Granite (GVA) Wins $72M Caltrans Contract, Fortifies Q2 CAP

Granite Construction Incorporated GVA secured a $72 million contract from the California Department of Transportation (Caltrans) to build auxiliary lanes and bus-on-shoulder facilities on Highway 1 between Bay/Porter and State Park Drive in Capitola.

GVA will build various critical components, like concrete retaining walls, noise reduction measures, storm drains and a bicycle and pedestrian bridge. It will also reconstruct a 165 ft long vehicle bridge that will have bicycle and pedestrian features.

The company will recycle approximately 12,000 tons of existing asphalt and concrete into recycled aggregates, as well as utilize approximately 88,000 tons of subbase & base from its local aggregate and recycled aggregate plants. Granite's Salinas Hot Plant will provide 24,000 tons of hot mix asphalt (HMA) and 13,000 tons of rubberized HMA (a product that incorporates and recycles old tires). This move will ensure GVA's commitment to environmentally conscious practices and sustainability.

The Caltrans contract is funded by the Santa Cruz County Regional Transportation Commission (SCCRTC) with Local Measure D-Highway Corridor funds, Senate Bill 1 grants and other SCCRTC discretionary funds. This is expected to be included in Granite’s second-quarter Committed and Awarded Projects ("CAP"). The work will begin in September 2023 and is expected to be completed in third-quarter 2025.

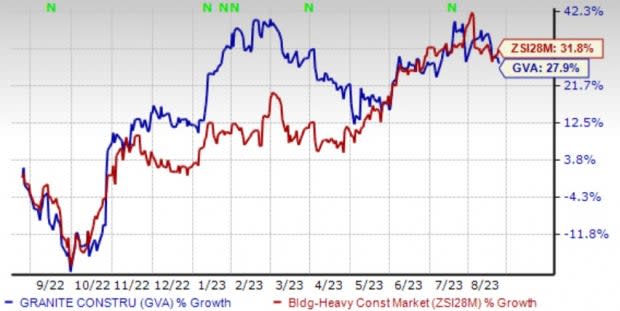

Image Source: Zacks Investment Research

Shares of GVA rose 27.9% in the past year compared with the Zacks Building Products - Heavy Construction industry’s 31.8% growth. Although its shares have underperformed the industry, consistent contract wins will enable GVA to gain momentum in the upcoming period.

Solid CAP Synergies

The performance of Granite’s operating segments showcased strong market growth in second-quarter fiscal 2023, benefiting from a strong public funding environment, with California leading the way. CAP reached $5.4 billion in the second quarter, a sequential increase of $334 million and year-over-year growth of $1.2 billion. Despite unfavorable weather conditions, the company's strategic approach of selective bidding resulted in increased margins and a higher number of projects won in the quarter.

During the fiscal second quarter, the California unit reported CAP of $2.35 billion, up 22.6% sequentially and 43.9% from the prior-year quarter. Despite budget challenges, bidding activity in the state remained robust, driven by the Federal Infrastructure Bill. The bill presented a range of opportunities.

Zacks Rank & Key Picks

GVA carries a Zacks Rank #3 (Hold).

Some better ranked stocks in the Zacks Construction sector are:

Sterling Infrastructure, Inc. STRL provides transportation, e-infrastructure and building solutions. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $4.09 per share from $3.52 in the past 30 days.

STRL’s expected earnings growth rate for 2023 is 29.4% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fluor Corporation FLR benefits from its diverse presence in various markets, which allows it to reduce the impact of market fluctuations. The company adopts a strategic approach by maintaining a well-balanced business portfolio, enabling it to prioritize stable markets while taking advantage of opportunities in cyclical markets when the timing is appropriate.

FLR presently sports a Zacks Rank #1. Its expected earnings growth rate for 2023 is 141.5%. The Zacks Consensus Estimate for Fluor’s 2023 earnings has moved north to $1.98 per share from $1.87 in the past seven days.

Willdan Group WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry.

Willdan Group presently flaunts a Zacks Rank #1. WLDN’s expected earnings growth rate for 2023 is 50%. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $1.32 per share from $1.25 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance