Guangzhou Tinci Materials Technology And Two Other Stocks Possibly Trading Below Estimated Fair Value On Chinese Exchange

Amidst a backdrop of deflationary pressures and subdued consumer sentiment in China, investors may find potential opportunities in stocks that appear undervalued relative to their estimated fair value. Identifying such stocks requires careful consideration of various economic factors and market conditions, which can influence the intrinsic value and potential growth prospects of companies.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

YanKer shop FoodLtd (SZSE:002847) | CN¥49.52 | CN¥94.36 | 47.5% |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥58.68 | CN¥110.11 | 46.7% |

Center International GroupLtd (SHSE:603098) | CN¥8.51 | CN¥16.69 | 49% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.53 | CN¥21.99 | 47.6% |

Weaver Network Technology (SHSE:603039) | CN¥33.68 | CN¥61.96 | 45.6% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥11.01 | CN¥20.23 | 45.6% |

Hainan Drinda New Energy Technology (SZSE:002865) | CN¥47.15 | CN¥91.56 | 48.5% |

INKON Life Technology (SZSE:300143) | CN¥7.38 | CN¥14.64 | 49.6% |

Ningbo ShanshanLtd (SHSE:600884) | CN¥10.37 | CN¥20.73 | 50% |

Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥21.88 | CN¥40.70 | 46.2% |

Let's dive into some prime choices out of from the screener

Guangzhou Tinci Materials Technology

Overview: Guangzhou Tinci Materials Technology Co., Ltd. is a company specializing in the development, production, and sale of fine chemical products, with a market capitalization of approximately CN¥39.20 billion.

Operations: The company generates revenue primarily from the fine chemical industry, totaling CN¥13.55 billion.

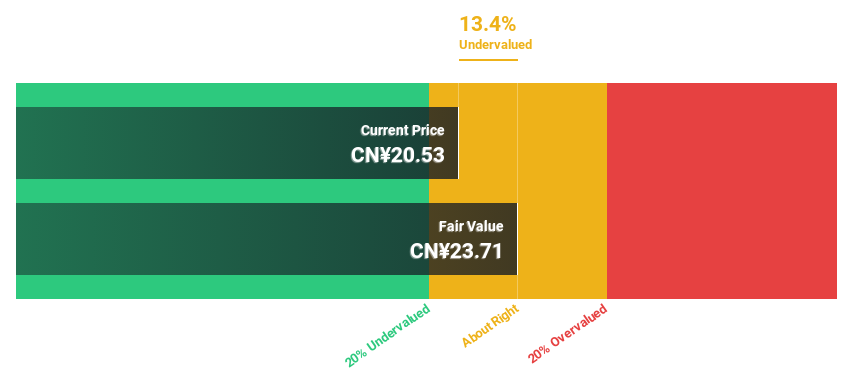

Estimated Discount To Fair Value: 13.4%

Guangzhou Tinci Materials Technology, valued at CN¥20.53, trades below the estimated fair value of CN¥23.71, suggesting undervaluation based on DCF analysis. Despite a significant drop in Q1 earnings from CN¥694.77 million to CN¥114.39 million year-over-year and a reduction in dividends, the company's future looks promising with expected annual earnings growth of 27.6% and revenue growth forecasts outpacing the Chinese market average. However, concerns arise as recent profit margins have decreased significantly to 9.7% from last year's 22.9%.

EVE Energy

Overview: EVE Energy Co., Ltd. specializes in the production of lithium batteries, serving customers both in China and globally, with a market capitalization of approximately CN¥87.71 billion.

Operations: The company generates CN¥46.92 billion from manufacturing electronic components.

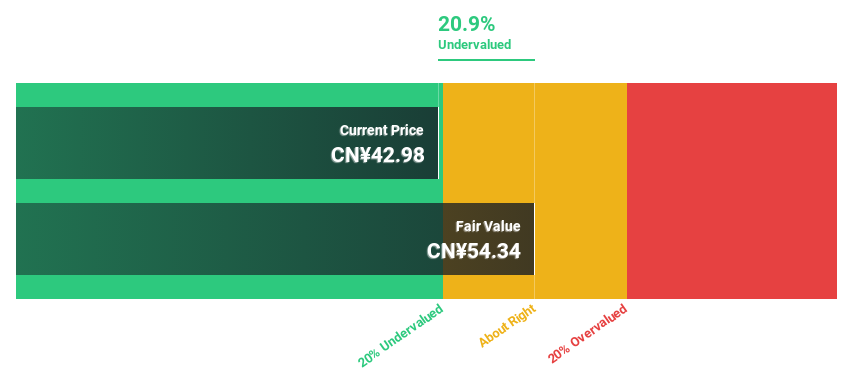

Estimated Discount To Fair Value: 20.9%

EVE Energy, trading at CN¥42.98, is valued below its estimated fair value of CN¥54.34, indicating potential undervaluation based on DCF analysis. Despite a recent decline in quarterly revenue and net income, the company's earnings are expected to grow significantly over the next three years, outpacing the Chinese market's average growth rate. However, its dividend track record remains unstable and recent financial results have been impacted by large one-off items.

Suzhou TFC Optical Communication

Overview: Suzhou TFC Optical Communication Co., Ltd. is a company specializing in the research, development, and manufacturing of optical communication components, with a market capitalization of approximately CN¥53.66 billion.

Operations: The primary revenue segment for the company is optical communication devices, generating CN¥2.37 billion.

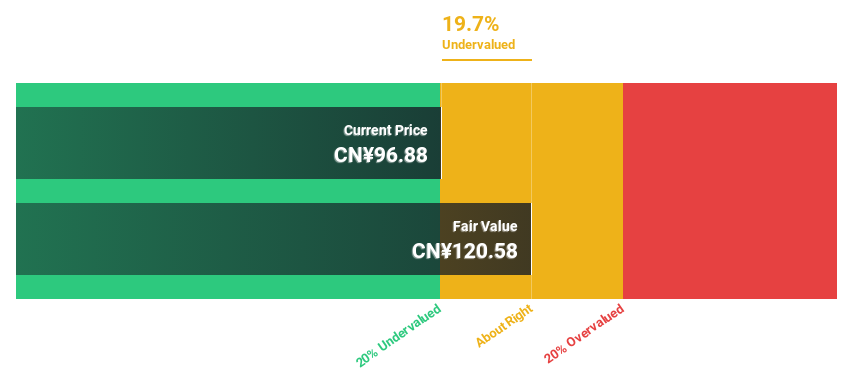

Estimated Discount To Fair Value: 19.7%

Suzhou TFC Optical Communication is currently priced at CN¥96.88, below the DCF-estimated fair value of CN¥120.58, suggesting undervaluation. The company's earnings have surged by 122.4% over the past year with expectations of a 35.9% annual growth rate, outperforming the Chinese market forecast of 22.7%. Despite an unstable dividend history, significant revenue growth and high projected returns on equity indicate strong future potential, bolstered by recent robust quarterly results and a beneficial stock split.

Turning Ideas Into Actions

Embark on your investment journey to our 95 Undervalued Chinese Stocks Based On Cash Flows selection here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SZSE:002709 SZSE:300014 and SZSE:300394.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance