Is it a Good Deal?: $1.53M for a 936-sq ft unit in District 1

Since launch, One Shenton has had more unprofitable than profitable transactions. (Photo: Samuel Isaac Chua/EdgeProp Singapore)

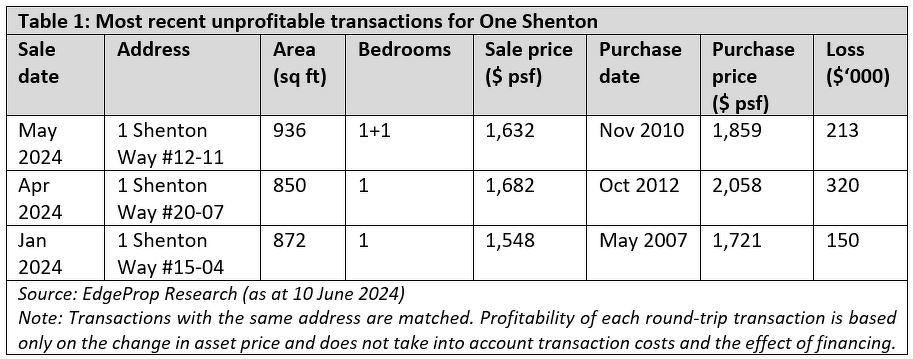

SINGAPORE (EDGEPROP) – Last month saw a sale transaction for One Shenton which resulted in a loss of approximately $213,000. The 936-sq ft unit on the 12th floor was sold for $1,632 psf. The seller purchased the one-bedroom-plus-study unit in November 2010 for $1,859 psf.

At the time of writing, One Shenton had 100 unprofitable and 91 profitable transactions out of 290 resale and sub-sale transactions since its launch in January 2007. Losses range from approximately $10,400 to $2.56 million, while profits range from approximately $8,700 to $542,000.

We used our analytics tool, "Is it a Good Deal?", to determine whether last month’s unprofitable sale transaction constituted a good bargain for the buyer.

Read also: Penthouse at Veranda sold for $1.67 mil profit

In the heart of the CBD

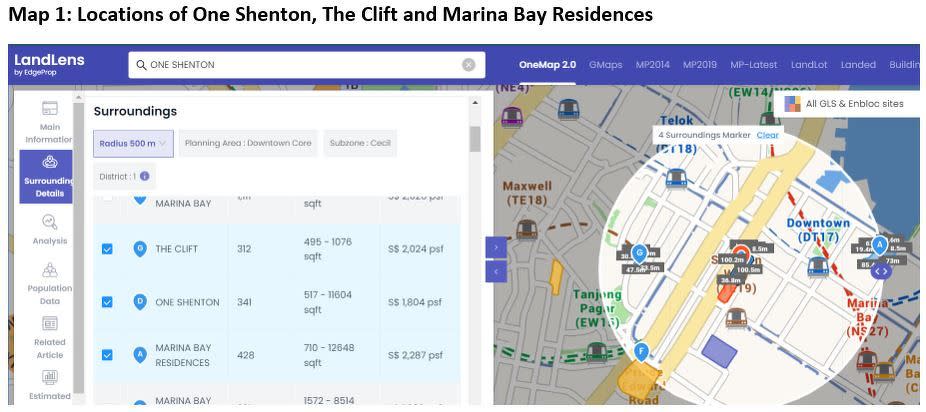

One Shenton is a 99-year leasehold development located along Shenton Way in the Downtown Core Planning Area. The condo obtained its temporary occupation permit (TOP) in 2011. The 341-unit development comprises a wide variety of unit types from one-bedroom units to penthouses. The units range from 517 sq ft to 9,085 sq ft in size.

Amenities within walking distance include Shenton Way, Telok Ayer, and Downtown MRT Stations, as well as Lau Pa Sat, Amoy Street Food Centre, China Square Food Centre, Downtown Gallery, and The Westin Singapore. There are no schools within a 1km radius, but Cantonment Primary School and Outram Secondary School are within a 2km radius. However, Outram Secondary School is expected to move to Sengkang in 2026.

Source: EdgeProp LandLens (as at 10 June 2024)

The buyer may have secured a good deal

According to our "Is it a Good Deal?" analytics tool, it appears that the buyer managed to snag a bargain because the transacted price was below the average prices for the development, the district, and several neighbouring developments. Additionally, the 99-year leasehold development has a remaining tenure of 80 years and is located near numerous MRT stations. The main drawback appears to be the lack of nearby primary schools.

Source: EdgeProp Is it a Good Deal (as at 10 June 2024)

Small units could be losing favour

At the time of writing, three unprofitable and four profitable transactions have taken place for One Shenton this year. Losses range from approximately $150,000 to $320,000, while profits range from approximately $138,000 to $500,000. It is notable that all three recent unprofitable transactions are for units that measure less than 1,000 sq ft.

The most recent unprofitable transaction is for a one-bedroom-plus-study unit that measures 936 sq ft. The owner bought the unit in November 2010 for $1,859 psf and sold it last month for $1,632 psf, resulting in a loss of approximately $213,000.

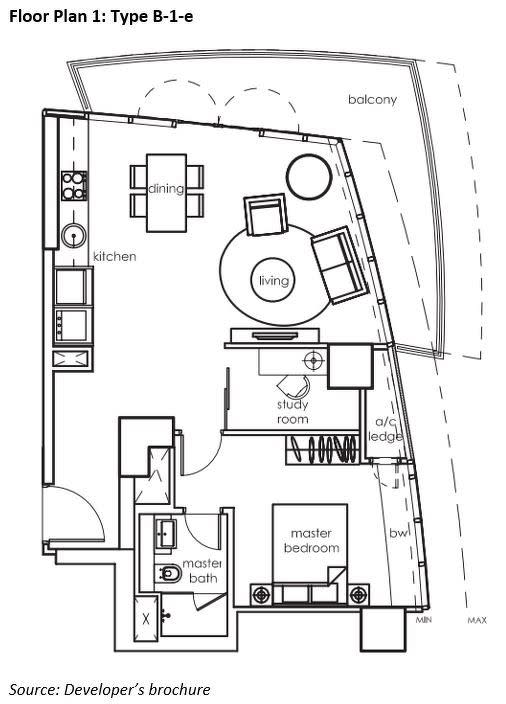

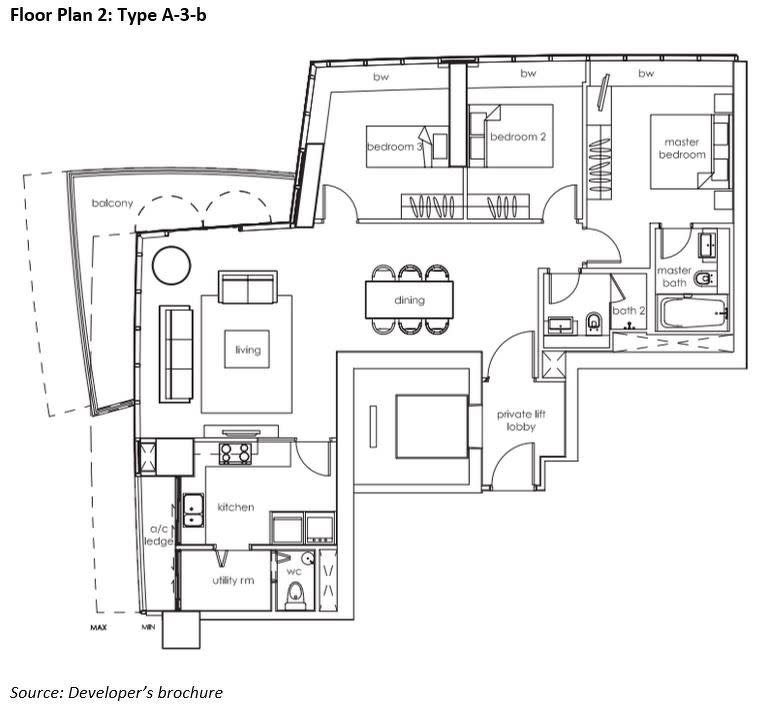

The unit is unlikely to appeal to residents who cook frequently because it has a small open-concept kitchen. Additionally, the unit has an irregularly shaped balcony that spans the entire dining and living areas. The spacious balcony is unlikely to appeal to residents who prefer indoor space over outdoor space.

Read also: Four-bedder at Ardmore Park sold for $6.5 mil profit

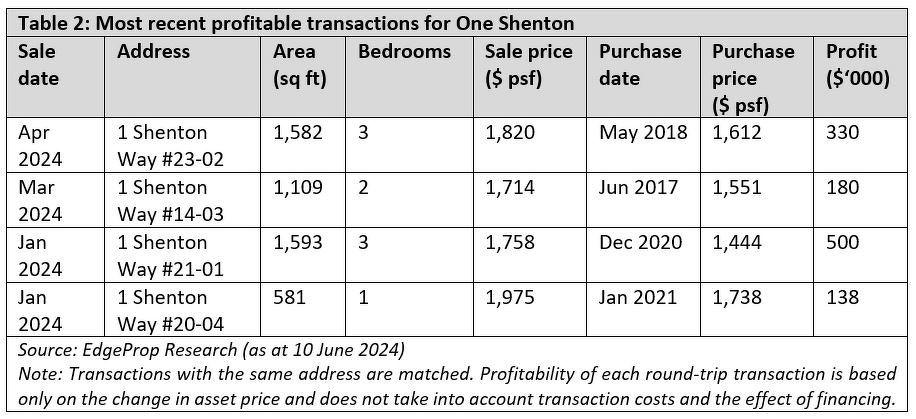

In contrast, three out of the four profitable transactions that took place this year involve larger units with two or three bedrooms that measure at least 1,100 sq ft. The fourth profitable transaction is for a one-bedroom unit that measures 581 sq ft.

The most recent profitable transaction is for a three-bedroom unit that measures 1,582 sq ft. The seller sold the unit in April for $1,820 psf after purchasing it in May 2018 for $1,612 psf, resulting in a profit of approximately $330,000.

The unit has a private lift that opens into a foyer. The living and dining areas, as well as the kitchen, are to the left of the foyer. There is a balcony that is accessible via the living area. The en-suite master bedroom, two bedrooms, and the common bathroom are located to the right of the foyer. The spacious unit has regularly shaped rooms that are expected to appeal to a wide pool of buyers.

One Shenton is more affordable than comparable neighbours

There are eight condos within walking distance of One Shenton. With the exception of Robinson Suites, the remaining seven condos are 99-year leasehold developments. The newest development is the uncompleted Skywaters Residences, which was recently in the news for the sale of one of its penthouses at an eye-watering price of $47.34 million or $6,100 psf.

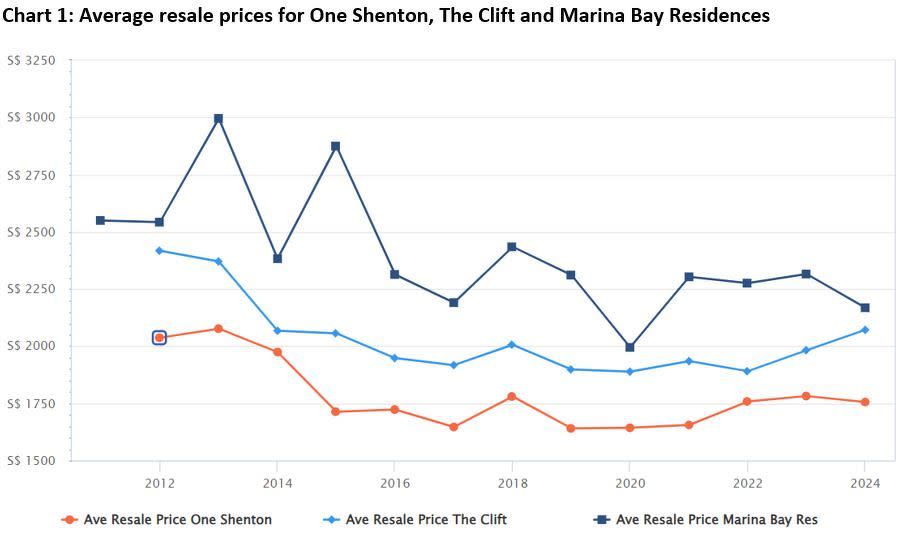

The Clift is the closest in age to One Shenton because both developments obtained their TOP in 2011. Marina Bay Residences is a year older, having obtained its TOP in 2010. The Clift is located along McCallum Street and features 312 units. Marina Bay Residences is located along Marina Boulevard and is a larger development with 428 units. Similar to One Shenton, both condos are located in District 1 and the Downtown Core Planning Area.

Source: EdgeProp Is it a Good Deal (as at 10 June 2024)

The average resale price for One Shenton has been trending below that of The Clift and Marina Bay Residences. It is notable that the current average price for One Shenton ($1,756 psf) is still below $2,000 psf, while the average prices for The Clift ($2,071 psf) and Marina Bay Residences ($2,168 psf) have surpassed this benchmark.

Read also: Is it a Good Deal?: Studio CCR condo sold for $85,000 loss

The average resale prices for all three developments have declined since 2012. However, One Shenton has shown the smallest decline of 13.8% despite having the lowest average price. The average prices for The Clift and Marina Bay Residences fell by 14.3% and 14.7%, respectively.

Source: EdgeProp Market Trends (10 June 2024)

Average resale price for One Shenton lower than District 1

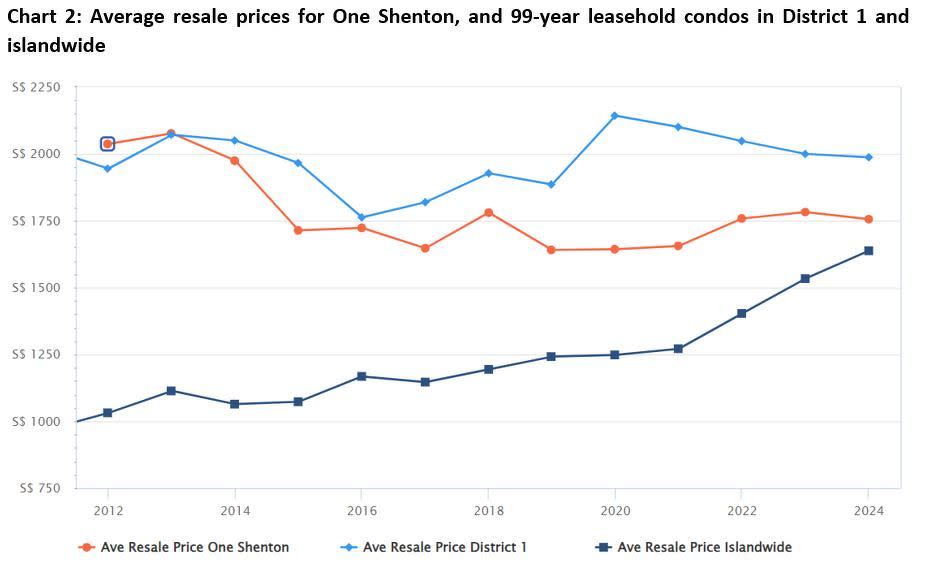

The average resale prices for One Shenton ($1,756 psf) and leasehold condos in District 1 ($1,987 psf) have been higher than that for leasehold condos in Singapore ($1,638 psf). However, the average price for One Shenton has trended higher than that for District 1 only since 2014.

It is notable that the average resale price for One Shenton has declined by 1.5% y-o-y this year, mirroring the 0.7% y-o-y price fall of its counterparts in District 1. However, the average resale price for leasehold condos islandwide has increased by 6.8% y-o-y over the same timeframe.

Despite the decline in the average resale price this year, the average price for leasehold condos in District 1 has shown a weak increase of 2.2% since 2012, while the average price of their counterparts islandwide surged by 58.9% over the same timeframe. In contrast, the average price for One Shenton has declined by 13.8% since 2012.

Source: EdgeProp Market Trends (as at 10 June 2024)

Conclusion

An examination of this year’s profitable and unprofitable transactions for One Shenton seems to indicate that smaller units in the development are less popular with buyers compared to the larger units. The silver lining is that the losses suffered by owners who sold their units this year are below $330,000, which is at the lower end of the loss spectrum for the development. Furthermore, four profitable transactions have been recorded for the development this year.

It should be noted that price growth for leasehold condos in District 1 has been weak, in contrast to the stellar growth for their counterparts islandwide. While price decline has been observed for One Shenton, the development is more affordable than The Clift and Marina Bay Residences. Furthermore, One Shenton has shown a smaller price decline than both neighbouring developments.

To learn more about this transaction, and whether it is a good deal, click here.

Check out the latest listings for One Shenton, Marina Bay Residences, The Clift properties

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance