FTSE 100 Live: ECB holds interest rates, shares lower as blue-chips firms' earnings disappoint

![[object Object] (Evening Standard)](https://s.yimg.com/ny/api/res/1.2/PYx65NygTjm.Chfg_27kIA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA--/https://media.zenfs.com/en/evening_standard_239/54d2528a265b00cd5fd7acb443d7fe4a)

Lloyd's of London unlocks its expertise and innovation to help tackle global risks

Thursday 26 October 2023 15:28 , Daniel O'Boyle

Lloyd’s of London chairman Bruce Carnegie-Brown writes exclusively for the Standard

The world’s always been a risky place. But in the last decade, it’s transformed into a more complex, connected and changing environment than we’ve ever seen before.

Only innovative, resilient and digital organisations will be able to keep up with the changes.

I’m aware I’m writing this from the vantage point of a 300-year-old marketplace: one renowned for marble, mahogany and time-formed tradition. Our challenge is therefore to use the library of data and expertise we’ve developed over recent centuries to stay at the forefront of innovation.

Tesco UK CEO to step down

Thursday 26 October 2023 14:27 , Daniel O'Boyle

Tesco UK CEO Jason Tarry will step down after 33 years at the country's biggest supermarket.

Tarry said: “Little could I have imagined 33 years ago, the journey I would go on with Tesco.

"My life in Tesco has been a wonderful experience. This decision was not made easily but this is the right time for me to move on. I am grateful to my amazing colleagues and the lifelong friends I have made here.

"I will continue to give my all to being UK CEO until March, and my determination that we give our customers the best Christmas is heightened knowing that this will be my last as a Tesco colleague.”

Fed rate cuts 'long way off'

Thursday 26 October 2023 14:15 , Daniel O'Boyle

Matthew Ryan, Head of Market Strategy at global financial services firm Ebury, said the latest US GDP numbers mean it'll be some time before the Fed cuts rates.

“The US economy continued to power ahead in the third quarter, as is now expanding at a pace that far outstrips pretty much every other major economic area. At a time when the UK and Euro Area economies are teetering on the brink of recessions, the US appears to be firing on all cylinders, with consumers seemingly unperturbed by tight financial conditions and elevated uncertainty from abroad.

“Gangbusters growth of almost 5% annualised was not only well above expectations, but the fastest pace of expansion since the final quarter of 2021. The bottom line for the Federal Reserve is that no recession is in sight, and policymakers can be content in the knowledge that they can keep interest rates higher for longer, without triggering a meltdown in the US economy.

“We don’t think that this impressive GDP data will be enough to encourage the Fed to deliver another rate increase, though we do at least believe that the first cut is a long way off. This could provide some additional medium-term support for the US dollar.”

US GDP soars

Thursday 26 October 2023 14:03 , Daniel O'Boyle

US GDP grew by a huge 4.9% in the third quarter, as the world's biggest economy shows no signs of being anywhere near a slowdown.

The rise came in ahead of the estimated 4.5%, and represents the biggest rise in two years.

Neil Birrell, Chief Investment Officer and lead manager of the Premier Miton Diversified Growth Funds, Premier Miton Investors, said: “The US economy is flying high, the annualised GDP number was considerably higher than expected in the third quarter. The data we are seeing will be giving the Fed plenty to think about when they meet. We have a strong economy, inflation that is moderating, a decent jobs markets and a consumer sector that is still spending. What will the Fed make of that? It points to “higher for longer” being the outcome.”

"It isn't easy being a central banker"

Thursday 26 October 2023 13:56 , Daniel O'Boyle

Marcus Brookes, chief investment officer at Quilter Investors, said Christine Lagarde likely doesn't think ECB interest rates are at their ceiling, even after today's pause.

“Following the most aggressive series of rate hikes in its history, the European Central Bank has joined the Federal Reserve and Bank of England in hitting the pause button and assessing exactly what impact its actions are having to date. Eurozone inflation has come down significantly and is expected to moderate further, although it is still some way off target.

“It seems, however, that Christine Lagarde does believe that 4% is the ceiling for rates this time around and should help moderate inflation further, although much of that is out of their control. There remain several risks that may keep inflation stubbornly high including increasing wage growth and the uncertainty in the Middle East which is pushing up energy prices. Going forward, like other central banks it will say the market needs to expect higher interest rates for longer, with the door being left open should we see inflation spike again.

“However, given the stagnating economy and the fact other central banks have moved into a holding pattern, something very unexpected would need to happen for rates to be raised again. The pressure will quickly shift to cutting rates given the lack of economic growth. This is the problem facing central banks now. They have successfully guided economies to this level of rates without tipping them into full-blown recessions, although Germany is experiencing one and others will have felt like they were in one.

“So how long can rates really remain at this level before things really start to bite? If they move too early, they risk bringing inflation back into the system – but move too late and the economic impact will be significant.

“With geopolitical events flaring up, it isn’t very easy being a central banker right now.”

ECB holds rates

Thursday 26 October 2023 13:16 , Daniel O'Boyle

The European Central Bank has held its interest rates, as had been widely expected.

The central bank for the Eurozone kept its mean refinancing rate at 4.5% and its deposit facility rate at 4%, after a rise in September.

Wilko products to return to high street in The Range stores

Thursday 26 October 2023 13:12 , Daniel O'Boyle

Wilko products are set to return to the high street on Friday as The Range brings the brand into its stores across the UK.

It comes after historic discount retailer Wilko shut its final shop earlier this month after collapsing into administration.

Administrators for PwC sold off a raft of assets, including the Wilko brand and some store properties, as they sought to recover funds to pay off outstanding debts after failing to secure a full rescue deal.

Risk of terrorist bioweapons and societal unrest caused by AI, UK government warns

Thursday 26 October 2023 12:27 , Daniel O'Boyle

The Government has warned on the risk 'terrorist groups trying to develop bioweapons' and 'societal unrest' caused by advances in artificial intelligence ahead of Rishi Sunak's key AI safety summit next week.

In a research paper circulated with summit attendees, the Government Office for Science explores a series of potentially catastrophic scenarios that could be brought about by enhanced capabilities of artificial intelligence if left unregulated over the coming decade.

The paper considers a 'Wild West' scenario in which "a big increase in misuse of AI causes societal unrest as many members of the public fall victim to organised crime."

Hipgnosis shareholders vote to wind up fund

Thursday 26 October 2023 11:56 , Daniel O'Boyle

Shareholders in music fund Hipgnosis have voted for a resolution to wind up the fund, by an overwhelming majority, in a major blow to its founder Merck Mercuriadis that will raise questions over the future of listed music rights funds in the City.

Hipgnosis confirmed today that its continuation resolution - usually seen as a formality for listed funds - was defeated.

According to Citywire, 82.3% of votes were cast against the fund, which owns the rights to hits by artists from Britney Spears to Barry Manilow continuing for another five years.

Shareholders also voted against chairman Andrew Sutch’s re-election. Sutch had already announced plans to depart last month.

Standard Chartered leads weaker FTSE 100, Hunting down 7%

Thursday 26 October 2023 10:22 , Graeme Evans

Standard Chartered shares have slumped 12% after it reported a 54% deterioration in third quarter profits to $633 million, a performance much worse than City forecasts.

Increased bad debt provisions in Chinese commercial real estate contributed to the profit miss, while the value of its holding in China Bohai Bank was also written down.

The share price fall of 85.4p to 628.6p returned Standard to where it was in May as optimism over the post-Covid recovery of China’s economy continues to cool.

Richard Hunter, head of markets at Interactive Investor, said: “China remains both a blessing and a curse for Standard, with the country’s faltering economic recovery weighing heavily on these results.”

The update did little for the rest of the sector as fellow Asia-focused lender HSBC retreated 2% or 11.1p to 604p ahead of its own update on Monday.

Lloyds Banking Group fell 0.2p to 41.3p after JPMorgan analysts stuck with their “underweight” rating despite yesterday’s better-than-expected results. Counterparts at UBS are more optimistic after backing shares to reach 50p.

With Unilever and WPP shares also struggling after their updates, the FTSE 100 index fell 0.8% or 62.54 points to 7351.80. That’s the lowest level since August following a fall of 4% in the past fortnight.

The cautious mood of investors was shown by the number of defensive stocks on the leaderboard, with Imperial Brands, Tesco and National Grid among the risers.

The FTSE 250 index also sustained more losses, having slumped to a one-year low in the wake of a 11% decline since mid-September.

It lost another 0.5% or 76.90 points to 16,793.81, with oil industry services firm Hunting the biggest faller as shares gave up some of their recent gains.

The decline of 7% or 22.5p to 286.5p came despite Hunting’s chief executive Jim Johnson describing the company’s third quarter performance as encouraging.

Market snapshot with shares lower

Thursday 26 October 2023 09:22 , Daniel O'Boyle

The FTSE 100 is lower this morning, with Unilever, Standard Chartered and WPP results all disappointing the City.

Take a look at our latest market snapshot.

PPHE taking bookings for new London hotel as it cheers strong UK demand

Thursday 26 October 2023 09:04 , Simon Hunt

Hotel chain PPHE has begun taking bookings for is giant new 26 storey hotel in Shoreditch, due to open next year, as the firm welcomed a strong recovery in demand in London.

PPHE, which operates the Park Plaza group of hotels, posted sales of £141 million for the three months to September, up 8.8% on the previous year as it prepared to open a suite of new sites in London, Rome and Belgrade.

CFO Daniel Kos told the Standard demand in London had not been mirrored across Europe.

“The picture amongst the different territories has been mixed,” he said.

“The UK has shown an incredibly strong recovery coming out of Covid [but] we do see that the German region hasn’t performed that well and the recovery out of Covid was less strong. It’s very hard to put your finger on what the exact reason for this is.”

Kos said inflationary pressure had begun to show signs of cooling, but he cautioned that recruitment challenges had led to higher wage costs in the UK compared to other parts of Europe.

PPHE shares fell 1% to 1040p.

Thursday 26 October 2023 08:51 , Simon Hunt

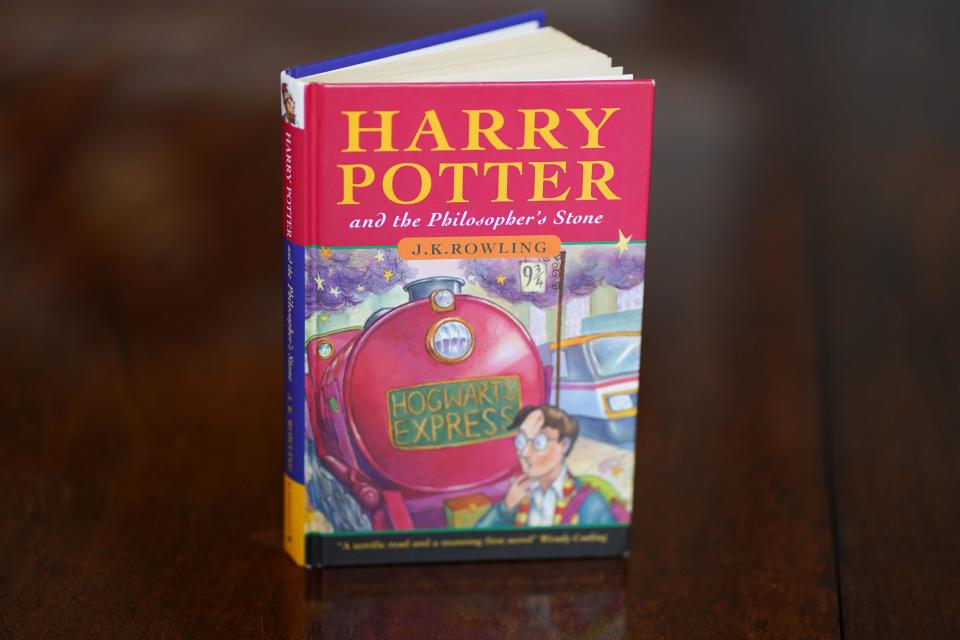

Bloomsbury today upped its dividend and said it was ready to make fresh acquisitions as it cheered record first-half sales and profits.

The Harry Potter publisher posted a 11% rise in sales to £136.7 million in the six months to the end of August, while profits grew 8% to £14 million, amid a surge in demand for fantasy novels across the UK, including the Samantha Shannon book Day of Fallen Night, with sales of the Shannon fantasy titles surging 169%.

The firm said it had “significant opportunities for further acquisitions” as its dividend rose to 3.70 p from to 1.41p last year.

Bloomsbury CEO Nigel Newton said: “Our strategy remains to seek out academic publishers who will support our growth plan.

“The strength of our balance sheet is one of our biggest assets [and] we have plenty to look forward to.”

Shares nudged up 1.3% to 409p.

Standard Chartered falls 12%, FTSE 250 slump continues

Thursday 26 October 2023 08:45 , Graeme Evans

Standard Chartered is down 12% at the top of the FTSE 100 fallers board after the banking giant’s third quarter results included provisions to cover its exposure to China’s troubled real estate sector.

Shares slumped 86.6p to 627.8p, while WPP shares fell 3% or 20p to 671p as the advertising services giant downgraded its 2023 revenues and margin guidance.

Heavyweight stock Unilever also dipped 3% or 114p to 3899.5p, meaning the FTSE 100 index weakened by a bigger-than-expected 0.6% or 43.62 points to 7,370.72. Defensive stocks fared best in the top flight, with Sainsbury’s and Imperial Brands both 1% higher.

The FTSE 250 remains under pressure, having hit a one-year low in the wake of a 11% decline since mid-September. It lost another 67.58 points to 16,803.13, with the oil services firm Hunting the biggest faller after its trading update caused shares to decline 3% or 10.5p to 298.5p.

Cooling ice cream sales take a bite out of Unilever revenue

Thursday 26 October 2023 08:02 , Michael Hunter

Consumer goods giant Unilever reported a drop in third-quarter revenue today, in part due to bad ice cream sales.

Overall, third quarter turnover was down 4% to €15.2 billion (£13.26 billion) at the owner of a range of blockbuster brands from Ben & Jerry's and Walls ice cream to Marmite, the famously divisive toast topper.

The FTSE 100 giant also said the worst of inflation was behind it, and volumes were coming back as price rises moderate.

But ice cream sales fell almost 6% year-on-year to €2.2 billion.

CFO Graeme Pitkethly called the ice cream sales "pretty bad", adding:

"A lot of our volume is represented by the summer season in Europe and the weather in Europe relative to last year was really pretty poor."

ECB set to pause run of rate rises

Thursday 26 October 2023 07:39 , Graeme Evans

The European Central Bank (ECB) is widely expected to keep interest rates on hold later today, the first time it has done so in over a year.

The no change decision follows 10 consecutive hikes since July 2022, a run that has taken the main interest rate to a 22-year high of 4.5%.

The likely wait-and-see approach from policymakers comes amid expectations that the EU economy contracted in the third quarter.

Michael Hewson, chief market analyst at CMC Markets, said: “While ECB President Christine Lagarde has been at pains to insist that the ECB isn’t done on the rate hike front, the ECB would be foolhardy in the extreme to hike rates again in a week that has seen economic data show little signs of picking up.”

Recap: Yesterday's top stories

Thursday 26 October 2023 07:28 , Simon Hunt

Good morning. Here's a summary of our top stories from yesterday:

Lloyds profits up 46% to £4.3 billion but debt impairment charges rise to £849 million as consumers fell the strain

London property market finally returned to pre-mini Budget levels of activity in September as confidence begins to return

Reckitt Benckiser launches £1 billion buyback in “strategic review” and says “most inflation behind us”

Brick maker Ibstock says third quarter sales volumes falls as UK housing slowdown bites

Heineken’s UK sales flat after pushing prices up by “high single digits.”

Used car marketplace Cazoo says it expects more costs related to last month’s major restructuring that drastically watered down shareholders’ stakes, as it revealed sales fell by 49% in the third quarter.

And...why £6 billion has been wiped from the value of European payments firms this week.

US tech stocks slide, FTSE 100 seen lower

Thursday 26 October 2023 07:26 , Graeme Evans

A poor reaction to Alphabet results contributed to the Nasdaq Composite tumbling 2.4% by last night’s close, its worst session since February.

In the latest paring back of lofty expectations for tech stocks, Alphabet shares fell 9.5% due to disappointment over Google Cloud revenues and the wider impact of another surge in long-term US bond yields.

The poor Nasdaq performance was in contrast to the more resilient showing of the Dow Jones Industrial Average, which lost 0.3%. The S&P 500 index fell 1.4% to close at its lowest level since June.

The downbeat mood was reflected in the reaction to figures from Meta Platforms. Even though the Facebook and Instagram owner beat revenue and earnings expectations, its shares were 4% lower in after-hours trading.

Deutsche Bank notes the Magnificent Seven index of mega cap stocks is down nearly 7% since last Monday. This follows results from four of the seven accounting for over 15% of the S&P 500, with their mixed quarterly performance accompanied by an underwhelming outlook.

The poor showing on Wall Street put pressure on Asia markets as the Nikkei 225 lost more than 2%. With attention turning to this afternoon’s US GDP print, CMC Markets expects London’s FTSE 100 index to follow yesterday’s positive session with a decline of 33 points to 7381.

Yahoo Finance

Yahoo Finance