Here's Why Crocs (CROX) Looks Poised for Earnings Beat in Q2

Crocs, Inc. CROX is scheduled to release second-quarter 2023 results on Jul 27, before market open. This leading footwear brand company is expected to have witnessed year-over-year revenue growth in the to-be-reported quarter.

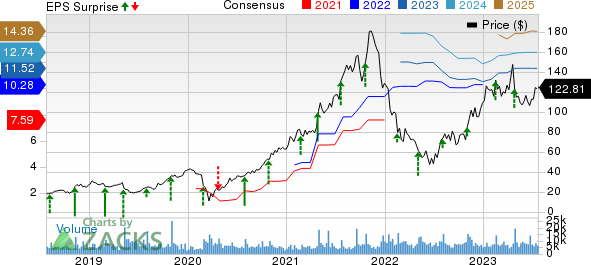

The Zacks Consensus Estimate for second-quarter earnings per share has been unchanged in the past 30 days at $2.95 per share. The consensus estimate suggests a decline of 9% from the year-ago period’s reported number. The Zacks Consensus Estimate for revenues is pegged at $1.04 billion, suggesting an improvement of 8.2% from the prior-year reported figure.

The Broomfield, CO-based company has a trailing four-quarter earnings surprise of 19.6%, on average. In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by 22.5%.

Crocs, Inc. Price, Consensus and EPS Surprise

Crocs, Inc. price-consensus-eps-surprise-chart | Crocs, Inc. Quote

Key Factors to Note

Crocs’s second-quarter 2023 sales are likely to have benefited from continued strong consumer demand for its new clog and sandal designs, which has been driving positive results for the past few quarters.

Brand strength, new products, refined user experience and marketing activities have been significant growth drivers for Crocs. Increased focus on the Crocs mobile app and global social platforms have been aiding digital sales. Gains from strategic collaborations, influencer campaigns, and digital and social marketing efforts are expected to have bolstered the company’s quarterly performance.

Additionally, the acquisition of HEYDUDE, a privately-owned brand specializing in lightweight and casual shoes and sandals for men, women, and children, is expected to have contributed to growth in the footwear business in the to-be-reported. The HEYDUDE brand is also likely to have witnessed continued momentum in direct-to-consumer (DTC) sales, further contributing to top-line growth.

We expect revenues for the HEYDUDE brand to increase 22.8% year over year in second-quarter 2023. Our model predicts revenues for the Crocs brand to improve 3.3% year over year in the to-be-reported quarter.

On its last reported quarter’s earnings call, management expected second-quarter 2023 revenues to grow 6-9% year over year to $1,026-$1,049 million. Adjusted earnings are expected to be $2.83-$2.98 per share and the adjusted operating margin is anticipated to be 26%.

However, Crocs has been facing some challenges related to the current economic environment. The company has been impacted by high inflation rates, rising costs related to expansion and duplicate rent costs for its distribution centers. Costs related to the HEYDUDE acquisition are likely to have been concerning. Elevated selling, general, and administrative (SG&A) costs have been concerning.

We expect the company’s adjusted gross margin to contract 250 basis points (bps) year over year in second-quarter 2023. Further, the company is likely to have witnessed an increase in SG&A expenses, weighing on its operating margin. Our model indicates a 14.4% year-over-year increase in adjusted SG&A expenses, with a 150-bps increase in the adjusted SG&A rate. The adjusted operating margin for the second quarter is expected to contract 410 bps to 26%.

What Does the Zacks Model Unveil?

Our proven model conclusively predicts an earnings beat for Crocs this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Crocs currently has a Zacks Rank #3 and an Earnings ESP of +0.34%.

Other Stocks Poised to Beat Earnings Estimates

Here are some other companies that you may want to consider, as our model shows that these also have the right combination of elements to post an earnings beat:

Wynn Resorts WYNN currently has an Earnings ESP of +55.56% and a Zacks Rank #2. WYNN is likely to register top and bottom-line growth when it reports second-quarter 2023 results. The Zacks Consensus Estimate for WYNN’s quarterly revenues is pegged at $1.49 billion, suggesting 64.1% growth from the figure reported in the prior-year quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Wynn Resorts’ second-quarter earnings is pegged at 42 cents, whereas it reported a loss of 82 cents in the year-ago quarter. The consensus mark for earnings has increased a penny in the past seven days.

Marriott International MAR currently has an Earnings ESP of +8.44% and a Zacks Rank #2. MAR is likely to register top and bottom-line growth when it reports second-quarter 2023. The Zacks Consensus Estimate for MAR’s quarterly revenues is pegged at $6.05 billion, suggesting 13.3% growth from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Marriott International’s second-quarter earnings is pegged at $2.19, suggesting 21.7% growth from the year-ago quarter’s actual. The consensus mark has increased a penny in the past seven days.

Hyatt Hotels H currently has an Earnings ESP of +8.14% and a Zacks Rank #3. H is likely to register top and bottom-line growth when it reports second-quarter 2023 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.65 billion, suggesting 11.3% growth from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Hyatt Hotels’ second-quarter earnings is pegged at 83 cents, suggesting an 80.4% improvement from the year-ago quarter’s actual. The consensus mark has moved up by a penny in the past 30 days.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance