Here's Why Ease2pay N.V.'s (AMS:EAS2P) CEO May Not Expect A Pay Rise This Year

Key Insights

Ease2pay to hold its Annual General Meeting on 21st of June

CEO Gijs van Lookeren Campagne's total compensation includes salary of €88.0k

Total compensation is 70% below industry average

Over the past three years, Ease2pay's EPS fell by 67% and over the past three years, the total loss to shareholders 82%

The disappointing performance at Ease2pay N.V. (AMS:EAS2P) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 21st of June. From our analysis below, we think CEO compensation looks appropriate for now.

Check out our latest analysis for Ease2pay

Comparing Ease2pay N.V.'s CEO Compensation With The Industry

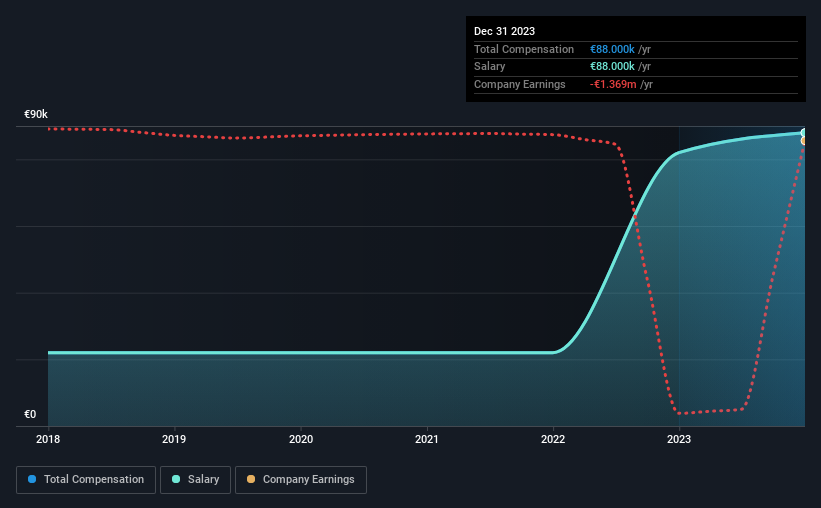

At the time of writing, our data shows that Ease2pay N.V. has a market capitalization of €13m, and reported total annual CEO compensation of €88k for the year to December 2023. That's a fairly small increase of 7.3% over the previous year. It is worth noting that the CEO compensation consists entirely of the salary, worth €88k.

For comparison, other companies in the the Netherlands IT industry with market capitalizations below €187m, reported a median total CEO compensation of €293k. This suggests that Gijs van Lookeren Campagne is paid below the industry median.

Component | 2023 | 2022 | Proportion (2023) |

Salary | €88k | €82k | 100% |

Other | - | - | - |

Total Compensation | €88k | €82k | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. On a company level, Ease2pay prefers to reward its CEO through a salary, opting not to pay Gijs van Lookeren Campagne through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Ease2pay N.V.'s Growth

Over the last three years, Ease2pay N.V. has shrunk its earnings per share by 67% per year. In the last year, its revenue is down 20%.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ease2pay N.V. Been A Good Investment?

Few Ease2pay N.V. shareholders would feel satisfied with the return of -82% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Ease2pay rewards its CEO solely through a salary, ignoring non-salary benefits completely. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which doesn't sit too well with us) in Ease2pay we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance