Here's Why You Should Add Ecolab (ECL) to Your Portfolio Now

Ecolab Inc. ECL has been gaining from its focus on research and development (R&D). The optimism, led by a solid first-quarter 2024 performance, along with its solid product portfolio, is expected to contribute further. However, concerns arising from cost fluctuations and the possibility of unsuccessful integration persist.

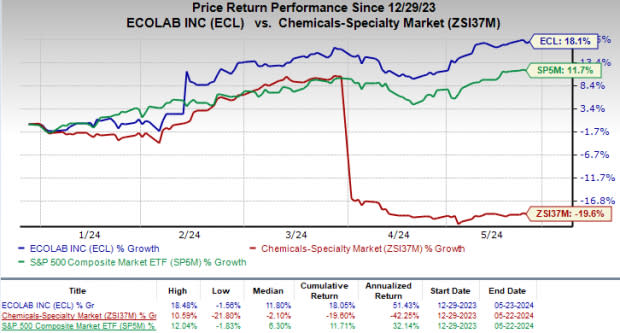

This Zacks Rank #2 (Buy) stock has gained 18.1% year to date against the industry’s 19.6% decline. The S&P 500 Composite has increased 11.7% during the same time frame.

The renowned water, hygiene and infection prevention solutions and services provider has a market capitalization of $67.11 billion. It projects 14.3% growth over the next five years and expects to maintain a strong performance going forward. Ecolab’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 1.3%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Focus on R&D: Ecolab’s R&D program primarily covers the development and validation of the performance of new products, processes, techniques and equipment. This improves the efficiency of the existing products and service program content and evaluates the environmental compatibility of products and technical support.

Management believes that continued R&D activities are critical to maintaining its leadership position within the industry and should provide it with a competitive edge as it seeks additional business with new and existing customers.

Well-Positioned for Long-Term Growth:Ecolab’s consistent delivery of considerable earnings growth despite macro uncertainties continues to impress. Management remains optimistic regarding improvement in its ability to attract new customers and opportunities for greater customer penetration through new product development.

Ecolab also makes business acquisitions that align with its strategic business objectives. In May 2023, the company acquired Chemlink Laboratories LLC, a U.S.-based producer of small-format cleaning solutions. Ecolab also made two other acquisitions during the second quarter of 2023. All three acquisitions have become accretive to the Global Institutional & Specialty segment and are likely to boost growth going forward.

Strong Q1 Results: Ecolab’s solid first-quarter 2024 results buoy optimism. Per management, Ecolab witnessed a strong first quarter with significant growth in organic sales and expansion in organic income margin. During the same time, the company drove pricing, which was backed by strong customer value, and improved its underlying productivity by leveraging its digital capabilities. On the earnings call in April, management stated that volumes in the first quarter continued to improve, reflecting new business wins.

On the first-quarter earnings call, management confirmed that it has entered into a definitive agreement for the sale of its global surgical solutions business to Medline for $950 million in cash. The sale is expected to close in the second half of 2024, subject to regulatory clearances and other customary closing conditions. The company expects to record an associated pre-tax gain.

Downsides

Cost Fluctuations: The cost of the raw materials that Ecolab uses in its operations is subject to occasional fluctuations. The company has also experienced periods of rising raw material costs in the last few years. Ecolab's combined operating results could be considerably and negatively impacted by changes in the price of raw materials and the lack of suitable and reasonably priced raw materials.

Possibility of Unsuccessful Integration: Ecolab seeks to acquire complementary businesses as part of its long-term strategy. There is no assurance that it will find attractive acquisition candidates or succeed at effectively managing the integration of acquired businesses. If the underlying business performance of such acquired businesses deteriorates or Ecolab fails to successfully integrate new businesses into its existing ones, the company’s consolidated results of operations could be adversely affected.

Estimate Trend

Ecolab is witnessing a positive estimate revision trend for 2024. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 3.1% north to $6.59 per share.

The Zacks Consensus Estimate for the company’s second-quarter 2024 revenues is pegged at $4.04 billion, indicating a 4.8% improvement from the year-ago quarter’s reported number.

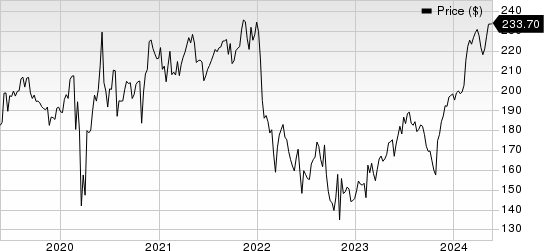

Ecolab Inc. Price

Ecolab Inc. price | Ecolab Inc. Quote

Other Key Picks

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, DaVita DVA and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2, reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

DaVita, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%.

DaVita’s shares have gained 40.1% compared with the industry’s 24.1% rise in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance