Henan Lingrui Pharmaceutical Leads Three Key Dividend Stocks In China

As global markets grapple with mixed economic signals, China's equity landscape remains a focal point for investors, particularly following recent data indicating subtle economic pressures. Amid these conditions, dividend stocks like Henan Lingrui Pharmaceutical offer an avenue for potential steady returns in a fluctuating market environment.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.09% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.69% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.37% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.20% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.39% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.61% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.51% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.06% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.13% | ★★★★★★ |

Click here to see the full list of 206 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Henan Lingrui Pharmaceutical

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is a Chinese company engaged in the production and sale of medicines, with a market capitalization of approximately CN¥14.09 billion.

Operations: Henan Lingrui Pharmaceutical Co., Ltd. generates its revenue from the production and sales of medicinal products within China.

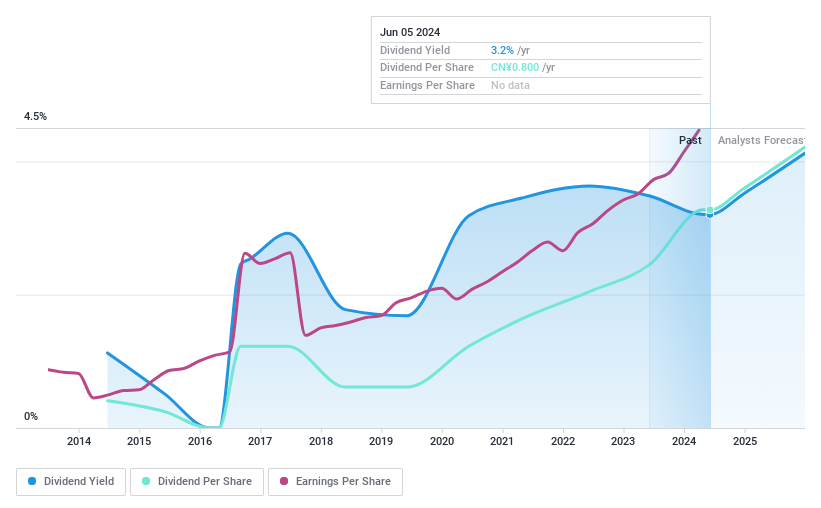

Dividend Yield: 3.2%

Henan Lingrui Pharmaceutical has shown robust financial performance with a 28.3% earnings growth over the past year and forecasts suggest a further 15.03% annual growth. Despite its Price-To-Earnings ratio of 22.9x being below the Chinese market average of 30.5x, indicating good value, the dividend history is marked by volatility, which raises concerns about reliability. Dividend coverage is healthy with both earnings (payout ratio: 73.3%) and cash flows (cash payout ratio: 59.7%) adequately supporting payouts; however, its track record of unstable dividends could be a red flag for those seeking consistent income streams.

Chongqing Department StoreLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Department Store Co., Ltd. operates department stores, supermarkets, and electrical appliances stores across China, with a market capitalization of CN¥12.06 billion.

Operations: Chongqing Department Store Co., Ltd. generates its revenue from operating department stores, supermarkets, and electrical appliances stores throughout China.

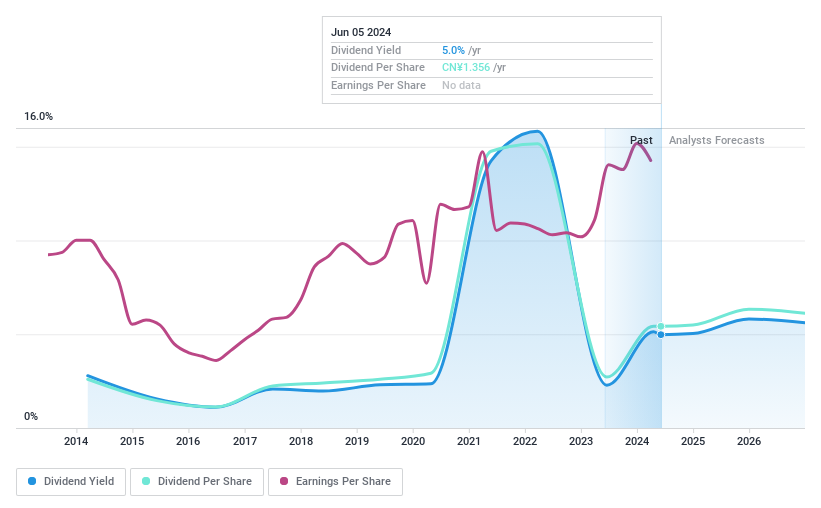

Dividend Yield: 5%

Chongqing Department Store Ltd. has demonstrated a mixed track record in dividend reliability, with payments showing volatility over the past decade despite a top-tier yield of 4.98%. The dividends are well-supported financially, evidenced by a low payout ratio of 43.4% and cash payout ratio of 45.7%, suggesting sustainability from earnings and cash flows perspective. Recent financials indicate a slight decrease in net income and revenue for Q1 2024, with net income at CNY 434.83 million from CNY 512.01 million year-over-year, potentially impacting future dividend stability.

Gold cup Electric ApparatusLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gold Cup Electric Apparatus Co., Ltd. operates in the manufacturing and sale of wires and cables, serving both domestic and international markets, with a market capitalization of approximately CN¥7.32 billion.

Operations: Gold Cup Electric Apparatus Co., Ltd. generates its revenue primarily through the research, development, manufacturing, and sale of wires and cables across both domestic and global markets.

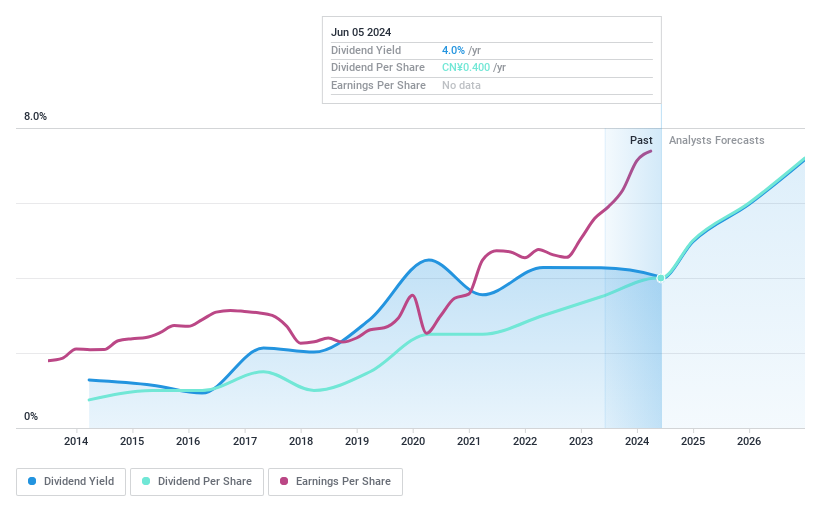

Dividend Yield: 4%

Gold cup Electric Apparatus Co.,Ltd. has recently increased its dividend to CNY 4.00 per 10 shares, reflecting a commitment to shareholder returns despite a high cash payout ratio of 776.1%, indicating potential concerns about sustainability from cash flows. The firm's financial performance shows improvement with Q1 2024 sales up to CNY 3.52 billion from CNY 2.96 billion year-over-year and net income rising to CNY 133.95 million from CNY 114.9 million, supporting an optimistic view on profitability growth, yet dividends remain poorly covered by earnings and free cash flow, posing risks for long-term reliability.

Summing It All Up

Explore the 206 names from our Top Dividend Stocks screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600285 SHSE:600729 and SZSE:002533.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance