FTSE 100 Live: London house prices falling, index closes down 1.3% after late tumble, John Lewis chair to quit

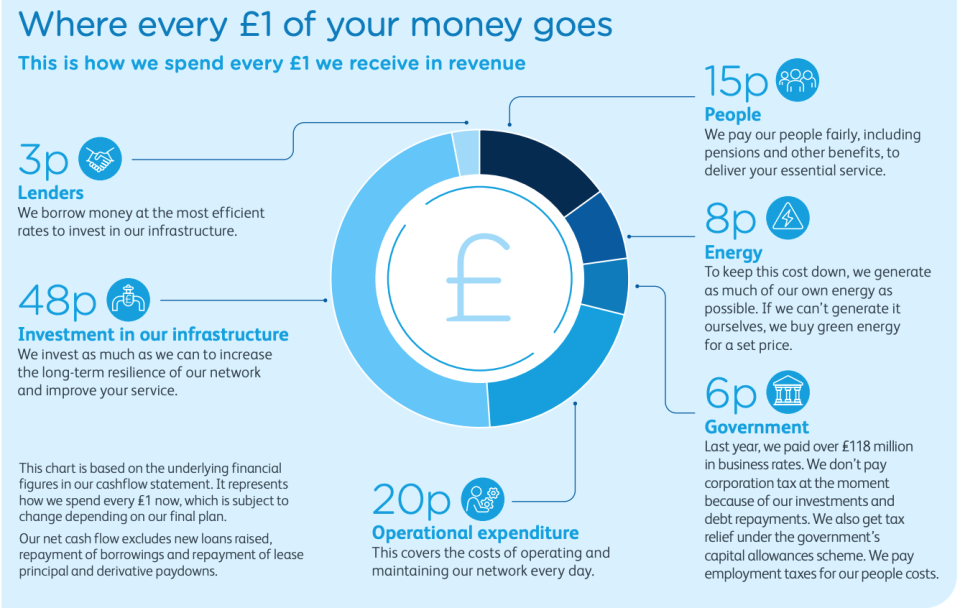

Water industry stocks including United Utilities and Pennon today filed five-year business plans with regulator Ofwat.

An average water bill is likely to go up by £84 in 2025 and by £156 in 2030 as the industry doubles infrastructure spending.

Elsewhere, survey figures continue to paint a bleak picture of activity in the UK manufacturing sector.

FTSE 100 Live Monday

John Lewis chair Sharon White to quit

Water industry sets out spending plans

House prices in 5.3% annual drop

UK manufacturing decline continues

30-year gilts approach mini-Budget levels

Monday 2 October 2023 16:49 , Daniel O'Boyle

The yield on a 30-year gilt has risen above 5%, ending the day just short of the levels reached in the aftermath of Kwasi Kwarteng’s disastrous mini-Budget.

The five-year gilt is yielding 5.006%, having yielded as much as 5.019% at one stage this afternoon, narrowly short of the yield reached just over a year ago.

While shorter yields can be driven more by expected interest rates, long yields often reflect the market’s broader faith in the state of the UK economy as an investment. After the mini-Budget, it was the 30-year gilt that saw the most dramatic rises.

FTSE closes down 1.3% at 7,510.72

Monday 2 October 2023 16:37 , Daniel O'Boyle

The FTSE 100 closed at 7,510.72 today, almost 100 points below where it opened.

The index opened the day ahead, hitting as high as 7628, but declined gently in the mid-morning before tumbling in the afternoon. It was below 7500 for parts of the day but ended up slightly ahead of that mark.

92 of the stocks on the index declined today, with insurer Beazley and energy firm SSE the biggest fallers.

Mixed start for US stocks

Monday 2 October 2023 16:17 , Daniel O'Boyle

The S&P 500 is slightly lower so far today on Wall Street, but the Nasdaq has climbed.

Big risers included Nvdia and Google’s parent company Alphabet.

Fallers include Kellogg and Marathon Oil.

Oil falls back to $91

Monday 2 October 2023 15:51 , Daniel O'Boyle

The price of a barrel of Brent Crude oil has fallen to $91, a three-week low, in a relief to those fearing a recent surge in the commodity’s price could trigger a new wave of inflation.

Oil had been hovering around $95 a barrel, and appeared to be within reach of $100 at times. The fall today brings oil to the lowest price since 11 September.

Market snapshot: FTSE keeps tumbling

Monday 2 October 2023 15:33 , Daniel O'Boyle

The FTSE 100 is now down 100 points despite starting the day ahead, while gilt yields have also surged upwards.

Take a look at our market snapshot below.

Next finance boss to retire in 2024

Monday 2 October 2023 15:05 , Daniel O'Boyle

Next CFO Amanda James is to retire in a little less than a year, the high-street retailer revealed today.

James has been with next for 28 years, Jonathan Blanchard, currently CFO at Reiss, which is owned by Next.

“Amanda has made a huge contribution to the Group in her 28 years with Next and has been an exceptional guardian of our finances. Our financial position today is testament to her diligence and hard work,” Next said. “The noard is extremely grateful to Amanda for her excellent service to the group.”

Pendragon agrees improved deal to sell UK dealerships to Lithia

Monday 2 October 2023 14:56 , Daniel O'Boyle

Pendragon has agreed a new deal with US car dealership giant Lithia to sell its UK dealerships for the higher price of £397 million.

Pendragon had previously agreed a £280 million deal, which would leave the business only with the dealership management tech it offers to other car sellers.

However, also facing two rival bids for the entire business, Pendragon has now negotiated a bigger deal with Lithia,

Pendragon shares rose 6.8% to 35.6p on the news. That is 0.2p above the value implied by the new deal.

Market snapshot as FTSE 100 falls further

Monday 2 October 2023 14:40 , Daniel O'Boyle

The FTSE 100 has fallen further in the early afternoon.

Take a look at our market snapshot.

Londoners’ water bills to go up by £14.55 from 2025 to 2030 as Thames Water unveils £18.7 billion spending plans

Monday 2 October 2023 13:35 , Michael Hunter

Thames Water has revealed the cost to Londoners of the next phase of investment needed to cut the discharge of sewage into rivers and the amount of supply lost to leaking mains.

Bills will go up by £14.55 a month in the 2025 to 2030 period for which it has unveiled spending plans. It would have been even more, but a slow performance in achieving improvements in the last spending period meant regulators limited the price hike by £100 million last week.

Overall in the five years from 2025, Thames Water will spend £18.7 billion on service improvements, an increase of 40%. It follows a wave of public and political anger at a perceived lack of investment which led to calls for the industry to be renationalised.

Raw sewage overflows, often triggered by heavy rainfall overwhelming ageing networks, ran for more than 7,000 hours into the areas rivers and streams last year.

There have also been concerns over the finances of the 15-million customer utility which has a £14 billion debt burden, at a time when rising interest rates are lifting repayment costs.

Its shareholders stumped up £750 million in more cash in July. Its biggest investor is Canadian pension fund OMERS and the UK’s Universities Superannuation Scheme. Thames’s chief executive, Sarah Bentley, resigned suddenly in June after less than three years in the job.

Co-CEOs Cathryn Ross and Alastair Cochran said today:

“We know our performance in some areas is not where it needs to be. That is why we are turning our business around. We have set ourselves a tough challenge. We are committed to learn from the past and adapt for the future so that we improve our service for you, your community and the world around you. You are impatient for us to make progress. We hear you and we are making progress toward delivering this ambition.”

FCA hits firm with £6.5m fine after series of financial crime failures

Monday 2 October 2023 13:10 , Daniel O'Boyle

An investment company that failed to do proper checks on its customers despite being given two years to get its house in order has been fined £6.5 million by the City watchdog.

The Financial Conduct Authority said that despite warning ADM Investor Services International in 2014 that its systems were not up to scratch, the company had not made sufficient improvements by 2016.

ADM Investor Services is a subsidiary of an American company. It had more than 2,000 business and personal customers including asset managers and wealthy people who used it to trade grains, energy, currency and other commodities.

Body scanning firm Thruvision to miss guidance after failed US customs order

Monday 2 October 2023 12:45 , Daniel O'Boyle

Body scan security firm Thruvision is set to miss sales guidance after US government budget challenges meant it did not receive an expected order from US border forces.

Shares in the company, which is listed on London’s junior Aim index, dropped as much as 20% at the start of trading as a result.

Thruvision said it will see a “material impact” to its financial performance over the second half of the year, and full-year results as a whole, after it was not awarded an order from US Customs and Border Protection (CBP).

Dame Sharon White’s John Lewis exit is no real surprise

Monday 2 October 2023 12:22 , Daniel O'Boyle

Today’s news that Dame Sharon White is to step down from leading Britain’s best-known partnership next year should not come as a huge shock despite John Lewis’s reputation for boardroom longevity.

The former Treasury civil servant and Ofcom boss was an eye-catching appointment when she took over from Charlie Mayfield, who served a 13-year stint, in 2020. She arrived with no retail experience and, in truth, little has gone right since.

Dame Sharon rightly identified that change was needed to modernise a business caught by the long-term trends of the pivot to online shopping and the shorter-term maelstroms of the pandemic and the cost-of-living crisis.

I’ll chart a path to lower taxes – I just can’t say when, Jeremy Hunt tells Tories

Monday 2 October 2023 11:53 , Daniel O'Boyle

Jeremy Hunt on Monday firmly kept ajar the door to pre-election tax cuts but told an increasingly fractious Tory party that there would be “no short cuts” and landmark reforms would be needed.

In his keynote speech to the Conservative annual rally in Manchester, the Chancellor was set to “chart a path to a lower tax economy”. But he earlier rebuffed growing calls from senior Tories for tax cuts to be announced now. Ahead of unveiling a series of major public policy changes, he stressed: “If we are prepared to walk this difficult path it is possible to bring down taxes, and we won’t hesitate to do that. But we can’t say when it will be possible.”

25% of young new mortgage holders ‘have terms of at least 35 years’

Monday 2 October 2023 11:31 , Daniel O'Boyle

A quarter of mortgage holders aged under 30 who started their loan in early 2023 have a repayment term of 35 years or more, according to analysis by a credit information company.

Experian found that 25% of new homeowners aged 29 and under between January and March 2023 had a repayment term of at least 35 years.

This has increased from 10% in January 2020, according to Experian’s analysis, which is based on new business rather than the overall stock of mortgages.

Market snapshot as FTSE 100 falls into red

Monday 2 October 2023 10:51 , Daniel O'Boyle

The FTSE 100 has fallen into negative territory this morning, slipping back below the 7600 mark as the strong start for London shares was quickly erased.

Elsewhere, Bitcoin remains sclose to its highest price in 15 months, after surging over the weekend.

Take a look at our full market snapshot.

Sharon White to quit John Lewis

Monday 2 October 2023 10:40 , Simon English

The £1 million a year boss of John Lewis surprised the business world today by saying she intended to stand down at the end of her five-year term in February 2025.

That will make Dame Sharon White, 56, the shortest serving chair in the history of the partnership that also owns Waitrose, a business that has struggled to compete lately with cut price competition from internet players and from supermarket rivals such as Aldi.

The John Lewis Partnership fell to a loss of £234 million last year, a plunge into the red that forced it to scrap the annual staff bonus.

That was a serious blow to the 74,000 staff for whom the bonus was both a celebrated annual event and a strong boost to their incomes.

That was only the second time there was no staff bonus since the scheme began in 1953.

A statement today said: “The Chairman of the John Lewis Partnership, Sharon White, has today asked the Partnership Board to initiate the process to appoint a successor as she enters the latter stages of her five-year term.”

Shares in BAE Systems lifted, XP Power slides 41%

Monday 2 October 2023 10:17 , Graeme Evans

Shares in BAE Systems have risen 2% or 17.55p to 1015.35p after the MoD announced £4 billion worth of contracts for development work on the next generation of nuclear-powered attack submarines.

The award as part of the trilateral AUKUS programme will fund significant investment at BAE’s Barrow-on-Furness site. Manufacturing is due to start towards the end of the decade, with the first UK submarines in service in the late 2030s.

BAE shares are up by about 30% in the past year but have fallen back since peaking at 1065p in mid-September. They were given additional support today as Berenberg gave the company a “buy” recommendation and 1170p target price.

The improvement for BAE came as the FTSE 100 index rose 5.05 points to 7613.13 on relief that US politicians secured an eleventh-hour temporary funding deal that has avoided an immediate shutdown of government operations.

The agreement resets the clock until 17 November, meaning the release of potentially market-moving US jobs figures will go ahead on Friday.

Other strongly performing stocks in London included supermarket Tesco, which gained 2.1p to 266.3p ahead of interim results on Wednesday.

The FTSE 250 index lifted 64.69 points to 18,344.11, with FirstGroup up 5.5p to 156.4p on hopes of a government funding boost for regional bus services.

Shares in XP Power slumped 41% in the FTSE All-Share after the supplier of critical power control components to the electronics industry issued a profit warning.

The Singapore-based company, a London-listed stock since 2000, said some customers had deferred shipments into 2024 while demand in China has been hit by economic uncertainty.

Shares fell 970p to 1390p as XP said no further dividends are likely in this financial year beyond the quarterly payment due on 12 October.

Peel Hunt offers banking optimism

Monday 2 October 2023 10:09 , Simon English

PEEL Hunt offered some hope today that the moribund market for investment bankers is starting to pick up.

A lack of flotations and takeover deals has left brokers and traders scrambling for trade, with the smaller end of the market in particular struggling.

Peel Hunt, which has seen its own shares crash since it floated in 2021 after a pandemic related trading boom, today said half-year revenues will be up 3.2% to £42.4 million.

It said in its statement to the City: “Whilst exact timing of recovery cannot be predicted, there are encouraging signs that interest rate rises are bringing inflation under control, and we may be nearing the end of the current tightening cycle.”

Peel Hunt was valued at £280 million when it went public. Today the shares were steady at 84p giving it a market value of £109 million.

The broker acted as joint bookrunner to CAB Payments recently, a £335 million raising of new equity. The firm said: “Whilst revenues in Investment Banking were significantly ahead of the same period last year, overall deal activity has remained subdued.”

Bigger players say privately that now there is more clarity on interest rates and inflation, deal flow should improve in the run up to Christmas. Bankers fear sweeping job cuts if that turns out not to be so.

Bills to rise as water industry sets out five-year plans

Monday 2 October 2023 09:55 , Michael Hunter

The cost to households of cutting sewage discharges into rivers and reducing leaks from water mains became clearer today, as the industry filed its next set of five-year business plans with regulators.

An average water bill is likely to go up by £84 in 2025 and by £156 in 2030 as the industry almost doubles the amount spent on updating ageing infrastructure to £96 billion.

If Ofwat approves the plans, £11 billion will be spent to cut enough sewage outflows to fill the equivalent of 6,800 Olympic pools each year.

The plans aim to cut leakage from supply mains by a quarter by the end of the decade. Water firms have faced public anger over the scale of discharges and leaks.

Zoho CEO warns on state of global economy

Monday 2 October 2023 09:54 , Simon Hunt

The boss of Zoho, a billion-dollar Indian multinational IT company, has warned on the state of the global economy after a slump in demand for the firm’s products across the board.

Sridhar Vembu said on X, the site formally known as Twitter: “We saw a fairly pronounced slow down in growth in September across countries and across products.

“Given the geographically and product-wise diversified nature of our revenue streams, I suspect the global economy is taking a turn for the worse. Caution ahead.”

We saw a fairly pronounced slow down in growth in September across countries and across products. Given the geographically and product-wise diversified nature of our revenue streams, I suspect the global economy is taking a turn for the worse.

Caution ahead.— Sridhar Vembu (@svembu) October 2, 2023

Dame Sharon White to step down as John Lewis chair - reports

Monday 2 October 2023 09:44 , Daniel O'Boyle

John Lewis chair Dame Sharon White is to step down next year, according to reports.

According to the BBC, White will not seek reelection when her five-year term as chair ends in 2024.

White survived a confidence vote at the John Lewis Partnership’s 2023 biannual meeting, amid reports that she was seeking outside investment that would have ended the retailer’s history of being fully employee owned.

The partnership, which also owns Waitrose, reported narrowing losses in the first half of 2023.

UK manufacturing decline continues, but at slower pace

Monday 2 October 2023 09:34 , Daniel O'Boyle

UK manufacturing continued its decline in September, but more slowly than in August, according to an influential business survey.

The S&P Global / CIPS UK Manufacturing Purchasing Managers’ Index for September came to 44.3, slightly above the “flash” reading of 44.2.

That was up from August’s 43.0, but still well below the 50 mark that separates growth from decline.

Dr. John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: “Uncertainty in the market and low demand resulted in a difficult end to the quarter for the manufacturing sector, with today’s results putting paid to any hope that falling inflation was a sign of better things to come.

“A subdued global economy and a continued cost-of-living crisis in the UK means the industry is facing the dual challenge of low demand both at home and abroad. New orders and new export business fell in September, causing output to decline for the seventh successive month.”

American salt maker heads to AIM to fuel expansion

Monday 2 October 2023 09:30 , Simon Hunt

A US firm hoping to shake up the salt industry is poised to list on London’s AIM market.

Miami-based MicroSalt, which has developed a low-sodium salt designed to mitigate against the risks of cardiovascular disease, is seeking to raise £10-15 million on the exchange to fuel its expansion plans.

The firm is seeking to attract retail investors to the fund raise, allowing individuals to invest pre-IPO with a minimum £500 commitment.

The global sodium industry is set to be worth almost $10 billion by 2032, according to MicroSalt.

Chancellor gives ‘pay boost for two million’ as living wage increases to £11 an hour

Monday 2 October 2023 09:03

ChancellorJeremy Hunt is expected to use his speech to Tory party conference to confirm an increase in the national living wage to at least £11 an hour from next April.

The Conservatives said the move will benefit two million of the lowest paid, with Mr Hunt also expected to announce ministers will look again at the benefit sanctions regime in a bid to get the unemployed back into work.

It comes as Rishi Sunak resisted calls from fellow Tories to commit to tax cuts in a pre-election giveaway and vowed to prioritise reducing inflation rather than taxes.

BAE leads FTSE 100 higher, United Utilities up 2%

Monday 2 October 2023 08:29 , Graeme Evans

Shares in BAE Systems are the best performing in the FTSE 100 index after the MoD announced £4 billion of funding for the next generation of nuclear-powered attack submarines.

BAE, which rose 22.7p to 1020.5p, was also boosted by analysts at Berenberg raising their recommendation on the shares to “buy” with a new price target of 1170p.

The FTSE 100 rose 18.45 points to 7626.53, with other strongly performing stocks including Burberry and GKN owner Melrose Industries.

United Utilities rose 2% or 16.2p to 964.4p after it presented details of its five-year investment plan, while Tesco rallied 1.8p to 266p ahead of interim results on Wednesday.

The UK-driven FTSE 250 index improved 0.6% or 115.66 points to 18,395.08.

Manolo Blahnik profits more than triple in 2022

Monday 2 October 2023 08:13 , Daniel O'Boyle

Luxury heel maker Manolo Blahnik saw profits more than triple in 2022 as its sales hit a record €118.2 million (£102.4 million).

The business said a rebound in occasion wear after the pandemic helped boost sales, especially in its Hangisi shoe. Towards the end of the year, as the cost-of-living crisis began to take hold, it said simple “investment” pieces such as the Maysale shoe also performed well.

Profit rose to €21.9 million, more than three times the total recorded in the previous year.

CEO Kristina Blahnik said: “We saw another record financial performance in 2022 at Manolo Blahnik Group with sales across all our channels rebounding very strongly and firmly establishing our position in the US market. 2022 was an extraordinary year of consumer demand which will naturally rebalance in 2023 given multiple macro-economic headwinds.

“In celebration of exceeding €100m Group sales for the first time in our history, we were very proud to share an exceptional bonus of over €1m with our Group employees in November 2022, recognising the hard work and dedication of our teams worldwide and their contribution to reaching this milestone.”

Crypto exchange provider Tap Global opens in US

Monday 2 October 2023 07:54 , Simon Hunt

London-listed crypto exchange provider Tap Global today unveiled the next stage in its global expansion plan as it opens to customers in the US.

The firm has partnered with American business Zero Hash and will operate under its existing regulatory license.

The US is the world’s largest cryptocurrency market, estimated to account for 48% of the global market growth between 2022 and 2027, with 17% of all US adults having invested in cryptocurrencies.

It comes during a period of heightened scrutiny of the activities of crypto firms by the US securities regulator.

Tap Global CEO David Carr said: “The US is the biggest cryptocurrency market in the world but has also suffered from the impact of bad actors in the market.

“Tap will offer its new users a secure, regulated and innovative alternative to the platforms currently falling under regulatory scrutiny for their imprudent approach to the safety of consumers and their digital assets.”

US shares seen higher, China activity slows

Monday 2 October 2023 07:23 , Graeme Evans

Wall Street futures are pointing higher and the FTSE 100 index set for a steady start after US legislators avoided a damaging government shutdown.

Saturday’s eleventh-hour funding agreement resets the clock until 17 November, giving traders the chance to refocus on the US economy after Friday’s Federal Reserve preferred measure of inflation showed that price pressures are easing.

On the back of the worst month for US markets so far this year, traders expect key benchmarks to open October in positive territory later.

The FTSE 100 index outperformed Wall Street during September, with CMC Markets forecasting a rise of six points to 7614 at this morning’s opening bell.

The Hong Kong stock market is closed today for the Golden Week holiday but survey data released yesterday showed the composite PMI for China, which measures the manufacturing and services sectors, fell to 50.9 from 51.7 in August.

Nationwide: UK house prices flat in September, down 5.3% year-on-year

Monday 2 October 2023 07:07 , Daniel O'Boyle

House prices in the UK were flat month-on-month in September, but still down 5.3% year-on-year, according to the Nationwide House Price Index.

Prices defied expectations of a 0.4% monthly fall, after a sharp decline in August as the impact of higher interest rates finally appeared to be taking hold.

The average house price is £257,808, according to Nationwide.

In London, house prices fell more slowly, at 3.8% year-on-year, with the average home costing £514,325. That’s a more gentle decline than in June whe the regional index was last published.

Robert Gardner, Nationwide's Chief Economist, said:

“Housing market activity remains weak, with just 45,400 mortgages approved for house purchase in August, c.30% below the monthly average prevailing in 2019 before the pandemic struck. This relatively subdued picture is not surprising given the more challenging picture for housing affordability. For example, someone earning an average income and purchasing the typical first-time buyer home with a 20% deposit would spend 38% of their take home pay on their monthly mortgage payment – well above the long-run average of 29%.

“However, investors have marked down their expectations for the future path of Bank Rate in recent months amid signs that underlying inflation pressures in the UK economy are finally easing, and with labour market conditions softening.

“This in turn has put downward pressure on longer term interest rates which underpin fixed rate mortgage pricing (see chart below). If sustained, this will ease some of the pressure on those remortgaging or looking to buy a home.”

Recap: Friday’s top stories

Sunday 1 October 2023 22:56 , Simon Hunt

Good morning. Here’s a summary of our top headlines from yesterday:

ONS confirms UK economy larger than previously thought as it brings GDP revisions up to date for this year. Economy grew 0.2% in the second quarter compared to the prior one. First quarter GDP growth was revised upwards from 0.1% to 0.3%.

Fifteen stock market listed companies with a combined market value of nearly £170 billion could be vulnerable to takeover, analysis for the Evening Standard shows, deals that would kick start the City and the moribund stock market.

Losses widen to $270 million at cyber security firm Snyk after it completed a round of over 100 layoffs.

CMA approves £1.2 billion purchase of healthtech firm Emis by American multinational United Healthcare

Water Utility firm Severn Trent seeks finance from Qatar Investment Authority as it plans to raise £1 billion via a placing of new shares to fund an overhauled business plan

Asda paid £2.1 billion dividend to its owners after profits sunk 80%.

And...the return of Friday lunchtime drinkers gets City pubs buzzing again.

Yahoo Finance

Yahoo Finance