Gol Linhas (GOL) Continues to Grapple With Higher Fuel Costs

Gol Linhas Aereas Inteligentes S.A. (GOL) recently reported a loss of 35 cents per share for the fourth quarter of 2022, wider than the Zacks Consensus Estimate of a loss of 19 cents. In the year-ago quarter, Gol had incurred a loss of 62 cents per share.

Net operating revenues of $898 million also lagged the Zacks Consensus Estimate of $916 million. With people again taking to the skies, the top line improved year over year.

Escalating fuel prices pose a threat to Gol Linhas’ bottom line. The average fuel price per liter increased 43.6% year over year in the fourth quarter of 2022. Primarily due to significant increases in fuel costs, total operating expenses increased 48.8% year over year. For first-quarter 2023, GOL expects fuel price per liter to be R$5.7. The fuel price per liter is now predicted to be R$5.4 (prior view: R$5.3) in the current year.

The company’s updated guidance for 2023 looks disappointing. Gol Linhas now expects capacity to increase 15-20% (prior view: 20-25%) year over year in 2023. The total operational fleet is now expected to be between 114 and 118 (prior view: 118-122).

Total net revenues are now expected to be R$19.5 billion (prior view: R$20 billion) in the current year. Net financial expense is expected to rise to R$2.1 billion from the prior guidance of R$2.0 billion. The pre-tax margin is estimated to be 3% (prior view: 4%) in the year.

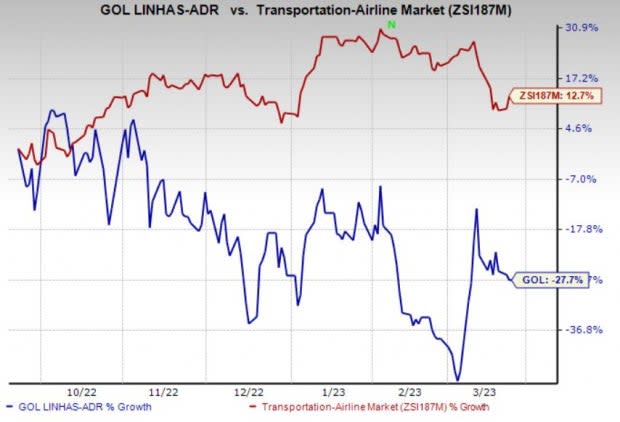

Partly due to these headwinds, shares of Gol Linhas have declined 27.7% over the past six months against the 12.7% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Despite such tailwinds,continued recovery in air-travel demand has been beneficial for GOL. In fourth-quarter 2022, revenues from passenger transportation, accounting for 92.7% of total revenues, rose 56.1% year over year, thanks to continued recovery in air-travel demand in Brazil.

Notably, Gol Linhas transported 7.8 million passengers in the fourth quarter of 2022, up 18.6% from the year-ago number.

Zacks Rank and Stocks to Consider

Gol Linhas currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader Zacks Transportation sector are Copa Holdings, S.A. (CPA), Alaska Air Group, Inc. (ALK) andAmerican Airlines (AAL). Copa Holdings presently sports a Zacks Rank #1 (Strong Buy), while Alaska Air and American Airlines currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Copa Holdings has an expected earnings growth rate of 39.83% for the current year. CPA delivered a trailing four-quarter earnings surprise of 33.35%, on average.

The Zacks Consensus Estimate for CPA’s current-year earnings has improved 21.1% over the past 90 days. Shares of CPA have soared 3.5% over the past three months.

Alaska Air has an expected earnings growth rate of 32.64% for the current year. ALK delivered a trailing four-quarter earnings surprise of 8.98%, on average.

The Zacks Consensus Estimate for ALK’s current-year earnings has improved 11.4% over the past 90 days.

AAL has an expected earnings growth rate of more than 100% for the current year. AAL delivered a trailing four-quarter earnings surprise of 7.79%, on average.

The Zacks Consensus Estimate for AAL’s current-year earnings has improved 31.1% over the past 90 days. Shares of AAL have gained 11.2% over the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance