Global logistics powerhouse Mapletree spreads its wings

Mapletree Investments is planning new private logistics funds in Japan and Asia-Pacific

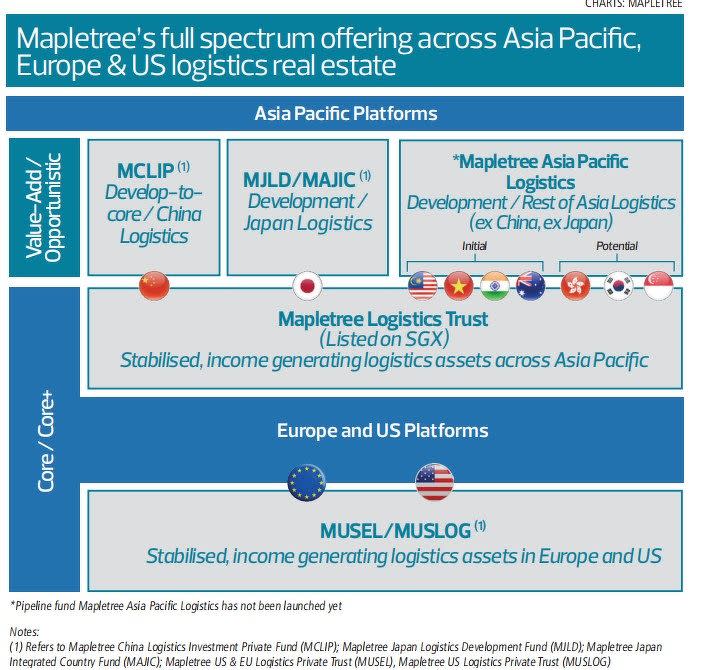

Mapletree Investments has been developing and operating logistics properties since 2000, well before the sector gained popularity as a New Economy asset. Since its inception, the company has expanded its focus to cover the entire real estate value chain, encompassing development, investment, capital, and property management. Mapletree now boasts assets under management (AUM) totalling $77.4 billion.

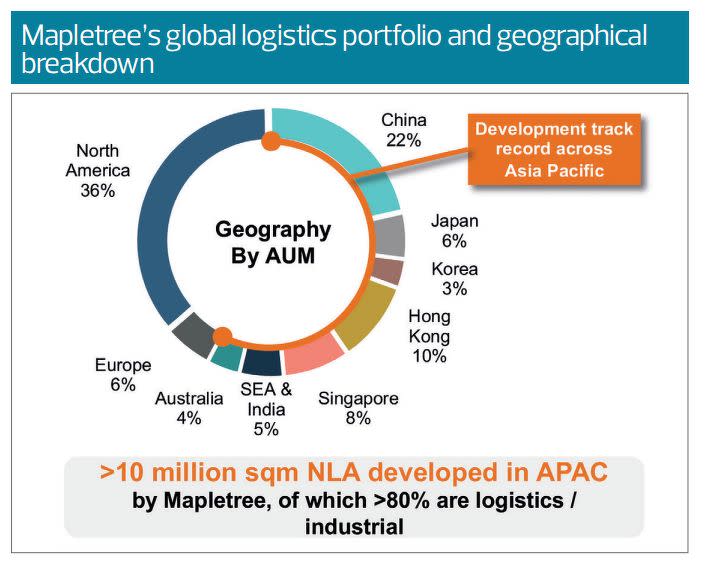

Over one-third of this is in logistics, amounting to approximately $30.4 billion as of March 31. This has propelled Mapletree to rank in the top five global logistics real estate players in terms of space under management, with more than 700 assets globally representing over 23 million sq m of space. In terms of NLA, Mapletree is the largest Grade A logistics owner-operator in Singapore, Vietnam and Malaysia.

The logistics sector attracted considerable investor attention during the pandemic in 2020 when supply chains were disrupted and e-commerce became prevalent. Interestingly, the first pure-play logistics S-REIT, Mapletree Logistics Trust M44u (MLT), was listed some 15 years earlier, in 2005, sponsored by Mapletree.

While logistics remains a key driver of Mapletree’s growth with new funds on the horizon, the Group has also benefitted from diversifying into other defensive sectors ahead of its peers, such as student accommodation and “new economy” assets such as data centres.

Staying ahead of peers

Logistics properties are crucial in supply chain management, enabling economies to produce, store goods and facilitate trade. Since the pandemic, these properties have also served as proxies for international trade and domestic consumption.

Increasingly, logistics properties are an important component of the China plus one strategy many companies are adopting as they diversify into Southeast Asia. As a geographically diversified developer, owner and operator of logistics properties, Mapletree recognised the importance of logistics and its role in trade and domestic consumption before its peers. Unsurprisingly, Mapletree remains at the forefront of shaping the region’s logistics landscape.

In the Financial Year 2022/2023, Mapletree reaffirmed its focus by acquiring and developing new logistics sites in Australia, China, India, Malaysia, South Korea and Vietnam. Mapletree completed the development of 14 logistics parks in China and is developing another 40 projects to create a robust pipeline of logistics assets. In April, MLT completed the acquisition of six logistics properties in Japan.

The network effect

Developers, owners and operators of logistics properties can no longer focus on a single country or region. A multi-country platform gives a group a network effect. A unique aspect of Mapletree’s logistics platform is its geographic presence. In Asia, Mapletree’s strategy was to initially expand from Singapore into Malaysia, Hong Kong SAR and South Korea via investments, and thereafter into Japan and Vietnam in 2005.

Mapletree subsequently grew its presence globally in the UK in 2016 and further expanded into the US in 2017.

Mapletree’s US, European and Asian presence enables it to offer its US and European tenants modern logistics space in Southeast Asia and China, and vice versa.

New funds

In December 2022, Mapletree launched its inaugural open-ended China logistics fund, Mapletree China Logistics Investment Private Fund (MCLIP), with a “build-to-core” strategy and a seeded portfolio of 43 Grade A logistics assets across key cities in China. MCLIP’s initial fund size is US$0.9 billion ($1.2 billion), with an initial portfolio value of US$1.7 billion on completion. MCLIP is positioned to deliver sustained profitability and stable and growing distribution yields through actively managing its diversified portfolio. This aligns with the Group’s overall strategy of pivoting towards Asia and leveraging its development capabilities in large domestic markets underserved for institutional-grade warehouses.

Plans are underway for a country-specific Japan Fund, Mapletree Japan Integrated Country Fund (MAJIC). Mapletree has an enviable track record in logistics development and value-add of office space, with its past two funds delivering over 23% equity IRR.

This outperformance in IRR of the vintage Japan funds was a result of well-executed divestment strategies, including divesting assets to institutional buyers such as Blackstone as well as to its own Mapletree REITs. It continues to look for good opportunities on a risk-adjusted basis and source attractive investments for its investors. Real estate in Japan has proven to be an inflation hedge in this challenging economy.

The Group is committed to investing in Japan for the long term. Across the Asia Pacific, the Group has successfully developed over 10 million sq m of NLA, with over 80% in the logistics and industrial sectors. Japan has consistently ranked in the top three markets in terms of logistics space developed and development value.

Alongside MAJIC, discussions are ongoing with investors to establish a new Asia Pacific logistics development fund, focused on markets in the region where Mapletree has a track record in logistics development. These markets include Malaysia, Vietnam, India and Australia.

Mapletree’s NLA in India is more than 844,000 sq m, while its NLA in Vietnam is at 1,120,000 sq m. More than that, Mapletree has on-the-ground expertise. Its staff strength in India and Vietnam tally around 280 as of March 31, compared to Mapletree’s global workforce of approximately 2,400 employees.

Given that emerging markets have relatively stronger GDP growth compared to developed markets and continue to see strong economic drivers, Mapletree expects to deepen its existing capabilities by bridging the supply gap and bringing in more Grade A logistics assets. A strong urbanisation rate and demand for logistics in these emerging markets further support the opportunity.

As of March 31, Mapletree has developed, owns and operates some US$6.4 billion of logistics AUM in China. In North Asia, Hong Kong SAR is Mapletree’s largest market with US$2.2 billion of logistics AUM, Japan with US$1.9 billion of logistics AUM and South Korea with US$0.9 billion of logistics AUM.

In Southeast Asia, Singapore is the largest market with US$1.8 billion of logistics AUM, followed by Malaysia with US$1.6 billion of logistics AUM and Vietnam with US$1 billion of logistics AUM.

In Australia, Mapletree’s AUM tops US$1.4 billion. Mapletree’s AUM of US$0.4 billion in India will likely be scaled up as the sub-continent continues attracting FDIs for the current government’s Make In India initiative. The AUM includes the valuation of completed projects and the total development costs of development projects.

In addition to logistics, partners such as Ivanhoé Cambridge, a global real estate firm that is a subsidiary of Canadian pension fund Caisse de dépôt et placement du Québec or CDPQ, have taken an interest in Mapletree’s venture in diversifying into other asset classes.

In February this year, Ivanhoé Cambridge and Mapletree launched a new investment platform to develop, own and operate technology-sector-focused workplaces in India with an investment capacity of over C$2.5 billion ($2.5 billion). Properties and projects have already been identified to meet these targets.

Skin in the game

Mapletree maintains prudent financial management in its REITs and funds. The REITs maintain very high levels of fixed debt and have well-staggered debt expiry profiles, to mitigate risks in this current high-interest rate environment. To maintain stable distributions, 80% of MLT’s overseas income is hedged for the next 12 months, while 92% of Mapletree Pan Asia Commercial Trust N2iu’s (MPACT) overseas income is hedged.

Separately, the existing private fund investors are primarily protected from the near-term downside risk of high interest rates as the hedges were locked in at inception for all the fully seeded core plus funds.

Mapletree is uniquely differentiated as its funds are typically substantially seeded with assets at inception, which Mapletree’s in-house development team often develops in line with the Group’s overall strategy. Mapletree typically also holds the single largest stake in its funds – between 20% and 35% — ensuring there is a very strong alignment of interest with its investors. The funds are specifically curated in a country/sector/strategy focus, so they never compete with the listed REITs in their respective markets.

Similarly, across its REITs, Mapletree retains significant ownership as a sponsor. For instance, it holds 31.5% of MLT, 26.8% of MIT and 55.6% of MPACT. The strong alignment of interest is also demonstrated in other ways, such as payment of fees in units and foregoing acquisition fees during the merger of Mapletree Commercial Trust and Mapletree North Asia Commercial Trust to form Mapletree Pan Asia Commercial Trust (MPACT).

Mapletree’s three REITs — MLT, MIT and MPACT have achieved total returns (unit price appreciation and dividends) since the IPO of 328%, 298% and 174%, respectively. These returns translate to a CAGR of 8.3%, 11.2% and 8.4% for MLT, MINT and MPACT, respectively.

Beyond its REITs and funds, Mapletree will continue to invest in Asia. In its three-pronged approach to long-term growth, the Group has established offices in its operating regions. Mapletree will continue to work closely with local governments in regions with a presence and will continue to have boots on the ground in these geographies.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance