Grifols Leads Three Stocks That May Be Priced Below Their Estimated True Value

As global markets exhibit mixed signals with modest gains in the U.S. and challenges in sectors like Chinese real estate, investors are keenly watching for opportunities that might be undervalued. In this environment, identifying stocks such as Grifols that potentially trade below their intrinsic value could offer attractive entry points amidst current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Pioneer Cement (KASE:PIOC) | PKR161.80 | PKR322.92 | 49.9% |

Boule Diagnostics (OM:BOUL) | SEK10.45 | SEK20.90 | 50% |

Arcoma (OM:ARCOMA) | SEK17.95 | SEK35.78 | 49.8% |

Count (ASX:CUP) | A$0.555 | A$1.10 | 49.7% |

Fodelia Oyj (HLSE:FODELIA) | €5.86 | €11.71 | 50% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49550.40 | 49.7% |

Elkem (OB:ELK) | NOK19.93 | NOK39.60 | 49.7% |

argenx (ENXTBR:ARGX) | €419.70 | €839.19 | 50% |

Wallbox (NYSE:WBX) | US$1.27 | US$2.53 | 49.8% |

3R Petroleum Óleo e Gás (BOVESPA:RRRP3) | R$26.10 | R$51.95 | 49.8% |

Let's dive into some prime choices out of from the screener

Grifols

Overview: Grifols, S.A. is a Spain-based plasma therapeutic company with operations across the United States, Canada, and other international markets, boasting a market capitalization of approximately €5.50 billion.

Operations: The company generates its revenue primarily through three segments: Biopharma, which brings in €5.66 billion, Diagnostic, accounting for €652.08 million, and Bio Supplies with €149.16 million in sales.

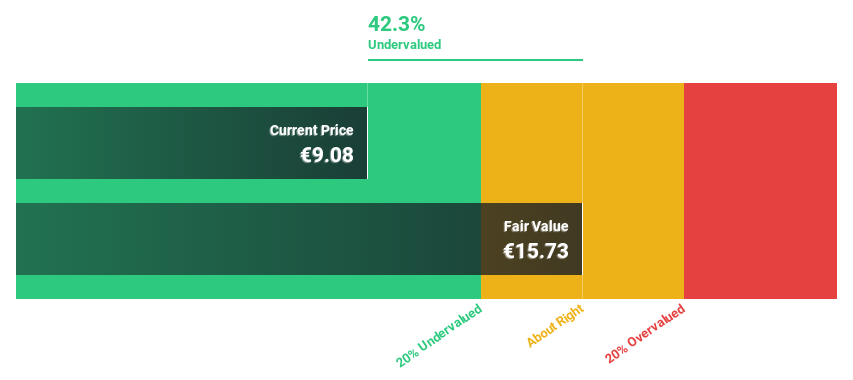

Estimated Discount To Fair Value: 42.3%

Grifols, trading at €9.08, is significantly below our €15.73 fair value estimate based on discounted cash flow analysis, indicating a potential undervaluation of more than 20%. Despite challenges in covering interest payments with earnings and one-off items affecting financial results, Grifols shows promising growth prospects. Earnings are expected to grow by 27.3% annually over the next three years, outpacing the Spanish market's 9.4% growth rate. Recent board changes and successful debt financing actions also reflect active management adjustments and strategic financial planning.

Prio

Overview: Prio S.A., together with its subsidiaries, is involved in the exploration, development, and production of oil and natural gas properties both in Brazil and internationally, with a market capitalization of approximately R$36.03 billion.

Operations: The company generates R$12.39 billion from its oil and gas exploration and production activities.

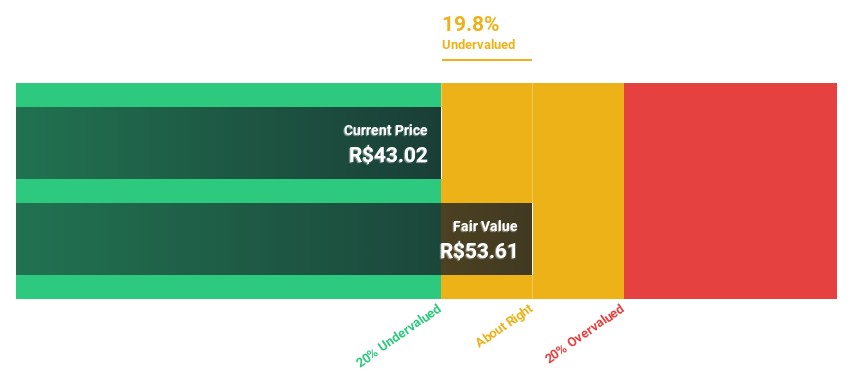

Estimated Discount To Fair Value: 19.8%

Prio S.A., with a current trading price of R$43.02, appears undervalued based on a discounted cash flow valuation estimating its fair value at R$53.61. Despite slower revenue growth forecasts at 14.6% annually compared to more robust markets, Prio's earnings are expected to expand significantly by 23.85% per year over the next three years, outperforming the Brazilian market's 14% growth expectation. Additionally, its strong cash position exceeding US$1 billion supports strategic mergers and acquisitions, aligning with its proactive management strategy in exploring new opportunities.

Grindr

Overview: Grindr Inc. operates a global social networking and dating application for the LGBTQ community, with a market capitalization of approximately $1.80 billion.

Operations: The company generates its revenue primarily from its role as an internet information provider, totaling approximately $279.23 million.

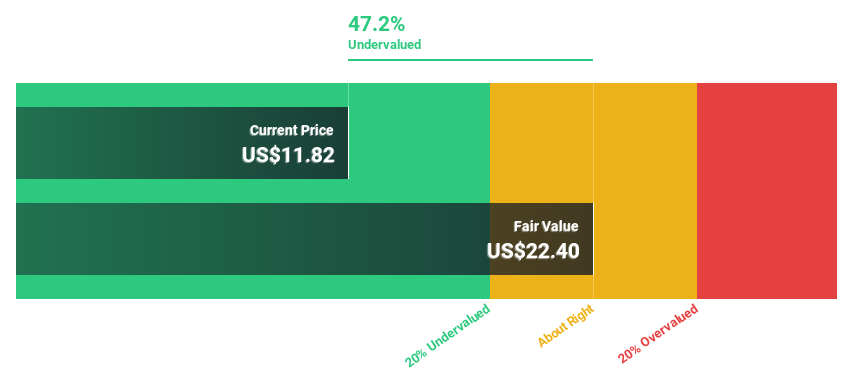

Estimated Discount To Fair Value: 47.2%

Grindr Inc., currently priced at US$11.82, is considered highly undervalued based on a discounted cash flow valuation showing its fair value at US$22.40. The company's revenue growth forecast of 12.8% annually surpasses the U.S market average of 8.6%. Recently, Grindr raised its 2024 revenue guidance to a minimum of 25% growth and expects continued strong growth through 2027. Despite current unprofitability, earnings are projected to grow significantly, with profitability expected within three years.

The growth report we've compiled suggests that Grindr's future prospects could be on the up.

Click here and access our complete balance sheet health report to understand the dynamics of Grindr.

Next Steps

Gain an insight into the universe of 956 Undervalued Stocks Based On Cash Flows by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BME:GRF BOVESPA:PRIO3 and NYSE:GRND.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance