Gilead's (GILD) Urothelial Cancer Study Did Not Meet Its Primary Goal

Gilead Sciences, Inc. GILD announced the failure of its late-stage confirmatory TROPiCS-04 study on Trodelvy in locally advanced or metastatic urothelial cancer (mUC).

Trodelvy (sacituzumab govitecan-hziy) is a first-in-class Trop-2-directed antibody-drug conjugate (ADC). It is approved in several countries for the treatment of adult patients with unresectable locally advanced or metastatic triple-negative breast cancer (TNBC) who have received two or more prior systemic therapies.

Gilead’s acquisition of Immunomedics added Trodelvy to its portfolio. The phase III TROPiCS-04 study evaluated Trodelvy vis-à-vis single-agent chemotherapy (treatment of physicians’ choice, TPC) in patients with mUC, who have previously received platinum-containing chemotherapy and anti-PD-(L)1 therapy.

The top-line results showed that the study did not meet the primary endpoint of overall survival (OS) in the intention-to-treat (ITT) population.

Additionally, there were higher number of deaths due to adverse events with Trodelvy compared to TPC in the overall study population. These adverse events, mostly observed in the early phase of the treatment course, were related to neutropenic complications.

Nonetheless, results showed improvements for select pre-specified subgroups and secondary endpoints of progression-free survival and the overall response rate.

We remind investors that Trodelvy was granted accelerated approval in the United States for patients with locally advanced or mUC, who have previously received a platinum-containing chemotherapy and anti-PD-(L)1 therapy. This indication is approved under accelerated approval based on tumor response rate and duration of response. Continued approval for this indication may be contingent upon verification and description of clinical benefit in confirmatory trials, including the TROPiCS-04 study.

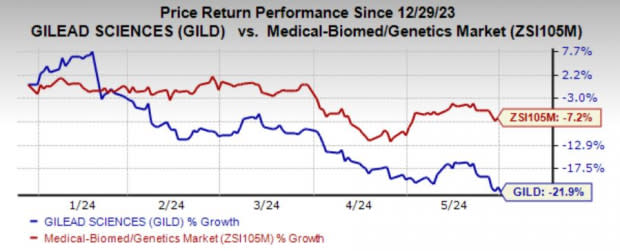

Shares are trading down in response to the study results. In the year-to-date period, shares of Gilead have lost 21.9% compared with the industry’s decline of 7.2%.

Image Source: Zacks Investment Research

Bladder cancer is one of the most common types of cancer and urothelial cancer accounts for 90% of these cases.

In January 2024, Gilead suffered another setback when the phase III EVOKE-01 study on Trodelvy did not meet its primary endpoint of OS in previously treated metastatic non-small cell lung cancer (NSCLC).

The results of the EVOKE-01 study in the lucrative NSCLC indication were a setback and disappointed investors. NSCLC is the most common form of lung cancer.

Trodelvy's performance has been strong since its approval. The drug is driving Gilead's efforts to build a strong oncology franchise, especially given the current focus on ADCs.

However, these setbacks in expanding Trodelvy’s label dent Gilead’s efforts.

Oncology franchise sales grew 18% in the first quarter to $789 million. Apart from Trodelvy, the Cell Therapy franchise, comprising Yescarta and Tecartus, also continues to witness a steady increase in sales, primarily due to higher demand for Yescarta in relapsed or refractory (R/R) large B-Cell lymphoma and Tecartus in R/R acute lymphoblastic leukemia and mantle cell lymphoma.

ADCs are in the spotlight in the pharma/biotech sector.

In February 2024, AbbVie Inc. ABBV acquired ImmunoGen and added its flagship cancer therapy Elahere (mirvetuximab soravtansine-gynx), a first-in-class ADC approved for platinum-resistant ovarian cancer, to its portfolio.

ImmunoGen's follow-on pipeline of promising next-generation ADCs further complements AbbVie's ADC platform and existing programs.

Zacks Rank & Stocks to Consider

Gilead currently carries a Zacks Rank #5 (Strong Sell).

A couple of better-ranked stocks from the healthcare sector are ALX Oncology Holdings ALXO and Krystal Biotech KRYS, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for KRYS’ earnings per share has increased 24 cents to $2.06. KRYS beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 21.46%. Shares of Krystal Biotech have surged 31.3% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance