GM & F Embrace Hybrids: Are the Stocks Worth Considering Now?

U.S. auto giants General Motors GM and Ford F are strategically shifting their focus toward hybrids and plug-in hybrid electric vehicles (PHEVs). That’s not to say that these companies are not enthusiastic about an all-electric future of mobility. It is just that GM and F are refining their strategies amid a cooling EV market due to consumer concerns about the high prices of EVs and the availability of charging infrastructure.

During the Bernstein Annual Strategic Decisions Conference held on May 29, both companies emphasized increasing their focus on hybrids, with Ford showing a stronger commitment to the idea.

Let’s delve into the evolving strategies of GM and Ford, their differing views on hybrid technology, and whether it is a good time to invest in these stocks.

Differing Views on Hybrid Future

GM plans to introduce plug-in hybrids by 2027 to comply with regulatory requirements and customer demands during the transition to full electrification. GM CEO Mary Barra emphasized that EVs remain the company’s long-term priority and views hybrid technology as merely a transitional phase.

She stated, "We do see hybrids, because of the regulatory changes, be a part of it, but let's remember with a hybrid, you have two propulsion systems on that vehicle. It’s not the end game because they are not zero emission. We're trying to be very strategic about how we approach this and allocate our capital."

In contrast, Ford CEO Jim Farley views hybrids as not just a transitional technology but a significant part of the company’s future. He argued that hybrids should not be seen merely as a bridge to full electrification. Quoting Farley, "We should stop talking about hybrids as transitional technology. Many of our hybrids in the U.S. are now more profitable than their non-hybrid equivalents."

Ford is focusing on a range of energy solutions beyond pure EVs, including extended-range electric vehicles (EREVs) and diverse PHEV applications. Farley highlighted that hybrids, like the popular F-150 hybrid, are more profitable than their non-hybrid counterparts, driven by features such as exportable power, which adds significant value for customers.

Roadmap to Growth

Both GM and Ford are committed to long-term electrification strategies, recognizing it as a pivotal growth driver. They acknowledge the rising significance of software and subscription services for future profitability. Concurrently, they remain resolutely focused on containing costs.

GM's Ultium Drive system and battery facilities across Ohio, Tennessee and Lansing are poised to bolster its electric mobility capabilities. Additionally, GM is refining its software-defined vehicle approach, prioritizing seamless updates and user experience enhancements. To trim costs, GM is streamlining its product lineup, leveraging artificial intelligence and optimizing business processes, which are yielding significant savings.

Ford also remains focused on integrating digital technologies for streamlined manufacturing and prioritizing in-house production of essential components. It is enhancing energy efficiency and lowering production costs for competitive pricing through supply chain and manufacturing optimizations, particularly in EV production. The company is investing in software and advanced driver-assistance systems, aiming for an enhanced digital journey for consumers.

Should You Invest in GM & F Now?

Both these legacy automakers are strategically positioning themselves to benefit from robust vehicle offerings, cost-containment efforts and a balanced approach toward hybrids and EVs. As these companies navigate the evolving automotive landscape, their hybrid strategies could provide a competitive edge in the near term.

Both companies are witnessing northbound estimates for the current fiscal. Over the past 30 days, the Zacks Consensus Estimate for GM’s 2024 EPS has been revised north by 2 cents to $9.40. The consensus mark for F’s 2024 EPS has moved up by 3 cents to $1.97 over the same timeframe.

From a financial standpoint also, GM and F are on strong grounds. General Motors had total automotive liquidity of $33.3 billion as of Mar 31, 2024, including around $19.7 billion of cash/cash equivalents/marketable debt securities. Ford ended the first quarter of 2024 with around $25 billion in cash and more than $43 billion in liquidity.

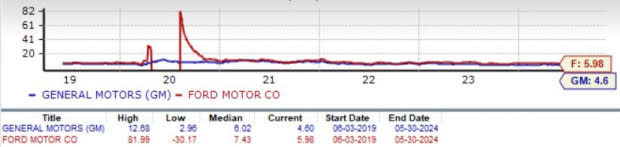

Additionally, both GM and F are valued attractively and carry a Value Score of A. If we look at the Price/Earnings ratio, GM is currently trading at 4.60 forward earnings and Ford at 5.98, compared with the industry’s 30.52. Both companies are currently valued well below their 5-year median values.

Image Source: Zacks Investment Research

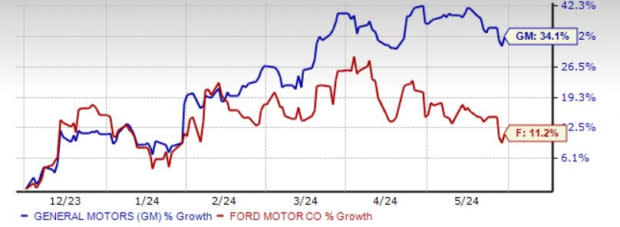

Over the past six years, shares of GM and Ford have gained 34.1% and 11.2%, respectively, and there seems to be much upside left given their cheap valuation and strong fundamentals. So, GM and Ford appear to be prudent investment choices now and any dip in their stock prices could present an opportunity to accumulate more shares.

Image Source: Zacks Investment Research

GM and F currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance