Here's Why You Should Hold Onto Huntsman (HUN) Stock for Now

Huntsman Corporation HUN is expected to gain from its investment in downstream businesses, differentiated product innovation and strategic acquisitions. However, it faces headwinds from soft demand in certain markets and pricing pressure.

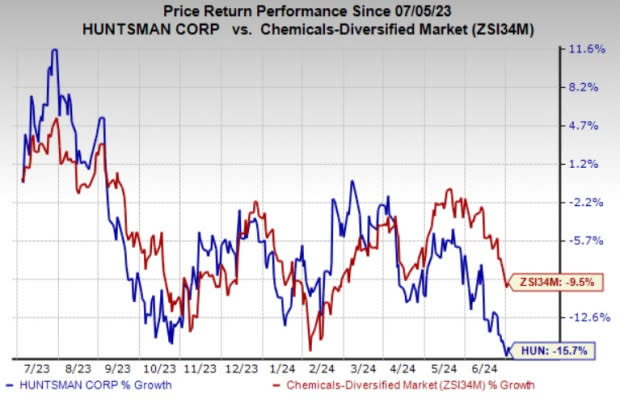

HUN’s shares have lost 15.7% over the past year compared with a 9.5% decline of its industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

HUN Gains on Downstream Expansion & Cost Synergies

Huntsman remains focused on growing its downstream specialty and formulation businesses and is shifting its MDI (methylene diphenyl diisocyanate) business from components to differentiated systems that typically have higher margins and lower volatility.

HUN’s Polyurethanes segment is well positioned for a strong upside in the long term on the back of its focus on ramping up its high-value differentiated downstream portfolio. The substitution of MDI for less effective materials will remain a key driving factor for the MDI business.

Moreover, the company should gain from significant synergies of acquisitions. Its strong liquidity and balance sheet leverage give it adequate flexibility to continue to develop and expand its core businesses through acquisitions and internal investments. The acquisitions of CVC Thermoset and Gabriel Performance Products are contributing to EBITDA in the Advanced Materials segment.

HUN remains committed to its cost realignment and synergy objectives. It realized more than $280 million in run rate savings at the end of 2023. It sees additional cost-improvement opportunities in 2024, focusing on manufacturing cost efficiency and the completion of European restructuring activities. Huntsman expects roughly $60 million of in-year cost optimization benefits, excluding inflation, in 2024.

Weak Pricing, Soft Demand Ail

Huntsman witnessed challenges from demand softness and significant de-stocking in 2023. Demand conditions in Europe weakened last year due to high levels of natural gas prices. Demand in China was impacted by reduced economic growth resulting from the pandemic-led restrictions and lower construction activities.

Although demand has improved of late in these regions as witnessed in first-quarter 2024, the lingering impacts of sluggish demand in certain markets are likely to continue in the near term. The residential construction market remains sluggish in China. Weaker activities in general industrial, infrastructure coatings and commodity markets are also expected to continue to impact volumes in HUN's Advanced Materials segment.

Huntsman also faces headwinds from pricing pressure. Lower selling prices across its segments weighed on its top line in the first quarter. A less favorable supply-demand environment contributed to the fall in MDI prices. Competitive pricing is also affecting the Performance Products segment. Weaker prices are likely to continue to impact HUN’s results in the second quarter.

Stocks to Consider

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Axalta Coating Systems Ltd. AXTA and Kronos Worldwide, Inc. KRO.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared roughly 93% in the past year.

Axalta Coating Systems has a projected earnings growth rate of 26.8% for the current year. In the past 60 days, the consensus estimate for AXTA's current-year earnings has been revised upward by 5.9%. The Zacks Rank #2 (Buy) company’s shares have gained roughly 7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide currently carries a Zacks Rank #2. KRO has a projected earnings growth rate of 297.7% for the current year. The company’s shares have rallied around 49% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Huntsman Corporation (HUN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance