GitLab (GTLB) Q1 Earnings and Revenues Surpass Estimates

GitLab GTLB reported non-GAAP earnings of 3 cents per share in first-quarter fiscal 2025, beating the Zacks Consensus Estimate of a loss of 4 cents. The company reported a loss of 6 cents in the year-ago quarter.

Total revenues of $169.2 million beat the consensus mark by 2.13% and rallied 33% year over year. The upside can be attributed to the continued adoption of GitLab's DevSecOps Platform by organizations seeking to streamline their software development processes.

Top-Line Details

Subscriptions- self-managed and SaaS (89.4% of total revenues) revenues increased 36% year over year to $151.2 million, beating the Zacks Consensus Estimate by 3.03%. License-, self-managed and other revenues (10.6% of total revenues) rose 14.8% year over year to $18 million.

SaaS revenues contributed 28% to total revenues and surged 50% year over year. The upside in SaaS revenues indicates a shift toward subscription-based models and highlights Gitlab’s success in driving recurring revenue streams.

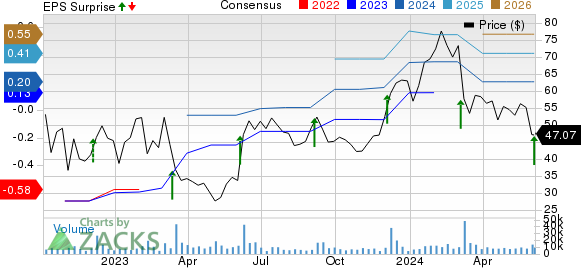

GitLab Inc. Price, Consensus and EPS Surprise

GitLab Inc. price-consensus-eps-surprise-chart | GitLab Inc. Quote

Customers with more than $5K of Annual Recurring Revenues (ARR) increased to 8,976, up 21% year over year. Customers with more than $100K of ARR increased to 1,025, up 35% year over year, demonstrating GTLB’s ability to attract and retain large enterprise customers.

The dollar-based Net Retention Rate was 129% in the reported quarter.

Total Remaining Performance Obligation (RPO) surged 48% year over year to $681.2 million. The current RPO increased by 34% to $436.1 million.

Gitlab’s collaboration with Alphabet GOOGL in the first quarter of fiscal 2025 remains noteworthy.

Per the terms of the deal, Gitlab will integrate its products with Google Console to help customers improve developer experience and decrease context switching across GitLab and Google Cloud.

The company also released GitLab 17 featuring GitLab Duo Enterprise, an end-to-end AI add-on to integrate secure AI-driven capabilities across every step of the software development lifecycle.

During the fiscal first quarter, Gitlab acquired Oxeye, a provider of cloud-native application security and risk management solutions, to streamline vulnerability management and remediation.

Operating Details

First-quarter fiscal 2025 non-GAAP gross margin was flat year over year to 91%, indicating improved operational efficiency and cost management.

On a non-GAAP basis, research & development expenses increased 14.1% year over year to $41.8 million. Sales and marketing expenses were up 7.3% to $74.3 million. General and administrative expenses rose 68.1% to $41.1 million in the reported quarter.

On a non-GAAP basis, operating loss was $3.8 million compared with the year-ago quarter’s loss of $15 million.

Balance Sheet

As of Apr 30, 2024, cash and cash equivalents and short-term investments were $106.1 million compared with $103.6 million as of Jan 31, 2024.

The company generated an operating cash flow of $38.1 million and an adjusted free cash flow of $37.4 million in first-quarter fiscal 2025 compared with $24.5 million in fourth-quarter fiscal 2024.

Guidance

For the second quarter of fiscal 2025, GitLab expects revenues between $176 million and $177 million, indicating growth rate of 26-27% year over year.

Non-GAAP operating income is expected to be $10-$11 million for the fiscal first quarter.

Non-GAAP earnings are expected between 9 cents per share and 10 cents.

Zacks Rank & Stocks to Consider

Currently, Gitlab has a Zacks Rank #3 (Hold).

Gitlab’s shares have declined 25.2% year to date compared with the Zacks Computer & Technology sector’s increase of 15.3%.

Micron Technology MU and Planet Labs PBC PL are some better-ranked stocks that investors can consider in the broader sector.

Micron Technology and SecureWorks each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Micron Technology shares have increased 50.2% year to date. MU is set to report third-quarter fiscal 2024 results on Jun 26.

Planet Labs PBC’s shares have declined 22.7% year to date. PL is scheduled to release first-quarter fiscal 2025 results on Jun 6.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Planet Labs PBC (PL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

GitLab Inc. (GTLB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance