FTX Has ‘Massive Shortfall’ in Assets, Say Bankruptcy Lawyers

Join the most important conversation in crypto and web3! Secure your seat today

FTX.com has a “massive shortfall” in assets, according to a press release detailing a presentation filed in the bankrupt crypto exchange’s Chapter 11 case on Thursday.

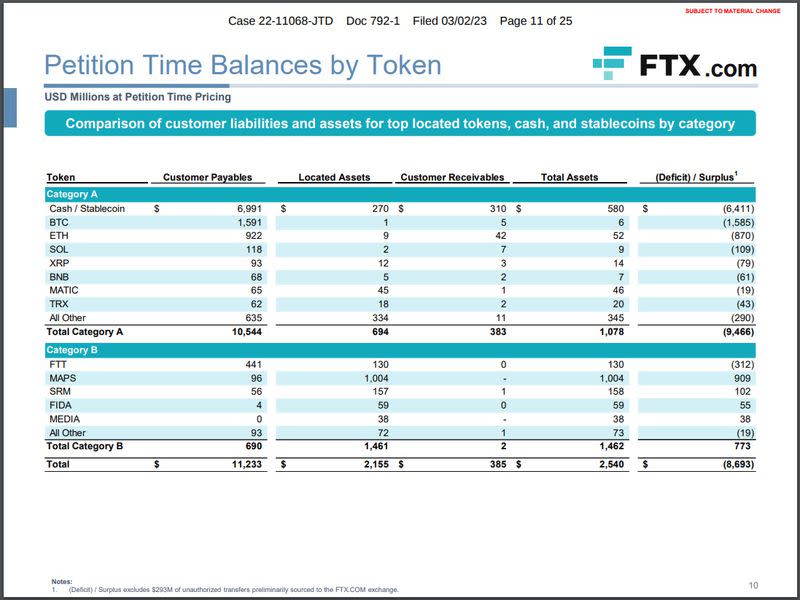

Using the latest spot prices, $2.2 billion of total assets have been identified in the wallets of the accounts associated with FTX.com, of which only $694 million constitute the most liquid “Category A Assets” that include fiat, stablecoins, bitcoin or ether.

Other assets include $385 million of customer receivables, and significant claims against FTX sister company Alameda Research and related parties. The presentation also shows a $9.3 billion net borrowing by Alameda from the FTX.com wallets and accounts.

FTX US also showed a shortfall in assets, with $191 million of total assets located in the wallets of accounts associated with the exchange, as well as $28 million in customer receivables and $155 million of related party receivables. There is also $107 million net payable by FTX US to Alameda Research.

“The exchanges' assets were highly commingled, and their books and records are incomplete and, in many cases, totally absent,” wrote John J. Ray III, the CEO and chief restructuring officer of the FTX Debtors, in the press release. “For these reasons, it is important to emphasize that this information is still preliminary and subject to change.”

According to the presentation, FTX's team identified $7 billion in customer payables in cash and stablecoins, offset by $580 million in identified assets as of its petition date.

FTX has a deficit for every token treated as a Category A asset – bitcoin, ether, sol, XRP, BNB, matic, tron and others – but is treating Category B tokens as having surpluses. These include tokens MAPS, serum and fida. The value of these token holdings do not go close to offsetting Category A liabilities, though.

FTX US did record some surpluses at the date of its petition, largely in relatively small amounts of certain tokens such as DOGE, but these weren't enough to offset deficits from its stablecoin, ether and sol payables.

UPDATE (March 2, 2023, 20:40 UTC): Adds additional information.

Yahoo Finance

Yahoo Finance