Global IPO proceeds down 61% in 2022, Southeast Asia down 50%: EY

Compared to Singapore’s eight listings raising US$40 million in 2022, Hong Kong saw 67 listings raising US$12.4 billion.

After a record-breaking 2021, the global initial public offering (IPO) market took a nosedive in 2022. With only 1,333 IPOs raising US$179.5 billion ($240.76 billion), IPO activity dipped 45% and 61% y-o-y by number of deals and proceeds, respectively.

According to the EY Global IPO Trends 2022 report released Jan 5, the average deal size shrank due to lowered valuation and poor stock market performance.

“Throughout 2022, global IPO activity was impacted by increased market volatility and other unfavorable market conditions, along with the dismal performance of many IPOs that were listed since 2021,” notes EY.

Faced with higher inflation and rising interest rates, investors have spurned new public companies and turned to less-risky asset classes, adds the consultancy.

Similarly, financial-sponsored IPO activity took a steep fall of 77% and 93% by number and proceeds, respectively.

Most special purpose acquisition companies (Spacs) listed from late 2020 are also reaching their two-year window, and they must now either find a target to merge or return the IPO proceeds to their investors.

EY's figures cover completed IPOs from Jan 1, 2022 to Dec 5, 2022, plus expected IPOs by Dec 31, 2022.

While 2022’s numbers represent a stark decline, global IPO deals still turned up a 16% increase by number when compared to pre-pandemic 2019.

That said, there were a few select industries and regions that did achieve modest success, says EY. The technology sector continued to lead by volume accounting for 23% of deals, while the energy sector dominated by proceeds, accounting for 22% in 2022.

Southeast Asia IPO value halved in 2022

Among listed mega IPOs, which are defined as those that raised proceeds of more than US$1 billion, the average proceeds in 2022 are 45% higher than those in 2021, on the back of strong valuation for the mega energy IPOs that took place this year.

Certain markets, such as Mainland China, Middle East and some Southeast Asian countries have performed relatively well despite the significant global underperformance, notes EY.

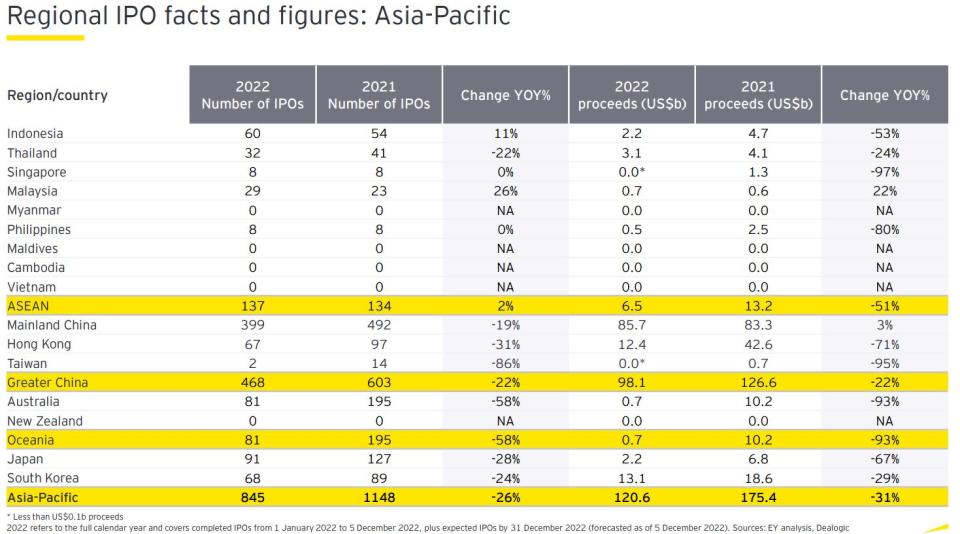

In Southeast Asia, there were a total of 137 IPOs raising US$6.5 billion in 2022, about half the value of the 134 IPOs that raised US$13.2 billion in 2021. Leading in performance were Indonesia (60 IPOs raising US$2.2 billion), Thailand (32 IPOs raising US$3.1 billion) and Malaysia (29 IPOs raising US$0.7 billion), followed by Philippines (eight IPOs raising US$0.5 billion) and Singapore (eight IPOs raising US$40 million).

Notably, the number of larger listings on Southeast Asia exchanges has been limited in 2022, but with reduced Covid-19 restrictions, there may be a return of larger IPOs in 2023.

Compared to Singapore’s eight listings raising US$40 million in 2022, Hong Kong saw 67 listings raising US$12.4 billion. This is down from 97 listings in 2021 that raised US$42.6 billion on the Hong Kong Stock Exchange, a 71% y-o-y drop.

The Asia-Pacific IPO market had 845 IPOs totaling US$120.6 billion in proceeds, taking the smallest hit from the global economic downturn and geopolitical tensions, and accounting for 63% of deals and 67% of funds raised globally in 2022.

Mainland China saw 399 IPOs in 2022, down from 492 in 2021. Proceeds, meanwhile, grew slightly to US$85.7 billion in 2022 from US$83.3 billion the year prior.

Mainland China is on course to set another record in the highest annual capital raising by the close of 2022, EY adds.

Outside of Mainland China and a few Asean countries, it has been a down year for IPOs, says Ringo Choi, EY Asia-Pacific IPO leader. “Many of the same challenges impacting global markets — inflation, interest rates and geopolitical issues — affected APAC as well. As many of these challenges subside, markets should rebound in 2023. For now, companies should focus on improving their fundamentals, including their environmental, social and governance (ESG) practices, which is becoming an increasingly key area of focus for investors.”

2023 IPO outlook

EY believes there is a strong IPO pipeline on the horizon. “Even though IPO activity will likely remain somber through at least the first quarter, favorable conditions seem to be set in place for the global IPO activities to regain greater momentum by the second half of the year.”

For the IPO market to become more active again, EY lists a few prerequisites: positive sentiment and an uptick in stock market performance; lower inflation and ending of the interest rate hikes; easing of geopolitical tensions; and diminished pandemic effects on the global economy.

Many prospective IPO companies are still going to take the “wait-and-see" approach, says EY, holding out for the right window. For now, investors will focus more on a company’s fundamentals, such as revenue growth, profitability and cash flows, over claimed growth projections.

Paul Go, EY Global IPO leader, says: “A record year for IPOs in 2021 gave way to increasing volatility from rising geopolitical tensions, inflation and aggressive interest rate hikes. Weakened stock markets, valuations and post-IPO performance have further deterred IPO investor sentiment.”

Go adds: “As the pipeline continues to build, many companies are waiting for the right time to revive their IPO plans. Still, with tightening market liquidity, investors are more risk-averse and favor companies that can demonstrate resilient business models in profitability and cash flows, while clearly articulating their ESG agendas.”

Infographics: EY, Dealogic

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Lim Wai Mun of Doctor Anywhere named EY Entrepreneur of the Year 2022 Singapore

Savvy, rational entrepreneurs welcome new market environment: EY’s Liew

BTS Group is determined to provide safe and reliable transport for its people

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance