Goldman brings back Tom Montag as CEO Solomon bolsters board support

(Reuters) -Goldman Sachs has brought back to its fold senior executive Tom Montag, adding him to its board as the Wall Street giant looks to regain lost ground after its ill-fated foray into consumer banking.

Montag, who had previously co-headed Goldman's securities division and held other senior roles in his 22 years at the firm, will join the audit, governance and risk committees.

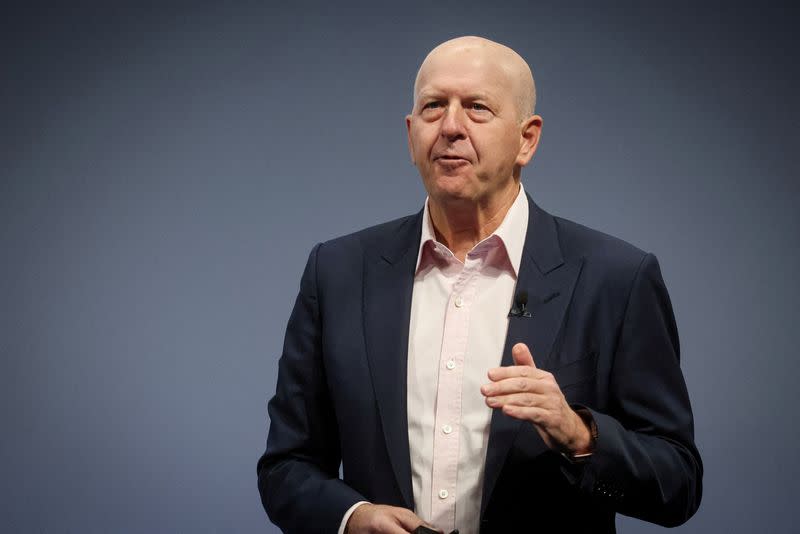

Considered to be an ally of CEO David Solomon, Montag could bolster support for the chief executive, who is looking to undo the damage from the company's high-profile flop in retail banking.

Solomon's plans to refocus Goldman to its mainstay businesses of investment banking, trading and asset management is already gaining traction with the board, two sources close to the CEO told Reuters.

"Tom has deep risk acumen that will further strengthen the depth and breadth of skills and experiences represented on our Board," said Adebayo Ogunlesi, the bank's lead director.

Montag left Goldman to join Merrill Lynch in 2008, which was then taken over by Bank of America during the throes of the financial crisis.

He also served as BofA's chief operating officer and the president of its global banking and markets division before retiring at the end of 2021. Last year, he became CEO of Rubicon Carbon, a TPG-backed firm working on developing carbon markets.

"Tom brings extensive financial services and risk management experience, with over 35 years in the industry," Solomon said. "He has incredible perspective regarding the complex financial and non-financial risks that large global financial institutions face."

Goldman had on Wednesday reported its lowest quarterly profit in three years, hit by writedowns tied to its consumer businesses and real estate investments.

"This moment in the economic cycle creates meaningful headwinds for Goldman Sachs... We are making tough decisions that are driving the strategic evolution of the firm," Solomon told analysts, warning that the bank was heading into "a period of lower results."

(Reporting by Saeed Azhar in New York and Niket Nishant and Manya Saini in Bengaluru; Editing by Arun Koyyur and Lananh Nguyen)

Yahoo Finance

Yahoo Finance