GlobalWafers further raises bid for Siltronic to 4.35 billion euros

BERLIN (Reuters) - Taiwan's Globalwafers further raised its offer for Germany's Siltronic by 150 million euros ($183 million) on Saturday as it tries to win over the target's shareholders to its bid to create a leading player in the global silicon wafer industry.

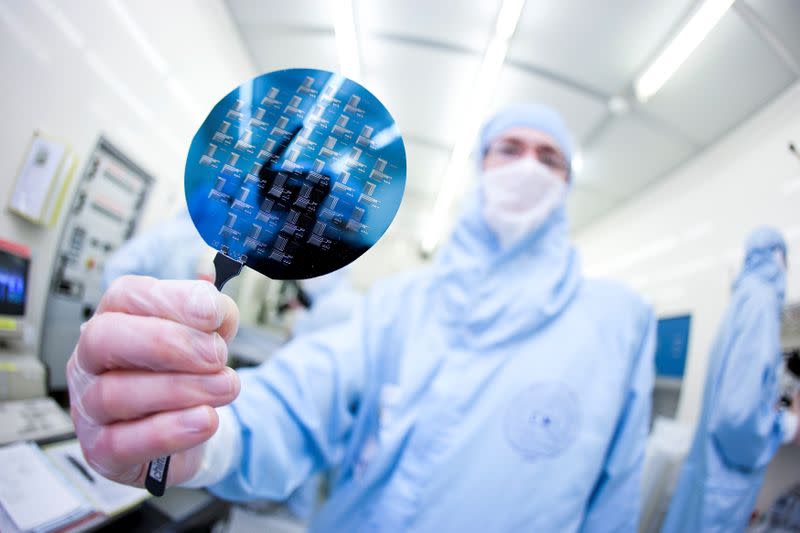

The sweetened offer, which values Siltronic at 4.35 billion euros, came just a day after Globalwafers previously increased its offer, which would create the world's second-largest player in the 300 millimeter wafers market behind Japan's Shin-Etsu.

The proposal has been in jeopardy after hardly any shareholders, besides Siltronic's former parent company Wacker Chemie which has 30.8%, accepted it.

GlobalWafers said it would increase the all-cash bid to 145 euros per share, 16% more than its original offer of 125 euros, having on Friday hiked its bid for the Munich-based rival by 450 million euros or 140 euros per share.

GlobalWafers Chief Executive Doris Hsu said the revised terms were its final offer and that the offer reflected a fair price for all shareholders.

Siltronic shareholders have until Jan. 27 to tender their shares in favour of the deal, which is subject to an acceptance threshold of 65%. Siltronic's management supports the deal.

($1 = 0.8219 euros)

(Reporting by Alexander Huebner and Douglas Busvine; Writing by Michael Nienaber; Editing by David Holmes)

Yahoo Finance

Yahoo Finance