H & M Hennes & Mauritz And 2 Other Swedish Exchange Stocks Estimated To Be Trading Below Their Intrinsic Value

As global markets exhibit varied performances with some regions showing signs of economic resilience and others grappling with challenges, the Swedish stock market presents unique opportunities for investors seeking value. In this context, understanding the characteristics that define potentially undervalued stocks can be crucial, especially in a market environment where strategic investment decisions are paramount.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK54.60 | SEK102.17 | 46.6% |

Boule Diagnostics (OM:BOUL) | SEK10.45 | SEK20.90 | 50% |

Arcoma (OM:ARCOMA) | SEK17.95 | SEK35.78 | 49.8% |

Biotage (OM:BIOT) | SEK156.90 | SEK297.61 | 47.3% |

Alleima (OM:ALLEI) | SEK69.10 | SEK127.81 | 45.9% |

Nordic Waterproofing Holding (OM:NWG) | SEK162.00 | SEK298.24 | 45.7% |

Nolato (OM:NOLA B) | SEK57.55 | SEK111.71 | 48.5% |

MilDef Group (OM:MILDEF) | SEK66.90 | SEK131.89 | 49.3% |

Humble Group (OM:HUMBLE) | SEK10.28 | SEK19.55 | 47.4% |

Hexatronic Group (OM:HTRO) | SEK50.02 | SEK98.82 | 49.4% |

Here's a peek at a few of the choices from the screener

H & M Hennes & Mauritz

Overview: H & M Hennes & Mauritz AB operates globally, offering apparel, accessories, footwear, cosmetics, and home products for women, men, and children with a market cap of approximately SEK 313.49 billion.

Operations: The company generates SEK 234.83 billion from its apparel segment.

Estimated Discount To Fair Value: 35.1%

H & M Hennes & Mauritz, trading at SEK 194.65, appears undervalued based on a discounted cash flow model with an estimated fair value of SEK 300.15. Despite this, its dividend sustainability is questioned as the current yield of 3.34% is poorly covered by earnings. The company's earnings have surged by over 100% in the past year and are expected to grow annually by 16.86%, outpacing the Swedish market forecast of 13.9%. However, revenue growth projections are modest at 3.4% per year.

Lime Technologies

Overview: Lime Technologies AB specializes in providing SaaS-based CRM solutions primarily in the Nordic region, with a market capitalization of approximately SEK 4.67 billion.

Operations: The company generates revenue primarily through the sale and implementation of software for CRM systems, amounting to SEK 601.83 million.

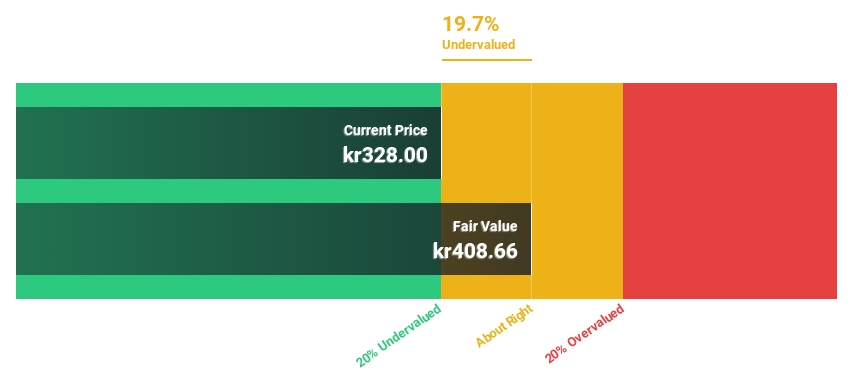

Estimated Discount To Fair Value: 14.2%

Lime Technologies, with a current price of SEK 351.5, is considered undervalued against a fair value estimate of SEK 409.7 based on discounted cash flow analysis. The company's robust financial performance includes a Q1 revenue increase to SEK 169.43 million and net income growth to SEK 23.43 million. Forecasted earnings growth at 21.52% annually over the next three years surpasses the Swedish market's expectation, despite carrying a high level of debt and slower revenue growth predictions at 14.7% annually.

Mips

Overview: Mips AB (publ) specializes in developing, manufacturing, and selling helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market capitalization of SEK 11.17 billion.

Operations: The company generates its revenue primarily from the sporting goods segment, amounting to SEK 352 million.

Estimated Discount To Fair Value: 12.8%

Mips, priced at SEK 421.6, is deemed undervalued with a fair value estimate of SEK 483.59. Despite recent dips in quarterly sales and earnings, Mips's financial outlook remains strong with expected annual earnings growth of approximately 49.62% and revenue growth forecasts at 30% per year—both well above the Swedish market averages. However, its profit margins have decreased from last year’s 27.4% to current 17.6%.

The growth report we've compiled suggests that Mips' future prospects could be on the up.

Dive into the specifics of Mips here with our thorough financial health report.

Summing It All Up

Click this link to deep-dive into the 49 companies within our Undervalued Swedish Stocks Based On Cash Flows screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:HM B OM:LIME and OM:MIPS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance