FTSE 100 Live: Pub stocks rise, banks fall after Autumn Statement, economy to grow slower than expected

Lower National Insurance payments, a boost to the minimum wage and what the Chancellor claimed to be “the largest business tax cut in modern British history” were unveiled by Jeremy Hunt this afternoon in the Commons.

He also stood by the controversial “triple lock” boost to state pensions and took a “carrot and stick” approach to cutting spending on working-age benefits.

The measures come into an election that must be held by the end of next year, and the giveaways were made possible because the economy had turned a corner, Hunt said.

Many of the measures had been trailed in advance, making market reaction muted, but shares in firms with high rates of investment spending rallied on news tax breaks there worth around £11 billion a year would be made permanent.

FTSE 100 Live Wednesday

Jeremy Hunt unveils tax plans in autumn statement

Are you better off after the Autumn Statement?

Wednesday 22 November 2023 16:37 , Neil Hunter

Fill in the four-part calculator below to see if you will be better off after today's statement, and if so, by how much.

FTSE closes flat after Autumn Statement

Wednesday 22 November 2023 16:53 , Simon Hunt

The FTSE 100 has closed relatively flat at the end of the day's trading session in London as investors digested policy changes unveiled at Jeremy Hunt's Autumn Statement.

Shares in BT rose on news of tax relief for businesses, but bank shares slipped after Hunt said the government's stake in NatWest would be cut further.

The FTSE 250 performed better, up around 0.7%, helped along by pub chain stocks nudging up on news of alcohol duty being frozen.

Here's a last look at today's key market data:

Autumn statement: Planning reforms fail to significantly excite housebuilding sector

Wednesday 22 November 2023 16:24 , Simon Hunt

Chancellor Jeremy Hunt has set out plans to unlock the building of more homes, including through tackling a planning backlog, but the reaction from shareholders in FTSE 100 residential businesses looked lacklustre on Wednesday afternoon.

Among measures in the Autumn statement to boost housing supply is the government investing an additional £32 million across housing and planning, including funding to tackle planning backlogs in Local Planning Authorities. That is alongside further reforms to streamline the system through a new Permitted Development Right to enable one house to be converted into two homes.

The government added that it is providing £110 million of funding to support Local Planning Authorities to deliver high quality schemes to offset nutrient pollution, unlocking planning permissions that are otherwise stalled.

Housebuilders have cut back on construction targets during a turbulent time since the controversial mini-Budget in Autumn 2022.

Sluggish economic growth on the cards until 2027 says OBR

Wednesday 22 November 2023 15:55 , Simon Hunt

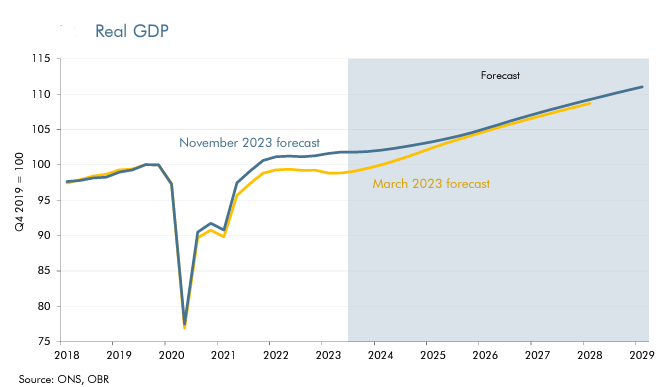

Britain’s stuttering economy will be stuck in the growth slow lane for the next three years as inflation and interest rates stay higher for longer than previously forecast.

Latest forecasts from the Government’s economic watchdog, the Office for Budget Responsibility (OBR), released to coincide with the Autumn Statement, show projections for GDP growth have been slashed out as far as 2027.

Although growth this year is expected to advance 0.6%, faster than the 0.2% expected at the time of the Budget in March, forecasts for subsequent years have been hacked back, although the OBR does not foresee any threat of a recession.

Next year will see GDP advance by a feeble 0.7%, compared with a projected 1.8% in March. The following year also has growth forecasts downgraded by 1.1%, from 2.5% to 1.1%.

Retail investors no longer 'left out' of NatWest share sales

Wednesday 22 November 2023 15:39 , Daniel O'Boyle

Susannah Streeter, head of money and markets, Hargreaves Lansdown, said the NatWest retail offer was welcome as retail investors had been 'left out' of past deals to sell down the Government's stake.

She said: “Giving retail investors a slice of ownership in NatWest is a welcome move given that they have been left out of previous sales, which have been reserved for institutional investors.

"This is a recurrent theme, retail investors are rarely offered the full suite of investing opportunities, so this would buck the trend. Further sales would again bring NatWest closer to full public ownership and would bring to a close crisis actions taken during the Great Financial Crisis. The government announced at the Spring Budget that it intended to fully exit the shareholding by 2025-2026, subject to market conditions and achieving value for money for taxpayers."

Size of Hunt’s cut to National Insurance contributions stands out ahead of election year

Wednesday 22 November 2023 15:31 , Simon Hunt

Millions of workers will get a bigger-than-expected cut in the amount of National Insurance they have to pay, in a move announced in the Autumn Statement on the UK’s finances today.

And it will kick in earlier than usual – at the start of next year – with January often the month when incomes are under the most pressure after Christmas. Changes to tax measures usually run from early April, when the financial year starts.

Chancellor Jeremy Hunt took the shears to one of the broadest taxes in the country, levied on every employee and self-employed person earning more than £123 a week. He cut it to 10%, or by 2 percentage points, for people earning between £12,570 and £50,270.

“For the average nurse, it’s saving of £520, for the typical police officer a saving of £630 every single year,” Hunt said. Someone earning the average UK salary of £35,000 will save £450 a year from the change.

Autumn statement: Business rates help welcomed but only scratches the surface

Wednesday 22 November 2023 15:02 , Simon Hunt

The Chancellor has used his Autumn statement to address business rates support, outlining measures that will help a raft of small companies but that will have limited benefits to a number of medium to larger firms according to property experts.

The government during and in the aftermath of the pandemic offered a range of help around business rates, which are are charged on most non-domestic properties, like shops, pubs, warehouses and offices. Jeremy Hunt today said: "It is not possible to continue with temporary support measures forever."

But what will be offered is a business rates support package worth £4.3 billion over the next five years to help high streets and small businesses. That comprises a rollover of 75% retail, hospitality and leisure relief for 230,000 properties and a freeze to the small business multiplier.

Around 230,000 retail, hospitality and leisure properties will receive the 75% relief, up to a cap of £110,000 per business, on their business rates bills for 2024-25.

Microsoft rises and stocks make gains on Wall Street

Wednesday 22 November 2023 14:51 , Simon Hunt

Stocks are making gains in the opening minutes of trade over in the US.

Microsoft shares have risen 1.6% as investors hoped for normal service to resume at OpenAI following the reinstatement of ousted CEO Sam Altman.

Here's a look at your key market data:

Is the Autumn Statement good for tech?

Wednesday 22 November 2023 14:38 , Simon Hunt

Is the Autumn Statement good for tech? Yes, says Startup Coalition's executive director, Dom Hallas.

Chancellor’s tax cuts are 'virtuous but impractical'

Wednesday 22 November 2023 14:06 , Simon Hunt

Yael Selfin, Chief Economist at KPMG UK, said the Chancellor’s tax cuts are “virtuous but impractical”, warning that the reductions will put pressure on government finances at a time when the cost of borrowing is high, and that it may fuel inflation.

“The Chancellor unveiled a budget for growth which is expected to boost the level of GDP by 0.3% on average. While the package of net giveaways worth £17 billion takes advantage of the recent windfall in the public finances, the prospect of higher interest rates, demographic pressures, and a slowing economy leaves the Exchequer vulnerable to a sudden reversal of fortune.

“The Government’s ambition to cut taxes is virtuous but impractical at a time when debt is still rising and inflation is well over 2%. Reducing the rate of employee National Insurance is a relatively regressive policy which doesn’t benefit those on lowest income. In addition, a 2p cut won’t be enough to offset the impact of threshold freezes which are already in place. Despite all the fanfare, household budgets will continue to be squeezed by tight monetary and fiscal policies, with the tax burden set to reach 38% of national income by 2028-29.”

National Insurance cuts: analysis

Wednesday 22 November 2023 13:59 , Simon Hunt

The cut in class 4 NICs comes after small businesses saw corporation tax jump to 26% on profits over £50k. It was previously a flat rate of 19%. So at the margins that's going to encourage some limited companies to flip into sole traders, or maybe stop people setting up as limited companies in the first place, surely?

Well, we are not so sure about it encouraging people to change as its more complicated than that Class 4 NIC is paid by the self-employed not a company.

Our resident expert Paul Noble at Blick Rothenberg says: But the self-employed are not as celebrated as @Jeremy_Hunt proclaimed - they get a 1% NIC cut from April 2024, whereas an employed worker will benefit from a 2% NIC cut from January 2024. The self-employed won't be doing cartwheels - relatively modest NIC cuts and nothing on reform to IR35. Also, the NI cuts don't even start to compensate for the fiscal drag of no inflation in tax thresholds.”

Moreover -- The 2% NIC cut for employees is not as generous as it may appear - for someone earning £20k, this is worth £149. But simply increasing the personal allowance in line with inflation (at current 4.6%) it would be worth £185

Simon French: little from Hunt on helping public markets

Wednesday 22 November 2023 13:51 , Simon Hunt

Simon French, chief economist at Panmure Gordon, said the Chancellor's statement gave little support to the UK's public markets.

OBR remains optimistic despite forecast downgrade

Wednesday 22 November 2023 13:40 , Simon Hunt

The OBR may have downgraded its forecasts, but it is still more optimistic about the UK’s economic prospects than most.

Lindsay James, investment strategist at Quilter Investors, said: “In recent budgets and fiscal events, when consulted, the Office for Budget Responsibility has been far more optimistic about the trajectory of the UK economy and inflation than the Bank of England. On inflation, today that has changed and it is now beginning to mirror the thoughts of the Central Bank. In March the OBR predicted inflation would be 0.9% by the end of 2024, yet today that forecast now stands at 2.8%. Inflation is not expected to hit the 2% target until 2025, and thus rates will likely stay ‘higher for longer’ even as economic growth stutters.

“However, the OBR continues to be a more optimistic voice compared to others on economic growth in the UK. Having avoided a technical recession to date, the forecasts now indicate sluggish growth, down from estimates in March, but growth nonetheless. But that optimism isn’t translating into strong expectations - growth forecasts have gone from 4.1% between 2023 and 2025 in the spring, to 2.7% today as growth deteriorates compared to what was expected. It is clear that interest rates are weighing on the wider economy and making up for these periods of lost growth will be difficult for the UK despite the government’s best intentions.”

Market moves as Hunt concludes speech

Wednesday 22 November 2023 13:35 , Simon Hunt

Here's your market snapshot as Jeremy Hunt concludes his Autumn Statement speech in the House of Commons.

The biggest FTSE 100 riser just now is Sage Group, up a whopping 14%, 139p, to 1135p. That's related to the tax break on infrastructure expenses, we assume, on top of a buyback announcement this morning. Also doing well, is the London Stock Exchange group, up 158p, 2%, at 8840p.

BT shares are also up considerably, while NatWest is down on news the government is set to cut its stake in it.

Personal tax cuts: employee National Insurance cut to 10%

Wednesday 22 November 2023 13:29 , Simon Hunt

Hunt says high employment taxes “disincentivise” work for 27 million people.

He announces a cut in the main 12% rate of employee national insurance by 2 percentage points to 10% from January 6, earlier than the start of the next financial year in April.

Someone earning £35,000 will save £450 a year.

Chancellor makes changes to business rates

Wednesday 22 November 2023 13:27 , Simon Hunt

Chancellor Jeremy Hunt, who had earlier this month faced calls to freeze the business rates multiplier and extend existing reliefs for a further year, has given some support when it comes to this type or property tax.

He outlined support that has already been given to companies, but added: "It is not possible to continue with temporary support measures forever."

But what will be offered is this: The standard multiplier, which applies to high-value properties, will rise in line with inflation, but the government will freeze the small business multiplier for a further year. Hunt has also decided to extend the 75% business rates discount for retail, hospitality and leisure businesses for another year too.

While the moves will help some companies, there are firms that will benefit less. UKHospitality boss Kate Nicholls posted on X that "many small businesses operate from larger standard rated premises, particularly hospitality".

According to real estate advisory firm Altus Group the freezing of the small business rates multiplier for another year, coupled with the extension of the 75% discount for occupied retail, leisure and hospitality premises for 2024/25 ,will save the average shop £11,728, restaurant £16,507, pub £12,869 and café £6,072 in business rates next April.

Minimum wage rise confirmed taking it to £11.44 an hour

Wednesday 22 November 2023 13:24 , Simon Hunt

The minimum wage, now called the National Living Wage, is confirmed to go up by 9.8% to £11.44 an hour, Hunt says.

It means a full-time worker on that wage will rise by 30% compared with 2010.

That increase in the National Minimum Wage is higher than that even predicted by the Low Pay Commission -- it is a near 10% increase.

"Anna Vishnyakov, Workforce Partner at PwC says: "This is welcome news to the estimated 1.6 million workers that are paid at minimum wage and especially welcome to workers aged 21 and 22 who will be entitled to the minimum wage from April 2024.

"Businesses are unlikely to have forecast this level of increase and will need to review their budgets for next year, including on-costs such as employer national insurance and pensions. In particular, businesses in retail and hospitality, who typically employ a younger and lower paid workforce, will be impacted."

Benefits changes for long-term jobseekers

Wednesday 22 November 2023 13:24 , Simon Hunt

The Government will stop benefits for long-time jobseekers, as it aims to push more people into work.

Hunt said an extra £1.3 billion will be offered to the 300,000 people who have been unemployed for a year.

“But we will ask for something in return,” he said.

“If after 18 months of intensive support jobseekers have not found a job, we will roll out a programme requiring them to take part in a mandatory work placement to increase their skills and improve their employability. And if they choose not to engage with the work search process for six months, we will close their case and stop their benefits.”

It follows the spring’s “back-to-work Budget”, which included many steps aimed at incentivising work including childcare and pension reforms.

BT shares jump as full expensing made permanent at cost of £11 billion

Wednesday 22 November 2023 13:19 , Simon Hunt

The super deduction tax break on business investment known full expenses is made permanent at a cost of £11 billion a year.

It was due to expire in April 2026. Hunt says this means that for every million pounds a company invests, it gets £250,000 off their tax bill in the same year.

He said: "This is the largest business tax cut in modern British history."BT is seen as one of the biggest beneficiaries from the tax breaks on investment, since it has so much to spend on making Britain an ultra-fast wifi nation.

The continuation of the "super deduction" should allow BT to increase its rollout of fibre broadband.

Hence the jump in the shares by nearly 7%, the biggest single-day rise in more than 9 months.

Outgoing BT boss Philip Jansen had urged the chancellor to make these fibre tax breaks permanent just last month. Arise Sir Philip?

Toby Ryland, Corporate Tax Partner at accountancy firm HW Fisher, said: “Businesses across the UK will be celebrating today - finally a simple tax policy from the Chancellor!

“Full Expensing is a straightforward and easy tax relief that will make the decision to invest in new equipment much easier. It covers a wide variety of business necessities, from IT infrastructure, office furniture, certain commercial vehicles, warehouse and construction equipment, and fixtures for non-residential properties.

“It means that tax deductions will follow the financial cost of investing in real time rather than spreading the cost over a longer period. It’s simple to administer too - companies can claim the relief through their Corporation Tax return."

Pub rates discount extended

Wednesday 22 November 2023 13:15 , Simon Hunt

The 75% business rates discount for retail hospitality businesses – the category that includes pubs – is extended.

It will save the average pub over £12,800 next year, Hunt says, and will cost the Exchequer £4.3 billion. He says its a “large tax cut” which “recognises the role of pubs and high street shops in our communities.”

Are pensions reforms a good idea?

Wednesday 22 November 2023 13:14 , Simon Hunt

Not all in the pensions sector are wild about the "pot for life" pension idea, thinking it could lead to another mis-selling scandal.

Nicholas Clapp, Business Development Director at TPT Retirement Solutions, said: “The proposal to use the Pension Protection Fund (PPF) as a state-sponsored consolidator establishes a clear vision for the future. The government is aiming for a sector comprising a small number of large Defined Benefit (DB) schemes that can benefit from economies of scale and invest more in growth assets.

"However, these reforms could be a double-edged sword. If the PPF can consolidate schemes with solvent sponsors, it may limit competition in the existing market and prevent the creation of innovative private-sector solutions."

Savers to be offered "pension pot for life"

Wednesday 22 November 2023 13:08 , Simon Hunt

The Government will consult on giving savers a legal right to require new employers pay their pension into the employer’s existing pension pot.

Hunt said: “These reforms could help unlock an extra £75bn of financing for high growth companies by 2030 and provide an extra £1000 a year in retirement for an average earner saving from 18.”

But Tess Page, wealth strategy leader at Mercer UK, said: “While this may have some consumer appeal, it will lead to a significant administrative and risk burden for employers, lower engagement levels from sponsors and fragment the system. In the context of the desire to have larger schemes with the scale to invest in productive finance, it seems an odd backdrop to broader policy intentions.”

Chancellor pledges to sell NatWest shares

Wednesday 22 November 2023 13:06 , Simon Hunt

Hunt pledges to cut the public stake in the NatWest, which was nationalised during the financial crisis.

A “retail share offer” will be held in the next 12 months, “subject to market conditions and achieving value or money”.

Shares in all big banks down in the light of Chancellor pledge to sell NatWest shares. HSBC is off 1.7%, Lloyds off 0.5%, Barclays off 1.2%. That suggests the market is not that enthusiastic about more bank shares being available to buy.

Chancellor commits £500 million to tech

Wednesday 22 November 2023 13:05 , Simon Hunt

Jeremy Hunt has unveiled a £500 million commitment to the tech industry.

He said: "When it comes to tech, we know that AI will be at the heart of any future growth. I want to make sure our universities, scientists and start-ups can access the compute power they need.

"So building on the success of the supercomputing centres in Edinburgh and Bristol, I will invest a further £500m over the next two years to fund further innovation centres to help make us an AI powerhouse."

Hunt vows to speed up planning

Wednesday 22 November 2023 13:02 , Simon Hunt

The chancellor has outlined a number of measures to try and speed up planning for businesses and boost the housebuilding sector. Hunt said: "From next year, working with the Communities Secretary, I will reform the system to allow local authorities to recover the full costs of major business planning applications in return for being required to meet guaranteed faster timelines. If they fail, fees will be refunded automatically with the application being processed free of charge."

He added that the government will invest £110m over this year and next to deliver high quality nutrient mitigation schemes, unlocking 40,000 homes. He said: " We will invest £32m to bust the planning backlog and develop fantastic new housing quarters in Cambridge, London and Leeds which will lead to many thousands of additional dwellings. We will allocate £450m to the Local Authority Housing Fund to deliver 2400 new homes. And we will consult on a new Permitted Development Right to allow any house to be converted into two flats provided the exterior remains unaffected."

That update could be welcome following a turbulent period. Housebuilders have cut back on construction targets during a turbulent time since the controversial mini-Budget in Autumn 2022. The industry has been grappling with various challenges from soaring mortgage costs hitting buyer demand, to the Help to Buy scheme closing to new applicants in October last year making affordability out of reach for numerous first time purchasers.

New £50 million funding to lift number of apprentices

Wednesday 22 November 2023 12:59 , Simon Hunt

Hunt says the new funds will be targeted to “increase the number of apprentices in engineering and other key growth areas” where there are shortages.

The funding comes after consultations with Make UK, the manufacturers’ trade group.

OBR downgrades its growth forecasts

Wednesday 22 November 2023 12:55 , Simon Hunt

The OBR downgrades its growth forecasts for the next three years.

Growth next year will be just 0.7% compared with a previous 1.8% forecast.

In 2025 it will be 1.4% down from 2.5%.

Veterans employment scheme extended

Wednesday 22 November 2023 12:54 , Simon Hunt

The government’s scheme for National Insurance relief for firms employing ex armed services personnel will be extended for a year.

There will also be £10 million to support the Veterans Places Pathways and People programme.

“We support a brave group of people to whom we owe our freedom”, Hunt says

Diageo rises 1.1% as Hunt freezes alcohol duty

Wednesday 22 November 2023 12:53 , Simon Hunt

Shares in London spirits maker Diageo nudged up 1.1% as Jeremy Hunt committed to freezing alcohol duty.

"As well as confirming our Brexit Pubs Guarantee, which means duty on a pint is always lower than in the shops, I have decided to freeze all alcohol duty until August 1st next year," he said.

"That means no increase in duty on beer, cider, wine or spirits."

UK Spirits Alliance spokesperson and distiller Stephen Russell said: “We raise a toast to the Chancellor today for his decision to freeze duty and thank him for listening to thousands of distillers, landlords and bar owners up and down the UK.

"He has raised the spirits of the sector, and his decision today is a vote of confidence in this vibrant homegrown sector. Today’s freeze will drive growth in the industry, support jobs and help consumers at a time when household budgets continue to be squeezed”.

Pensions — ‘triple lock ’ commitment ‘honoured in full’

Wednesday 22 November 2023 12:50 , Simon Hunt

The state pension will rise by 8.5% from April 2024, as Jeremy Hunt said the government would not abandon the “triple lock”.

Under the pension triple lock, the value of the state pension rises by the highest of inflation, wages or a flat 2.5%. But with wage growth hitting a record high over the summer, questions were raised over whether the Government could continue to keep the triple lock in place.

Hunt said: “From April 2024, we will increase the full new state pension by 8.5% to £221.20 a week, worth up to £900 more a year. That is one of the largest ever cash increases to the state pension – showing a Conservative government will always back our pensioners.”

Sian Steele, Head of Tax at professional services and wealth management firm Evelyn Partners, said: “This will be very welcome to those receiving, or about to receive, the state pension at a time of rising living costs.

“With an election on the horizon, the political consequences of tinkering with the triple lock might have figured in the Chancellor’s calculations. Whether the state pension can be increased in the same way over the long term alongside an ageing population is another question."

Headline debt predicted to be 94% of GDP

Wednesday 22 November 2023 12:48 , Simon Hunt

Headline debt is now predicted to be 94% of GDP by the end of the forecast, below the OBR forecast in the March Budget.

The OBR today said underlying debt will be 91.6% of GDP next year, 92.7% in 2024-25, 93.2% in 2026-27, before declining in the final two years of the forecast to 92.8% by 2028-29.

Borrowing is lower across the forecast by an average of £0.7bn every year compared to the Spring budget forecasts, according to latest OBR forecasts. It falls from 4.5% of GDP in 2023-24, to 3.0%, 2.7%, 2.3%, 1.6% and 1.1% in 2028-29.

Universal Credit up 6.7% from April

Wednesday 22 November 2023 12:45 , Simon Hunt

The Chancellor said that Universal Credit will rise by 6.7% next year, in line with September’s inflation figure, rather than the lower October inflation rate.

Universal Credit increases are typically based on September’s inflation rate, but campaigners feared the Government could choose the lower October rate instead.

Hunt called the decision to raise the benefit by 6.7% “vital support for those on the lowest incomes from a compassionate conservative government.”

Government to give £7 million to tackle antisemitism

Wednesday 22 November 2023 12:44 , Simon Hunt

The Chancellor opened his Autumn Statement by announcing that the Government will give £7 million to charities dedicated to tackling antisemitism over the next three years.

He said: “I will remember for the rest of my life – as I know many other honourable members will – being taken to Auschwitz by the Rabbi Barry Marcus and the remarkable Holocaust Educational Trust,” Hunt said. “But I am deeply concerned about the rise of anti-semitism in our country.

“When it comes to anti-Semitism and all forms of racism, we must never allow the clock to be turned back.”

Inflation to hit BoE target by 2025

Wednesday 22 November 2023 12:42 , Simon Hunt

Headline inflation will fall to 2.8% by the end of 2024, before falling to the 2% target in 2025, according to OBR forecasts.

Chancellor points to 110 ‘growth measures’

Wednesday 22 November 2023 12:42 , Simon Hunt

Hunt says the plans in the Autumn Statement will “cut business taxes”.

He said he would not go through all of them in the Commons, but said they would cut red tape and include ways to boost access to the National Grid.

Hunt begins Statement

Wednesday 22 November 2023 12:35 , Simon Hunt

Chancellor Jeremy Hunt has stood up to deliver his Autumn Statement. Follow along here for live updates and market reaction.

Market snapshot: steady trading across UK assets before Hunt stands up

Wednesday 22 November 2023 12:23 , Michael Hunter

Here's a look at the main market numbers flashing across the screens in City dealing rooms before the Chancellor stands up to deliver his Autumn Statement on tax and spending plans:

Government bonds

10yr yield: 4.094%; move: -0.012

5yr yield: 4.000%; move + 0.011

2yr yield: 4.550%; move 0.000

StocksFTSE 100: 7,474.05; down 7.94 points(-0.11%)

FTSE 250 :18,495.74: up 148.11 points(+0.81%)

CurrenciesPound/dollar: $1.2535; -0.02%

Pound/euro: €1.1499; +0.06%

Are 'vote-winning tax cuts' about to be unveiled?

Wednesday 22 November 2023 12:17 , Daniel O'Boyle

Victoria Scholar, Head of Investment, interactive investor says there is some room for 'vote-winning tax cuts'.

She said: “All eyes are on Chancellor Jeremy Hunt today as he prepares to deliver the Autumn Statement. With the Conservatives lagging in the polls, a looming general election, Rishi Sunak achieving his goal of halving inflation ahead of schedule, and the UK’s public finances in a better position than expected, the Treasury is anticipated to unveil some vote-winning tax cuts today. This marks a change from recent fiscal policy with the government until now refraining from tax cuts and keeping a lid on spending where possible in order to support the Bank of England in its attempts to tame inflation.

“We could see a one-year extension to tax breaks for business investment as well as a cut to national insurance contributions and business taxes. It has already been revealed that the minimum wage will go up and expand to cover 21- and 22-year-olds for the first time. The Chancellor will also announce a back to work plan to boost employment and help those with long-term health conditions. Other areas to watch out for include a ‘pot for life’ in major pensions reforms as well as possible changes to ISAs, inheritance tax and stamp duty. Focus will also be on the OBR’s independent economic forecasts for clues into the outlook for growth and inflation.”

Construction stocks gain ahead of Autumn Statement

Wednesday 22 November 2023 12:08 , Daniel O'Boyle

The FTSE 100 is down slightly for the day as Jeremy Hunt prepares to deliver his Autumn Statement, but the more UK-focused FTSE 250 is up, thanks to a strong performance from builders.

Russ Mould, investment director at AJ Bell, says: "UK stocks were in fashion ahead of the Autumn Statement at lunchtime. The more domestic-focused FTSE 250 index rose 0.2% to 18,378, with property and construction stocks among those in demand.”

“Chancellor Jeremy Hunt is expected to unveil measures to boost British business including removing planning red tape, boosting foreign investment and cutting business taxes.

“Talk that Hunt will make changes to National Insurance would amount to a tax cut for consumers, implying that many will have a few extra quid in their pocket on payday to spend on goods and services. That could be good news for retailers and leisure companies.

“Sterling has strengthened 3% against the US dollar over the past month to $1.2529 while the 10-year gilt yield has fallen from 4.54% to 4.13% over the same period, suggesting the market is starting to have more confidence that UK interest rates have peaked in the current cycle and that inflationary pressures are easing.

“Investors will be watching the currency and government bond yields like a hawk when Hunt gives his speech at lunchtime, hoping his announcement doesn’t cause tremors in the market like with the disastrous Truss/Kwarteng mini-Budget a year ago.

Autumn Statement just an hour away

Wednesday 22 November 2023 11:36 , Daniel O'Boyle

Jeremy Hunt's economic set-piece is just an hour away.

The Chancellor will reportedly use his autumn statement to reduce headline rates of national insurance and make permanent a £10 billion-a-year tax break for companies that invest in new machinery and equipment.

But economists have warned he has limited headroom for major giveaways.

City Comment: Telegraph sale drama will go on and on.... until close to election day

Wednesday 22 November 2023 11:18 , Daniel O'Boyle

Jonathan Prynn said the saga at the Telegraph could run and run

National newspapers are like Premier League football clubs.

As businesses their allure goes far beyond any valuation implied by the bottom line profits — if indeed there are any.

They both attract the interest of the billionaire classes and stir levels of emotions that few FTSE 100 companies could ever get close to.

Sage soars in FTSE 100, JD Sports continues strong run

Wednesday 22 November 2023 10:23 , Graeme Evans

Shares in Sage have jumped 10% to a record high after the accounting software business reported strong annual results today.

Underlining its confidence in the outlook, FTSE 100-listed Sage also announced plans to buy back £350 million of its shares.

The Newcastle-based provider of finance, HR and payroll tools expects revenues growth in 2024 to be on a par with the 10% rise to £2.2 billion seen in today’s results.

Chief executive Steve Hare added: “Small and mid-sized businesses are continuing to digitalise, despite the macroeconomic uncertainty.”

Shares rose 103.3p to 1100.5p, lifting the valuation by more than 45% this year.

The FTSE 100 index weakened 10.88 points to 7471.11, despite a better session for drinks giant Diageo as shares recovered 46p to 2844.5p.

The strong run for JD Sports Fashion continued after a rise of 2% or 3.1p to 147.7p, while Howden Joinery put on 4.4p to 690.4p thanks to Jefferies giving the kitchens supplier a “buy” rating and 835p target price.

The FTSE 250 index gained 57.12 points to 18,404.75, with Johnson Matthey up 31.5p to 1490.5p after the clear air company offset lower profits with stronger full-year guidance.

On AIM, Victorian Plumbing added 1.8p to 75.8p after a 29% rise in pre-tax profits to £20.3 million. Broker Peel Hunt backed the bathroom retailer with a 120p target price.

Markets to welcome tax cuts

Wednesday 22 November 2023 10:02 , Daniel O'Boyle

Matthew Ryan, head of market strategy at global financial services firm Ebury, says he expects shares to rise on the back of a growth-focused budget, and noted the environment is very different to when Kwasi Kwarteng delivered his mini-Budget a little over a year ago.

He said: “Investors will be paying close attention to this afternoon’s Autumn Budget announcement from Britain’s government. PM Sunak and chancellor Jeremy Hunt have already pre-warned markets to brace for tax cuts, with adjustments to inheritance and personal incomes taxes seemingly on the table. Of course the last time the UK government announced a lowering in taxes (former Liz Truss’ infamous mini-budget disaster in September last year), the pound tanked to a record low on the US dollar.

“It is with a high degree of confidence that we can assume that this time will be different. Macroeconomic conditions are completely unalike to a little over a year ago, most notably the fact that UK inflation has dropped sharply from last year’s peak. Indeed, we think that a slightly more growth-oriented budget, which delivers larger-than-expected tax cuts and a focus on supporting households during the elevated cost of living, may actually be greeted positively by markets.”

Grainger rents rise as occupancy approaches 99%

Wednesday 22 November 2023 09:31 , Daniel O'Boyle

The boss of build-to-rent landlord Grainger says there is much more “political understanding” of housebuilders today than in the recent past, as occupancy in its properties hit a record 98.6%.

CEO Helen Gordon said appetite among politicians to build new homes had increased. Low supply of rental housing has pushed occupancy close to 100%.

Gordon said: “We’ve got a much better political understanding of our sector than we’ve had historically. When I talk to people, especially in London, anything to deliver new homes is welcomed.”

Grainger’s rents rose by 7.7% in the year to 30 September, as high wage inflation fueled price increases. Gordon noted that the landlord’s rents as a percentage of wages were still below the sector average.

The shares were steady at 254p.

Sage tops FTSE 100, Johnson Matthey gets results boost

Wednesday 22 November 2023 08:38 , Graeme Evans

Kingfisher shares have fallen 6% or 13.5p to 217.1p after the B&Q owner lowered its profits outlook due to weakness in its French business.

The best stock in the FTSE 100 index is accounting software group Sage, which jumped 8% or 77.3p to a fresh record of 1074.5p.

As well as posting robust annual results, Sage reported strong momentum at the start of the new financial year.

The FTSE 100 index improved 15.07 points to 7497.06, with JD Sports Fashion among the other blue-chip risers as shares lifted 3.1p to 147.65p.

Howden Joinery also improved 9.8p to 695.8p after Jefferies gave the kitchens supplier a “buy” recommendation and 835p target price.

The FTSE 250 index added 62.19 points to 18,409.82, with shares in clear air company Johnson Matthey up 56p to 1515p following half-year results.

On AIM, Victorian Plumbing jumped 3p to 77p after annual results showed an 11% rise in gross profit to £134.6 million.

Market snapshot: FTSE 100 steady, Kingfisher dives

Wednesday 22 November 2023 08:33 , Daniel O'Boyle

The FTSE 100 is steady this morning, but Kingfisher shares are down almost 7%.

Take a look at our market snapshot.

Summer washout hits Britvic sales

Wednesday 22 November 2023 08:20 , Daniel O'Boyle

Britvic, the company behind drinks such as Robinson’s, Tango and J2O, said the wet weather over the summer led to slowing sales of its drinks as UK sales volumes declined.

For the year to 30 September, Britvic sold 1.75 billion litres of its drinks, down 2.3%, though higher prices meant revenue was up. The decline was mostly due to a tough July and August, as Brits opted against buying cool drinks during one of the wettest summers on record. This summer’s sales also faced a tough comparative, as July and August 2022 saw booming sales amid scorching temperatures.

CEO Simon Litherland said: “Last year was a super hot summer. If you cast your mind back to July and August this year it was very wet and rainy and that’s had an impact. So we grew volume in quarter two and quarter three but quarter four there was a decline.”

Profits were hit by a £20.5 million settlement over the rate of increase of Britvic’s pension.

Shares are steady at 841.8p.

CRH to sell lime business to SigmaRoc in £880 million, three-part deal

Wednesday 22 November 2023 08:18 , Michael Hunter

Irish building products giant CRH is selling its European lime business to SigmaRoc for $1.1 billion (£880 million).

The three-part deal involves operations in Germany, the Czech Republic and Ireland.

AIM-listed SigmaRoc will fund the deal in part via £200 million issue of new shares,

Due to its size, the acquisition is subject to shareholder approval.

Dublin-based CRH hit the headlines when it shifted its primary share listing to New York earlier this year. The former FTSE 100 firm now makes most of its profit in the US.

It announced the $2.1bn acquisition of Texas-based building industry assets yesterday and today's sale comes as the latest sign of its focus on the US.

Sigma Roc runs quarries in the UK and Northern Europe. It reported revenue of £538 million for 20222. Its shares fell 0.8p, or 1.6% to 50.2p.

Kingfisher warns on profits after 'weakness' in French business

Wednesday 22 November 2023 07:47 , Michael Hunter

Kingfisher, the owner of B&Q and Screwfix, issued a profit warning today, due to what it called "weakness" in its French business.

The International FTSE 100 home improvement chain trimmed is full-year profit forecast to £560 million from £590 million.

Slower demand from customers getting ready for winter at the Castorama and Brico Dépôt chains on the continent drove the trend

Thierry Garnier, Kingfisher CEO, said:

"In France, our performance was impacted by a weak retail market, as well as a delayed start to insulation, plumbing and heating sales - to which Brico Dépôt is more heavily weighted - due to unusually warm autumn weather, and strong prior year comparatives in these categories"

Its UK business "performed well", the company said while "cost actions" are being taken in France.

Nvidia shares fall despite earnings beat, FTSE 100 seen flat

Wednesday 22 November 2023 07:26 , Graeme Evans

Another forecast-beating performance by AI-focused semiconductor giant Nvidia failed to boost its shares in dealings after last night’s Wall Street closing bell.

Revenues for the three months to the end of October were a third higher than the previous quarter at $18.1 billion (£14.5 billion), leading to earnings per share 49% stronger at $4.02.

Fourth quarter guidance also smashed Wall Street expectations, but shares traded 1% lower as investors locked in profits after this month’s strong run.

The shares have risen by a fifth in November, part of a wider rally for US markets amid hopes that the next move by the Federal Reserve will be to cut interest rates.

There was a break in the progress during yesterday’s regular session as the S&P 500 index lost 0.2% and the tech-led Nasdaq retreated 0.6%.

The weakness came as minutes of the Fed’s most recent meeting pointed to rates staying high for some time.

The FTSE 100 index, which has failed to match the performance of US shares, retreated 14.37 points to 7481.99 and is expected to open broadly flat in today’s session.

Sam Altman returns as OpenAI CEO

Wednesday 22 November 2023 06:29 , Simon Hunt

Sam Altman has returned as CEO of OpenAI in the latest dramatic twist in its boardroom saga.

Altman was abruptly sacked by the OpenAI board on Friday, but staff at the ChatGPT maker had urged for his reinstatement and called on the board that sacked him to be replaced.

OpenAI appears to have heeded those calls, after introducing a new board with Altman back at the helm alongside new members which include former Salesforce CEO Bret Taylor.

In a statement OpenAI said: "We have reached an agreement in principle for Sam Altman to return to OpenAI as CEO with a new initial board of Bret Taylor (Chair), Larry Summers, and Adam D'Angelo."We are collaborating to figure out the details. Thank you so much for your patience through this."

Markets await Jeremy Hunt's Autumn Statement

Tuesday 21 November 2023 23:19 , Simon Hunt

Good morning from the City desk of the Evening Standard.

All City eyes are on Jeremy Hunt this afternoon as he unveils his Autumn Statement to the House of Commons, in what some have touted as the biggest round of tax cuts in years.

Will Hunt's proposals be as bold and market-moving as they have been billed? Probably not. But there remains a big City wish-list of policy changes the Chancellor should make.

Venture capitalist Seb Wallace of Triple Point has written in Standard urging for an end the EIS and VCT sunset clause for good.

Investors and academics in climate tech have urged more support for the nascent industry to make it globally competitive.

And former government adviser Ben Ramanauskas has laid out five tax measures Jeremy Hunt should prioritise, including a land value tax and making a measure known as full expensing permanent.

We'll be covering the Chancellor's remarks live -- stay tuned to follow along.

Here's a summary of our top stories from yesterday:

Public finances borrowing balloons to £14,9 billion in October, second highest on record, including a record £7.5 billion in interest debt

Deliveroo wins “landmark” Supreme Court ruling on rider worker rights

Capita to lay off 900 staff in redundancy drive

AO World upgrades profit expectations after introducing delivery charges for first time

Workspace falls to £147.9 million loss on property revaluation - but demand stays strong

BBC’s Wogan House in Fitzrovia to become a flexible work space in property deal after 60 years under the Beeb’s ownership

Green tech bosses write to PM to warn on impact of Government’s net zero retreat

Yahoo Finance

Yahoo Finance