GSK Buys Flu, COVID mRNA Jab Rights From Partner CureVac

GSK plc GSK recently restructured its existing collaboration with Germany-based vaccine maker CureVac N.V. CVAC into a new licensing agreement.

Per the latest agreement, GSK will acquire global rights to develop and commercialize mRNA-based vaccine candidates for treating influenza and COVID-19, including combination regimens, from CureVac. The companies were co-developing these vaccines per their agreement signed in 2020.

GSK and CVAC were developing vaccine candidates for seasonal influenza and COVID-19 in phase II studies. In contrast, a vaccine for avian influenza, also known as bird flu, was being developed in a phase I study. To date, data from the studies on these candidates have shown their potential to be best-in-class new vaccines.

With the latest restructuring, GSK assumes full responsibility for developing and manufacturing these vaccine candidates.

All the vaccine candidates are being developed based on CVAC’s proprietary second-generation mRNA backbone.

Shares of GSK have risen 3.8% so far this year against the industry's decline of 7.1%.

Image Source: Zacks Investment Research

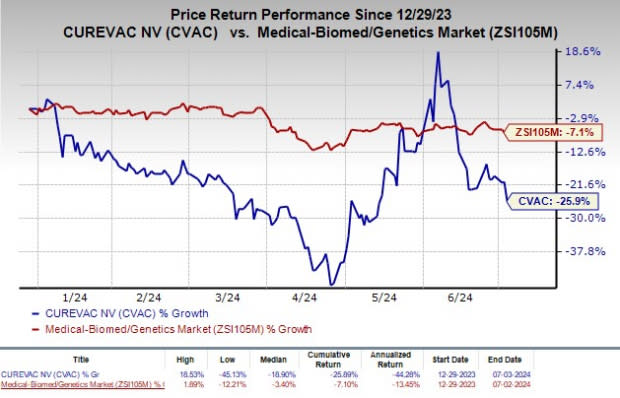

Meanwhile, shares of CureVac have plunged 25.9% year to date compared with the industry’s decline of 7.1%. CVAC stock fell 6.6% on Jul 3 following the announcement of the abovementioned news.

Image Source: Zacks Investment Research

CureVac will be eligible to receive an upfront payment of €400 million from GSK as well as an additional €1.05 billion in development, regulatory and sales-based milestone payments. CVAC will also be entitled to receive tiered royalties in the high single to low teens range on net sales upon potential approval.

The new licensing agreement will replace all previous financial considerations from the prior collaboration that were agreed upon between the companies.

GSK boasts a broad vaccine portfolio that targets infectious diseases like meningitis, shingles, flu and polio, among others. The company has more than 20 marketed vaccines in its portfolio.

GSK recorded vaccine growth of 25% at constant exchange rates in 2023, driven by strong sales for its shingles vaccine, Shingrix and meningitis portfolio, as well as an exceptional contribution from the new RSV vaccine, Arexvy.

Zacks Rank & Other Key Picks

GSK currently carries a Zacks Rank #2 (Buy), while CureVac currently carries a Zacks Rank #3 (Hold).

Some other top-ranked stocks in the healthcare sector are Aligos Therapeutics, Inc. ALGS and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, ALGS shares have declined 36.4%.

Aligos’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, RAPT shares have declined 89.1%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

CureVac N.V. (CVAC) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance