform, in alignment with expanding the choices for its members and guests.

Factors Marring Prospects

High Costs & Expenses: Given the persisting inflationary environment, Hyatt has been suffering from increasing costs and expenses for some time now. During the first quarter of 2024, the company’s margins were negatively impacted by higher real estate taxes, increased wages in certain markets and transaction costs associated with asset sales that closed after the first quarter.

During the first quarter, the total direct, general and administrative expenses increased to $1.67 billion from $1.6 billion reported a year ago. The uptick was backed by increased distribution costs, general and administrative expenses, and owned and leased costs.

Macroeconomic Risks: Financing conditions in certain regions have been challenging due to a rise in interest rates. The company’s considerable international presence makes it vulnerable to the economic conditions in the regions. In the Middle East, political unrest, lower government spending, new hotel supply and a tough oil market continue to hurt tourism and are a cause of concern.

Furthermore, the company is exposed to market risks, primarily from changes in interest rates and foreign currency exchange rates.

Key Picks

Here are better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has gained 46.2% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 52% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 66.1% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.8% and 63.8%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance