Growth Plans Aid American Eagle (AEO): Apt to Stay Invested?

American Eagle Outfitters Inc. AEO has retained its niche in the market, brand strength and solid demand for its products that resonated with customers. The company's Aerie and American Eagle brands have been the key drivers. American Eagle remains well-placed on the back of cost-reduction efforts and a solid online show. Also, its Real Power Real Growth value creation plan bodes well.

Notably, AEO’s profit improvement initiatives, along with lower delivery, distribution and warehousing costs, aided the first-quarter fiscal 2024 margins. Higher merchandising margins, stemming from lower markdowns, inventory control, and lower transportation and product costs, acted as other tailwinds. Driven by these factors, the gross margin expanded 240 basis points (bps) year over year. The operating margin of 6.8% expanded 270 bps year over year.

Buoyed by these, the company’s first-quarter fiscal 2024 earnings of 34 cents per share doubled from adjusted earnings per share of 17 cents in the year-ago quarter.

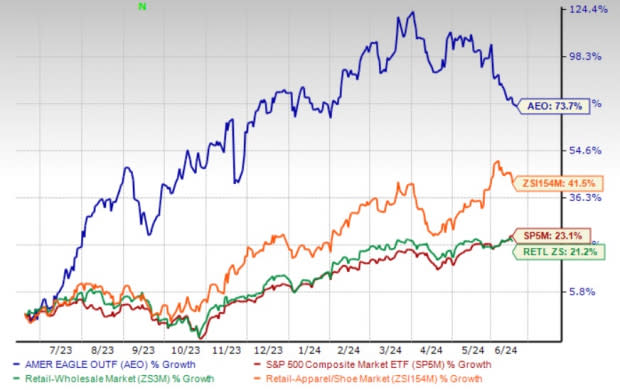

Consequently, shares of the Zacks Rank #3 (Hold) company have rallied 73.7% in the past year compared with the industry’s growth of 41.5%. AEO also compared favorably with the Retail-Wholesale sector’s growth of 21.2% and the S&P 500’s improvement of 23.1% in a year.

Image Source: Zacks Investment Research

Strategies in Focus

American Eagle has a clear vision for growth and profitability through its Real Power Real Growth and Powering Profitable Growth plans. This growth can be achieved by focusing on areas such as real estate optimization, inventory management, omni-channel strategies and customer-centric initiatives.

The targets in the new Powering Profitable Growth plan are achievable, which include annual operating income growth in the mid to high-teens to more than $570 million by the end of fiscal 2026. This translates into an operating margin of 10% through the end of fiscal 2026, implying an expansion of 300 bps in the three years between fiscal 2023 and 2026. The plan aims for 3-5% annual revenue growth by fiscal 2026, reflecting a strong belief in the brand’s potential for expansion. This indicates revenues of $5.7-$6 billion at the end of fiscal 2026.

As part of the Real Power Real Growth plan, American Eagle continues to pursue opportunities to grow the Aerie brand through expansion into newer markets, innovation and a growing customer base.

Driven by the progress on its growth plans, American Eagle reiterated its guidance for fiscal 2024. The company expects revenues to increase 2-4% year over year for fiscal 2024. Operating income is estimated to be $445-$465 million.

AEO expects the business momentum to continue in second-quarter fiscal 2024. The company anticipates year-over-year revenue growth in the high-single digits, including the $55-million positive impacts of the retail calendar shift. Operating income is projected to be $95-$100 million in the fiscal second quarter.

Setbacks to Watch

American Eagle has been witnessing increased corporate compensation, incentives and other corporate expenses, partially offset by cost efficiencies. This led to a year-over-year SG&A expense rise of 7% for first-quarter fiscal 2024. As a percentage of sales, S&A expenses extended 30 bps to 29.2%.

However, management expects SG&A expense leverage in the fiscal second quarter, driven by its profit improvement initiatives.

3 Picks You Can’t Miss

We have highlighted three better-ranked stocks in the broader sector, namely Abercrombie & Fitch Co. ANF, The Gap, Inc. GPS and Canada Goose GOOS.

Abercrombie, a leading casual apparel retailer, currently sports a Zacks Rank #1 (Strong Buy). ANF has a trailing four-quarter earnings surprise of 210.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANF’s current financial-year sales and earnings suggests growth of 10.4% and 47.3%, respectively, from the year-ago reported figures.

Gap, a leading apparel retailer, presently flaunts a Zacks Rank #1. GPS has a trailing four-quarter earnings surprise of 202.7%, on average.

The Zacks Consensus Estimate for GPS’s current financial-year sales and earnings suggests growth of 0.2% and 21.7%, respectively, from the year-ago reported figures.

Canada Goose operates as a global outerwear brand. It currently sports a Zacks Rank #1. GOOS has a trailing four-quarter earnings surprise of 70.9%, on average.

The Zacks Consensus Estimate for GOOS’s current fiscal-year earnings suggests growth of 13.7% from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance