Global sustainable bond volumes bounced back in 1Q2024; Moody’s keeps US$950 bil full-year forecast

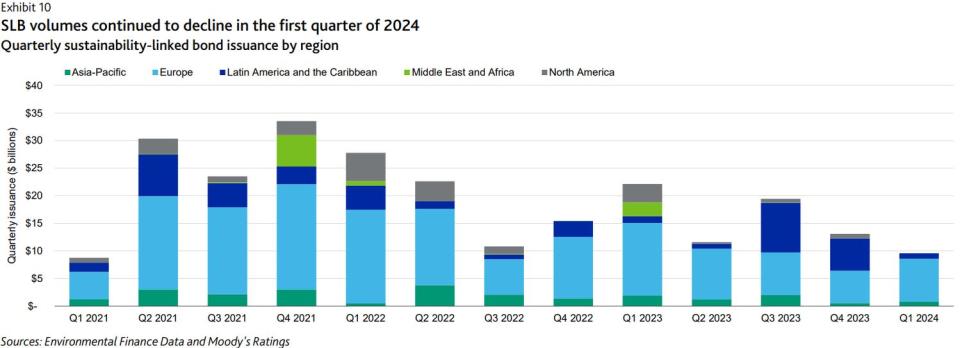

Sustainability-linked bond volumes fell for the second consecutive quarter, totaling just under US$10 billion in 1Q2024.

Global sustainable bond issuance bounced back to US$281 billion ($381.84 billion) in 1Q2024, up 36% from US$207 billion in 4QFY2023 and little changed from US$279 billion a year earlier.

This sets the stage for sustainable bond volumes on track to meet the US$950 billion full-year forecast. according to a May 1 report by Moody’s Investors Service.

Across the four segments, there were US$169 billion of green bonds, US$48 billion of social bonds, US$55 billion of sustainability bonds and US$10 billion of sustainability-linked bonds (SLBs).

The top issuer by volume was the International Bank for Reconstruction and Development, the lending arm of the World Bank Group, with a cumulative US$17 billion in sustainability bonds.

This is followed by the French public finance agency Caisse d'Amortissement de la Dette Sociale with nearly US$13 billion in social bonds.

The government of Japan was the third-largest issuer with two tranches of transition bonds — the first to be issued by a sovereign — totaling nearly US$11 billion.

Despite the strength of 1QFY2024 sustainable bond volumes, Moody’s is maintaining its 2024 sustainable bond issuance forecast of US$950 billion as global macroeconomic conditions remain relatively soft.

Transition finance ‘top of mind’

Transition finance, which Moody’s said in its last report on Jan 24 will gain prominence in 2024, remains top of mind for many issuers as policy support increases.

“The proliferation of green industrial policies, as well as growing regulatory pressure on companies to decarbonise, is starting to reshape both investment strategies and carbon transition risks for issuers in some hard-to-abate sectors,” reads the report by Moody’s.

Strong policy support around the globe, along with growing cost-competitiveness of clean energy technologies, has contributed to an acceleration in green investments and sustainable bond issuance that is likely to continue, according to Moody’s.

Sustainable bond issuance from the most exposed sectors has totalled US$845 billion since 2018, with US$53 billion in the first quarter of the year accounting for a 19% share of global issuance.

SLBs continue decline

SLB volumes fell for the second consecutive quarter, totaling just under US$10 billion during the first three months of the year, a significant decline from the US$22 billion issued in 1Q2023 and representing the lowest quarterly SLB issuance since 1Q2021.

“While SLBs remain a potentially appealing financing option, especially for issuers in hard-to-abate sectors with longer decarbonisation pathways, investor focus on the ambition of sustainability performance targets and the materiality of financial adjustments has continued to discourage some would-be issuers from entering the market,” says Moody’s.

The market's appetite for SLBs will likely remain subdued this year, add analysts, contributing to their forecast of just US$60 billion of full-year SLB issuance in 2024.

SLBs accounted for 7% of sustainable bond issuance last year, down from 8% in 2022 and 9% in 2021. SLB issuance dropped for the second consecutive year in 2023, with volume sliding to US$10 billion in 4Q2023, the lowest quarterly total since the segment began its ascent.

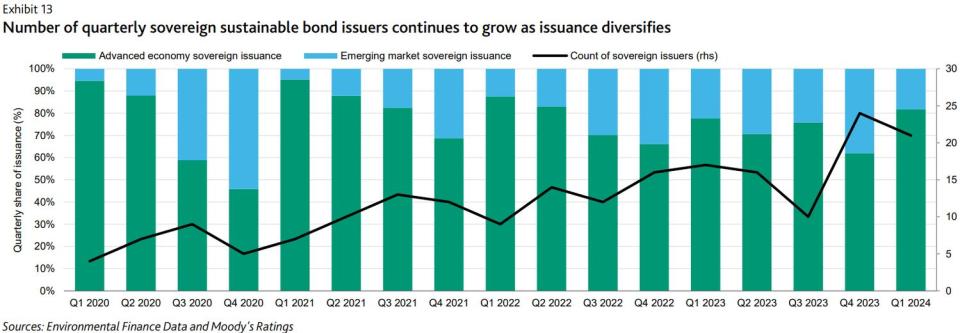

Sovereigns pick up speed

Sovereign volumes are growing as more countries use labelled bonds to advance sustainable investment goals,notes Moody’s.

Sovereign sustainable bond issuance totalled US$59 billion in the first quarter, the segment's third-highest quarterly tally to date. It was also well above the US$43 billion average quarterly sovereign issuance achieved in 2023 and the US$35 billion achieved in 2022.

“Sovereign volumes will likely continue to increase over time as more countries finance their climate and sustainable investment goals with labelled bonds,” add analysts from Moody’s.

Finally, Moody’s believes mandatory disclosure reporting will support best practices in sustainable bond markets.

“Regulators are increasingly mandating companies to disclose information related to climate and sustainability. While the scope and detail of disclosures vary by jurisdiction, greater standardised requirements and reporting transparency will help improve industry practices in the sustainable bond markets, such as the increasing use of third-party audits for sustainable bond reporting.”

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Transition finance to gain prominence in 2024 as SLBs face greater scrutiny: Moody's

Singapore's $2.8 bil green bond among growing sovereign offerings hawking ESG

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance