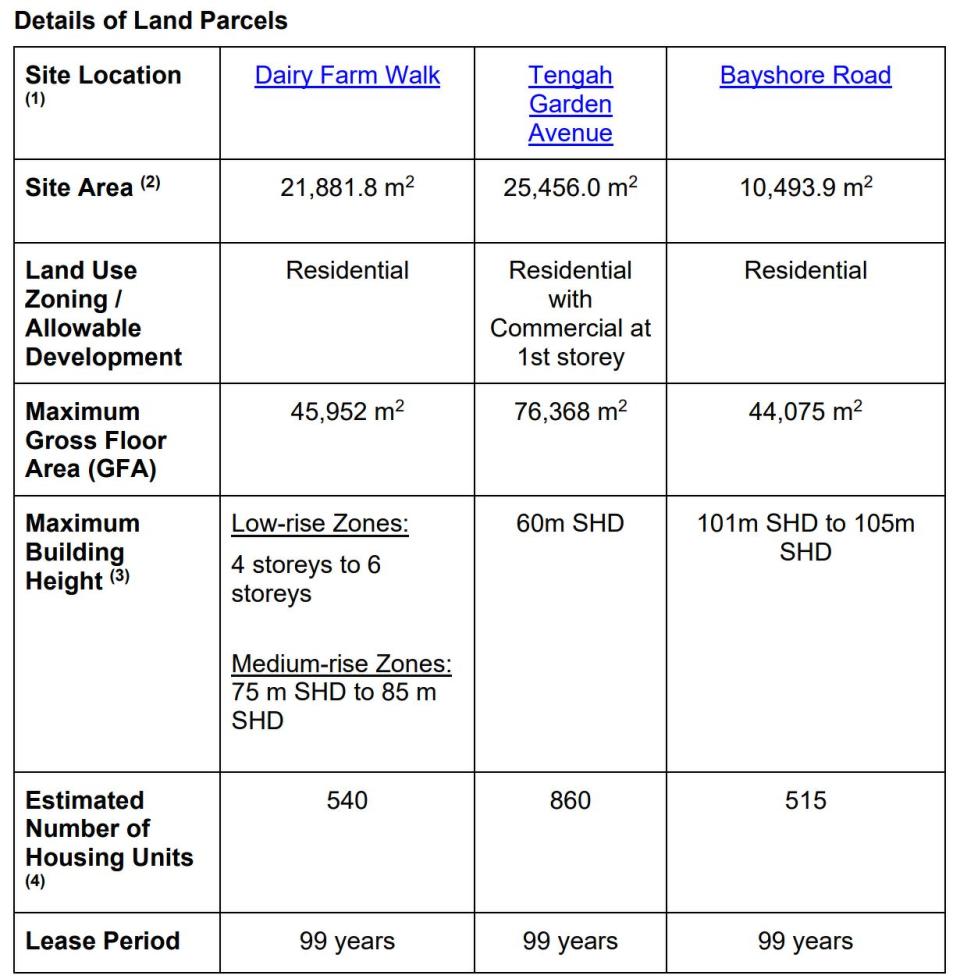

GLS sites at Dairy Farm Walk and Tengah Garden Ave launched for sale, Bayshore Rd site open for application

The government has initiated the tender for two government land sale (GLS) sites listed in the Confirmed List of the 1H2024 GLS programme, and another site is available for application under the Reserve List.

The two sites on the Confirmed List are at Dairy Farm Walk and Tengah Garden Avenue, while the site on the Reserve List is at Bayshore Road.

Despite the numerous GLS sites launched for sale and made available to developers this year, Lee Sze Teck, senior director of data and analytics at Huttons Asia, warns that upcoming bids may be more subdued and cautious.

Read also: GuocoLand-Hong Leong JV submit sole bid for Upper Thomson Road GLS site at $905 psf ppr

“With the Government increasing land supply and developers facing challenging conditions from high construction costs, interest rates and the harmonisation of Gross Floor Area, land bids will be lower than previously sold sites in the vicinity,” he says.

Marcus Chu, CEO of ERA Singapore, echoed this sentiment. “There will be seven sites with tenders closing between July and September. Apart from the EC site at Jalan Lorong Besar and the residential site at Margaret Drive, which are expected to be hotly contested, we may see lacklustre bids for the other sites due to the higher number of GLS sites open for tender.”

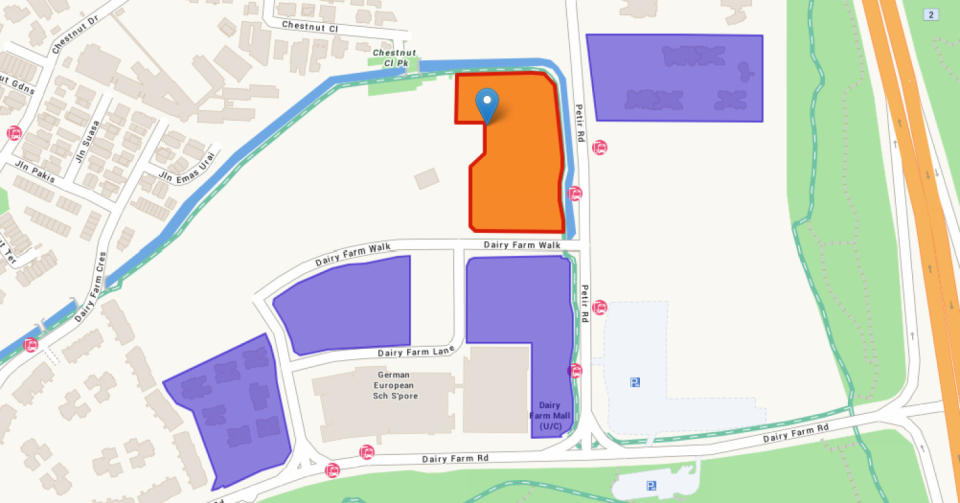

Dairy Farm Walk

The residential site at Dairy Farm Walk is 235,448 sq ft with a maximum gross floor area (GFA) of 494,443.5 sq ft. As part of the site control plan, the site will feature a low-rise zone of up to six storeys and a medium-rise zone comprising residential blocks of up to 85m. The plot is expected to yield about 540 units.

“This parcel of land is one of the few plots in the Dairy Farm area to have a plot ratio of 2.1 and can be built up to 85m SHD. This means that north-facing units on higher floors will potentially enjoy unblocked views of the Chestnut Avenue GCBA,” says Lee.

The government released this third GLS site for sale in this area after two successful GLS tenders in 2022 and 2018. Development in this area started with the tender of a mixed-use residential and commercial site on Dairy Farm Road. United Engineers secured the 211,488 sq ft site with the highest bid of $368.8 million, translating to a land rate of $830 psf per plot ratio.

The site is being developed into the 460-unit Dairy Farm Residences, which was launched for sale in 2019 and is fully sold. The project achieved an average selling price of $1,835 psf.

Read also: Two sites at River Valley Green launched for tender

In March 2022, a 168,536 sq ft site along Dairy Farm Walk was awarded to Sim Lian Group. The developer beat out six other contesting bids with the highest bid of $347 million, which works out to $980 psf per plot ratio. The site is being developed into the 386-unit project The Botany at Dairy Farm, launched for sale in March 2023. Sim Lian sold 187 units (48%) during the opening sales weekend. Based on the latest developer sales data, the project is 90% sold to date and commanded an average selling price of $2,022 psf.

“The earlier projects, namely Dairy Farm Residences and The Botany at Dairy Farm, have seen a balanced mix of buyers from HDB and private residential addresses. This trend highlights the strong appeal of Dairy Farm Walk to a diverse group of potential homeowners,” says Chu.

Huttons’ Lee expects the new GLS site at Dairy Farm Walk to attract up to three bidders and a top bid of between $800 psf ppr and $850 psf ppr.

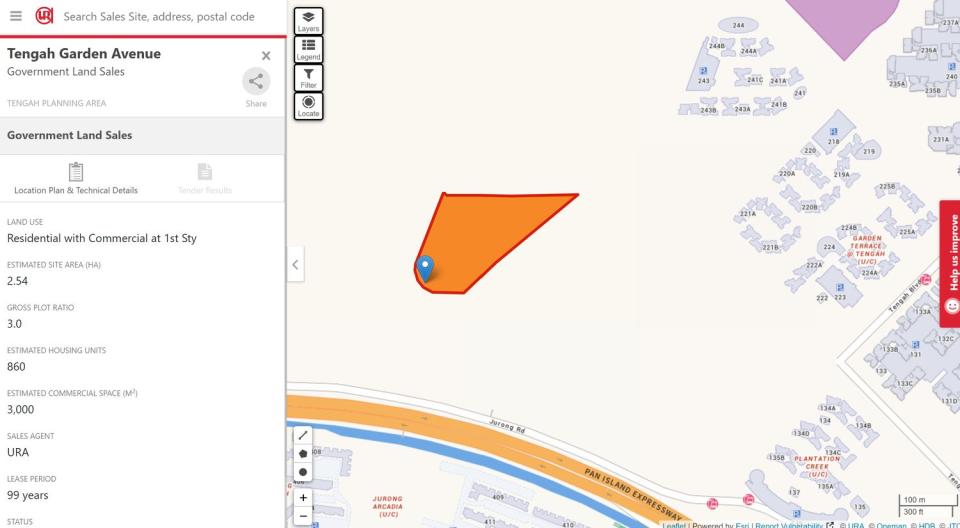

Tengah Garden Avenue

The second site launched for sale today is a 273,906.5 sq ft plot at Tengah Garden Avenue. This site is zoned ‘Residential with Commercial at 1st storey’ with a maximum GFA of 821,720 sq ft that could yield up to 860 residential units.

The new development, located next to Hong Kah MRT Station on the upcoming Jurong Region Line scheduled for completion in 2027, will feature a pedestrian side gate connecting it to the future MRT station. According to the site's control plan, a public space is also envisioned to front the MRT plaza.

“The site is strategically located next to the upcoming Hong Kah MRT Station on the Jurong Region Line. This provides an unmatched advantage with enhanced connectivity and convenience, making the GLS site more appealing to homeowners and investors,” says Chu.

Read also: Tender launched for GLS sites at Clementi Ave 1 and Pine Grove

This will mark the debut of condominiums in the burgeoning Tengah estate, following the successful launch of the estate's first Executive Condominium (EC), Copen Grand, in 2022. Developed jointly by City Developments (CDL) and MCL Land, Copen Grand secured the site with a winning bid of $400.32 million, translating to a land rate of $603 psf per plot ratio. The EC completely sold out in 2022.

Chu says the upcoming condominium at Tengah Garden Avenue will be the largest, featuring 860 dwelling units and up to 3,000 sqm of commercial use GFA. He adds: “There might be some hesitation for a bigger site like this due to the heavy upfront capital investment and higher development risks”.

“Despite the alluring prospects from the West Region’s upcoming rejuvenation and the development of new transport infrastructure, Tengah remains a relatively unfamiliar locale for homebuyers. Developers would need to balance demand drivers and supply influx from the surrounding new developments against gaining a first-mover advantage.”

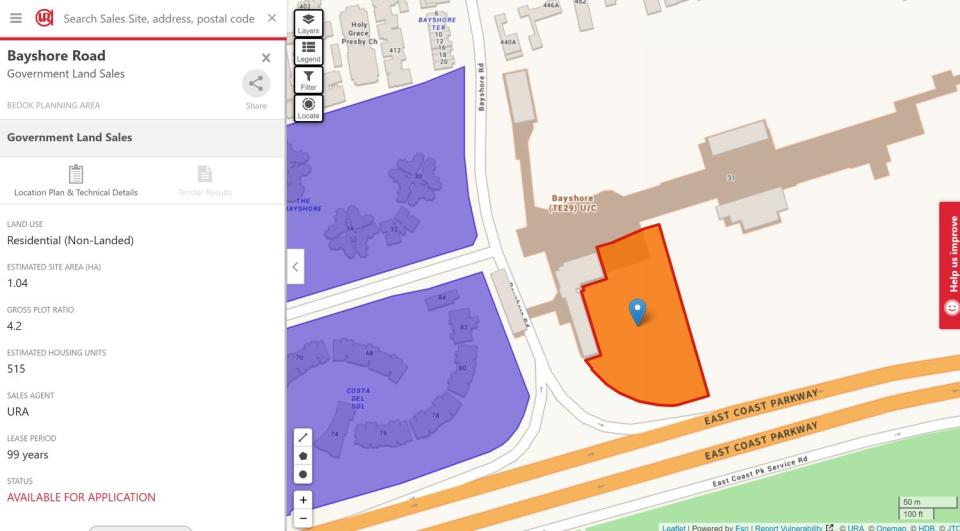

Bayshore Road

A 112,914 sq ft residential site at Bayshore Road has now been available for application under the Reserve List. The plot has a maximum GFA of 474,247 sq ft and could yield 515 units if developed.

Sites under the Reserve List are not released for tender immediately but are initially made available for application. It will be considered tender only when a developer applies with an acceptable minimum price.

The site is adjacent to the soon-to-open Bayshore MRT Station on the Thomson-East Coast Line, scheduled to commence operations on June 21. Across from the Bayshore Road GLS site are two condominiums: The Bayshore, featuring 1,038 units, and Costa Del Sol, comprising 906 units.

If the GLS site at Bayshore Road is put up for sale and successfully awarded, it will mark the inaugural private residential development in the emerging Bayshore housing estate. Spanning 60 hectares and bordered by Upper East Coast Road and the East Coast Parkway, this residential area is set to introduce 10,000 new homes, with 70% designated for public housing, says the government.

“Bayshore is a new estate in the east and an extension of Bedok town. It will draw buyers living in the east. This includes HDB upgraders or those living in nearby landed homes rightsizing to a condominium unit without relocating too far away. In particular, buyers who desire a sea view or close to East Coast Park for recreational activities will likely be interested,” says ERA's Chu.

He adds that developers likely hope to capitalise on a first-mover advantage by being the first to launch a new condo in this estate, and the attractiveness of the site is elevated due to its proximity to Bayshore MRT Station.

“We will likely see developers triggering this site for sale due to high demand. There is pent-up demand for homes in the area. The last GLS site awarded in the area was in January 2016, which was hotly contested and saw eight bidders. The site was eventually awarded at $858 psf ppr. Now Seaside Residences, the development sold 70% of units launched on the launch weekend.”

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

GuocoLand-Hong Leong JV submit sole bid for Upper Thomson Road GLS site at $905 psf ppr

Tender launched for GLS sites at Clementi Ave 1 and Pine Grove

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance