Greif (GEF) Stock Declines 7% in a Month: Factors to Note

Greif GEF failed to impress investors with its second-quarter fiscal 2024 earnings results reported on Jun 5, 2024. Despite a 4% improvement in sales and return to volume growth, the company witnessed a 54% plunge in earnings due to elevated raw material, transportation and manufacturing costs, and higher SG&A expenses.

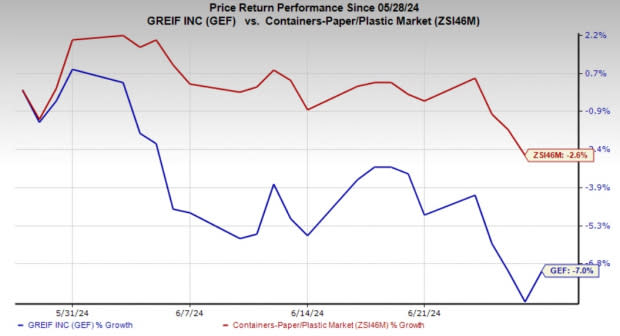

Due to this performance, the company’s shares have lost 7% in the past month compared with the industry’s 1.5% decline.

Image Source: Zacks Investment Research

The Zacks Rank #3 (Hold) company has a market capitalization of $2.79 billion. Let us discuss the factors that are taking a toll on the company.

High Costs Offset Volume Improvements in Q2

In the Global Industrial Packaging segment, volume growth has been in the negative territory for eight quarters in a row, reflecting the overall contraction in the industrial sector. The segment’s results were also impacted by the divestiture of Flexible Products & Services business in the second quarter of 2022.

In the Paper Packaging and Services segment, demand has remained soft across most key end markets, with continued weakness in textiles and paper cores, partially offset by strength in non-residential construction. Volumes have declined for seven consecutive quarters.

Greif witnessed a slight improvement in volumes in the fiscal second quarter in both segments, with a 1.7% rise in Global Industrial Packaging and 2.2% in Paper Packaging Services. This led to a 4.7% rise in total revenues for the April-ended quarter.

However, this did not translate to improved bottom-line results due to a 10.4% increase in the cost of sales and a 21.9% surge in SG&A expenses. This increase was attributed to elevated raw material, transportation and manufacturing costs. Meanwhile, SG&A expenses were higher, reflecting rising compensation expenses and costs incurred for strategic investments.

Declining Earnings

Notably, Greif had been witnessing a decline in adjusted earnings since the fourth quarter of fiscal 2022 due to lower volumes and high input costs. GEF delivered a turnaround performance in the fiscal first quarter, with a 19.8% improvement in earnings. However, this momentum was not sustained in the fiscal second quarter, with earnings plunging 54% to 82 cents per share.

Meanwhile, Greif’s peer Amcor Plc AMCR reported fiscal third-quarter (ended Mar 31, 2024) adjusted earnings per share (EPS) of approximately 18 cents, a 1.7% increase from the year-ago quarter. This was primarily attributed to the realization of benefits from structural cost initiatives. AMCR has also delivered a turnaround performance from the four consecutive quarters of decline in earnings.

AptarGroup, Inc. ATR reported first-quarter 2024 adjusted EPS of $1.26, which increased 31% from 95 cents (including comparable exchange rates) in the year-ago quarter aided by strong sales growth in the Pharma business and continued margin expansion in the Beauty and Closures businesses.

GEF’s Guidance Indicates Y/Y Decline

Following the results, Greif raised its EBITDA guidance for fiscal 2024 to range between $675 million and $725 million (from the prior stated $610 million). However, the updated guidance indicates a 14.5% decline from the adjusted EBITDA of $819 million in fiscal 2023. GEF expects an improvement in volume and price to be offset by higher transport and manufacturing costs.

Adjusted free cash flow is now expected between $175 million and $225 million, down from the prior projection of around $200 million. The company’s adjusted free cash flow was $481 million in fiscal 2023.

In sync with the increase in guidance, the Zacks Consensus Estimate for the company’s 2024 earnings has been revised 6.7% upward in the past 30 days. However, the consensus mark of earnings of $4.27 per share indicates a year-over-year decline of 30.5%.

Efforts to Offset Headwinds Will Bear Fruit

Greif’s focus on cost-rationalization measures, improving operational execution and capital discipline will help offset the impact of cost headwinds on margins. The company continues to make strategic acquisitions to expand its geographic reach and its product portfolio, which will aid growth. Its M&A pipeline remains solid and it plans to continue to deploy capital toward value-accretive targets in the coming quarters. The Zacks Consensus Estimate for fiscal 2025 indicates 19% year-over-year growth.

Stock to Consider

A better-ranked stock in the Industrial Products sector is Intellicheck, Inc. IDN, which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Intellicheck’s 2024 earnings is pegged at 2 cents per share. The consensus estimate for 2024 earnings has been unchanged in the past 30 days. The company has a trailing four-quarter average earnings surprise of 28.9%. IDN shares have gained 9.6% in the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Greif, Inc. (GEF): Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN): Free Stock Analysis Report

Amcor PLC (AMCR): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance