Goldman (GS), Others Team up for Client Disclosure Reporting

Goldman Sachs Group Inc. GS has collaborated with HSBC Holdings Plc HSBC, Barclays PLC BCS, BNP Paribas and another unnamed bank to adopt a unified global approach for disclosing clients' stock positions.

The consortium, Endoxa, will use the services of Droit, a financial technology firm, to develop a Position Reporting Utility. The Position Reporting Utility will review disclosure rules across key jurisdictions with the help of Allen&Overy law firm.

This will be followed by the consortium developing a consensus view on meeting these obligations. Droit will then translate this consensus into a model for GS, HSBC, BCS and other banks to understand the reporting obligations for each trade.

With this, the new tool aims to improve disclosure quality related to clients’ long and short bets across different markets. It will also enhance transparency and reduce costs. Per GS management, the platform will promote unified standards, and encourage transparent and consistent compliance across the industry.

"Creating this consortium will enable us as financial institutions to more effectively and efficiently navigate the regulatory complexity of the global position reporting rules while retaining each firm’s ownership of the underlying risks," said Richard Hempsell, global head of core operations at Goldman.

The move follows regulators pushing for higher disclosures from hedge funds and other asset managers related to their investments. The Securities and Exchange Commission has been drafting rules needing more transparency on certain types of derivatives.

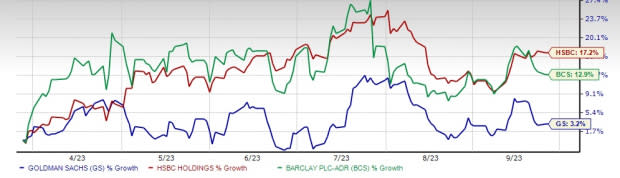

Goldman’s shares have gained 3.2% over the past six months, whereas HSBC and BCS have risen 17.2% and 12.9%, respectively.

Image Source: Zacks Investment Research

HSBC presently sports a Zacks Rank #1 (Strong Buy). BCS presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, GS presently has a Zacks Rank #4 (Sell).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance