The Gap (GPS) Gains Momentum, Rises 10% in the Last Six Months

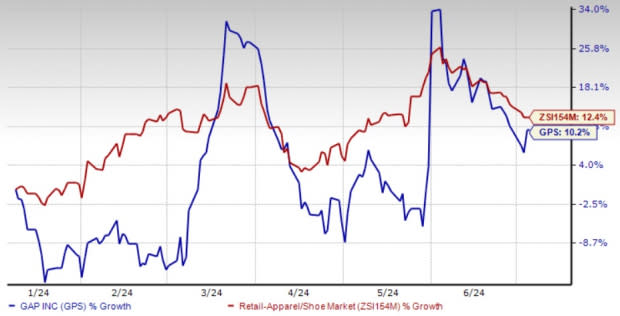

The Gap, Inc. GPS has demonstrated success driven by lower airfreight, improved promotions, and cost-cutting actions. These strategic efforts have contributed to a notable increase in the company’s stock price, which rose 10.2% in the past six months. This performance is slightly behind the industry’s growth of 12.4% but still highlights the company's positive trajectory.

The company’s significant success can be largely attributed to Gap’s enhancements in its operating structure, including increasing spans of control and decreasing management layers to improve the quality and speed of decision-making. Additionally, creating a consistent organizational structure across all four brands has further strengthened its operations.

The company’s proactive approach has been validated by upward revisions in earnings estimates. In the past 30 days, the consensus estimate for the current and the next fiscal year has risen by 3.6% and 2.7% to $1.74 and $1.87, respectively. These figures suggest growth expectations of 21.7% and 7.8%, respectively, from the year-ago levels, showcasing the company’s potential and solid outlook. Sales estimates suggest a promising trajectory, forecasting year-over-year increases of 0.2% and 1.8%, respectively, for the same periods.

Image Source: Zacks Investment Research

Factors Boosting GAP's Success

Gap has been making significant strides in improving its margins. In the first quarter of fiscal 2024, the company's gross margin of 41.2% expanded 400 basis points (bps) year over year in the reported quarter. Additionally, the merchandise margin grew by 330 bps, benefiting from lower commodity costs and better promotional strategies.

Gap expressed encouragement about the momentum and results achieved. The company remains steadfast in its commitment to four strategic priorities: maintaining and delivering financial and operational rigor, reinvigorating its brands, strengthening its platform and energizing its culture.

Looking at the performance, the company highlights improved relevance with customers as it executes its brand reinvigoration playbook. It remains focused on its goal of becoming a high-performing house of iconic American brands that shape culture, recognizing that this transformation requires time, perseverance and rigorous execution.

This Zacks Rank #1 (Strong Buy) company is well placed, driven by a strong emphasis on building greater consumer trust through clear and precise storytelling and pricing, offering compelling "wow prices" across its in-store and online platforms. Concurrently, it is actively exploring ways to elevate the in-store customer experience through innovative store layouts and fresh merchandising strategies. These efforts are aimed at improving consistency and enhancing the overall consumer experience, leading to increased market share in key categories.

Wrapping Up

The company is optimistic about its targets for fiscal 2024. It expects gross margin expansion of at least 150 bps and operating income to grow in the mid-40% range.

For the second quarter of fiscal 2024, management envisions net sales growth in the low-single digits year over year. The company anticipates gross margin expansion of at least 300 bps, with operating expenses expected to increase by approximately 5% from $1.214 billion in the year-ago quarter.

This, along with the company’s commitment to outperform, is likely to bolster its position in the market and sustain its growth momentum.

3 Other Picks You Can’t Miss

We have highlighted three other top-ranked stocks, namely, Abercrombie & Fitch Co. ANF, Burlington Stores BURL and DICK'S Sporting Goods DKS.

Abercrombie & Fitch, a specialty retailer of premium, high-quality casual apparel, currently sports a Zacks Rank #1 at present. ANF has a trailing four-quarter average earnings surprise of 210.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales and earnings indicates growth of 10.4% and 47.3%, respectively, from the year-ago figures.

Burlington Stores, a nationally recognized off-price retailer, currently carries a Zacks Rank #2 (Buy). BURL has a trailing four-quarter earnings surprise of 21.7%, on average.

The Zacks Consensus Estimate for Burlington Stores’ current financial-year sales and earnings suggests growth of around 9.5% and 25.4%, respectively, from the year-ago reported numbers.

DICK'S Sporting operates as an omni-channel sporting goods retailer. It currently carries a Zacks Rank #2. DKS has a trailing four-quarter earnings surprise of 4.7%, on average.

The Zacks Consensus Estimate for DICK’S Sporting's current fiscal-year sales and earnings implies an improvement of 1.8% and 6.6%, respectively, from the prior-year numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance