FTSE 100 Live: Benchmark gilt yield highest since 2008, BAE $5.6bn acquisition, FTSE down 300 points in a week

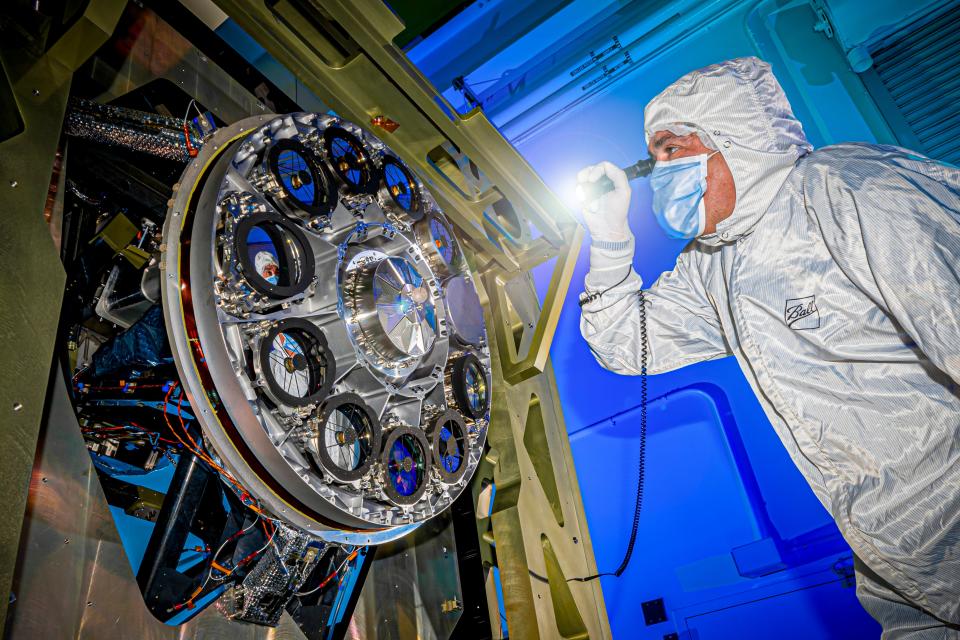

BAE Systems today revealed plans to buy Colorado-based Ball Aerospace in a deal worth $5.6 billion (£4.4 billion).

Chief executive Charles Woodburn called the move a “unique opportunity” to add a high quality, fast growing technology focused business.

The acquisition brightened another dour session after the Federal Reserve fuelled worries that US interest rates will stay higher for longer.

FTSE 100 Live Thursday

BAE Systems to acquire Ball Aerospace for $5.6 billion

US rate rise fears hit markets

Grosvenor owner Rank sees slow London recovery

Workers walked out of ExxonMobil refinery due to safety fears, says union

18:46 , Daniel O'Boyle

Workers at a Fife refinery withdrew their labour over safety concerns prompting calls for an investigation, a union has said.

ExxonMobil’s Mossmorran refinery in Cowdenbeath will be subject to inquiries from the Health and Safety Executive after industrial action on Tuesday August 15.

Unite claimed about 200 workers withdrew their labour at the petrochemical plant – a legal right under the Employment Rights Act – due to safety concerns.

FTSE closes at 7,310.21, down 300 points in five days

16:42 , Daniel O'Boyle

The FTSE 100 closed at 7,310.21 today, down another 0.6%. That means the index has now lost more than 300 points, or 4% of its value, in the space of a week, having closed at 7618 a week ago.

Ocado and Entain both fell by more than 5%, while BAE and Abrdn were also on the fallers board. Top risers included miners Rio Tinto and Glencore as well as Smith & Nephew and Admiral.

Businesses and airport chiefs in new call to scrap the tourist tax

16:27 , Daniel O'Boyle

|More than 350 businesses have called for the reintroduction of tax-free shopping for international tourists to help boost the West End.

They were joined by bosses of Heathrow, Gatwick and London City airports, who warned London was losing out to cities like Paris and Milan as tourists abandoned the capital due to the loss of the tax break.

Business LDN, which represents some of London’s biggest firms, believes scrapping the tourist tax — which effectively makes prices 20 per cent higher in Britain — could generate £4.1 billion annually for the UK economy. It said: “We must do all we can to boost it.”

New luxury homes make affordable housing cheaper, City Hall finds

15:46 , Daniel O'Boyle

Building new homes, even expensive ones, helps to make housing more affordable for those on lower incomes, City Hall has found.

A new research note from the Greater London Authority, based on a number of pieces of economic research, examined the impacts on affordability of new housing supply.

It found that the building of new homes helped to increase the amount of affordable options, even if the new homes were more expensive or located elsewhere in London.

It said that market-rate homes helped make cheaper housing more affordable by “creating chains of vacancies and moves that can reach across an entire housing market area”.

Vertical Future seeks £60 million in fresh funding round

15:15 , Simon Hunt

Farming tech firm Vertical Future is in the course of raising £60 million in a fresh funding round, the Standard can reveal.

The London-based business is seeking to expand operations as it eyes partnerships with major supermarkets to develop giant UK-based vertical farms.

It comes at a difficult time for the vertical farming sector that has seen a string of collapses as businesses struggled to raise the cash to fuel operations. In June, US-based AeroFarms entered administration, while French firm Agricool went into receivership earlier in the year.

But Vertical Future CEO Jamie Burrows insisted his business was not headed in the same direction.

Dutch fintech Adyen loses $13 billion in market value after revenue miss

14:30 , Simon Hunt

Adyen’s shares plunged after increased competition in North America contributed to the slowest revenue growth since its initial public offering, wiping out more than €12 billion ($13.1 billion) of its market value in a single day.

Shares of the Dutch payment processing company fell a record 27% to €1,081.40 at 11:40 a.m. in Amsterdam, the lowest since May 2020. Trading was temporarily halted due to volatility earlier in the day.

Revenue growth in the first half was impacted by pricing competition, as well as higher inflation and interest rates, the Amsterdam-based fintech firm said on Thursday. Net sales rose 21% to €739.1 million in the period, compared to an estimate of €776.5 million in a Bloomberg survey of analysts,

EY to cut jobs and hand out smaller pay rises

14:17 , Daniel O'Boyle

EY is set to cut jobs in the UK and has told staff to expect less generous pay rises as it seeks to cut costs.

The accounting giant has confirmed the round of redundancies will impact staff at its financial services consulting arm amid pressure on market demand.

EY will axe more than 5% of the roughly 2,300-strong practice, with 150 jobs due to be impacted which advise on business transformation and risk management, according to the Financial Times.

FTSE pares losses: lunchtime update

13:04 , Simon Hunt

Midway through the day’s trading session in London, the FTSE 100 has pared back some of the morning’s losses, and is now down just under 0.2%.

But defence contractor BAE Systems remains subdued after this morning’s bumper $5.6 billion acquisition, with the shares down 3.6%.

Here’s a look at yourkey market data.

Entain shares fall as US partner reveals UK move

13:01 , Daniel O'Boyle

Shares in Ladbrokes owner Entain fell as its US joint venture partner MGM Resorts announced that it would launch an online betting site in the UK, without Entain’s technology.

MGM and Entain together ran the BetMGM brand in the US, which is one of the biggest betting operators in the country. Analysts had long seen the joint venture as “unsustainabe” though, with regular speculation that one company would eventually own 100% of the business.

MGM sought to buy Entain last year, but its bid was rejected.

Now, the US casino giant known for venues like the Bellagio is making a move on the Ladbrokes and Coral owner’s home turf with the launch of BetMGM here. Rather than using Entain’s technology, the site will use the platform MGM acquired when it bought Swedish company LeoVegas last year.

“BetMGM is a proven brand in the sports betting and iGaming space, and we look forward to welcoming international players into our platforms designed specifically for them,” said MGM Resorts CEO and President Bill Hornbuckle. “Today’s announcement represents a key step forward in our international growth strategy, which has been advancing rapidly since our acquisition of LeoVegas.”

Shares in Entain are down 4.7% to 1,175p.

“BetMGM, LLC, the joint venture between MGM Resorts and Entain, will continue to operate the BetMGM brand in the United States and Canada utilizing the technology and platform provided by Entain,” MGM said.

Entain said the launch did not impact its business.

It said: “MGM has been operating an UK online casino for some time under the Leo Vegas brand. They are not permitted to operate the BetMGM brand on the highly developed Entain platform utilising its advanced technology outside of the US and Ontario, Canada.

“The UK market is a highly competitive, well-regulated market where many brands operate and where leadership is gained through brand familiarity and high quality, in-house technology. Entain operates a well-known portfolio of respected brands as well as an established online and retail presence. We do not consider that this new launch will make any impact to our business or indeed the market."

City Comment: Our Young Ones deserve better on student digsOur Young Ones deserve better on student digs

12:52 , Jonathan Prynn

Ever since the Young Ones hit TV screens in the 1980s the reputation of student accommodation has been one of chaotic squalor and a sea of empties.

There is something in that.

No one would ever claim that students are the tidiest or most house proud of tenants. But they are young, often vulnerable and living away from home for the first time, and are entitled to expect a decent standard of affordable housing for their years of study.

They also play a crucial role in the London economy. But there is growing evidence that many of the tens of thousands of freshers about to start their courses, and the others beginning second or third years of study, will struggle to achieve that.

10-year gilt yields surge to highest since financial crisis

12:15 , Daniel O'Boyle

Yields for 10-year gilts - a key benchmark for the UK economy - have surged today, hitting the highest point since 2008.

The yield on a 10-year gilt, which represents the return on government debt that is repaid over 10 years, is 4.71%. That is higher than the peak reached in early July amid fears of sky-high interest rates when inflation was still 8.7%, and is also higher than during the mini-Budget crisis which rocked confidence in the UK economy.

The 10-year gilt carries a particular significance as it is seen as the benchmark for “risk-free” lending. It is often used as a general proxy for the strength of the UK economy, is widely held by pension funds and plays a role in the pricing of mortgage rates.

Mortgage price decline continues despite higher Bank Rate expectations

11:47 , Daniel O'Boyle

Average mortgage prices are continuing to fall, data from Moneyfacts shows, even as City traders’ have bet on more Bank fo England rate rises this week.

The average two-year fixed residential mortgage rate today is 6.77%, down from 6.79% yesterday. The average five-year fixed residential mortgage rate today is 6.26%, down from 6.28% .

That comes even as markets now see a rate hike from the Bank of Engand next month as a certainty, and now believe rates will peak at 6%, which would be the highest they have reached this century, rather than the 5.75% that had been expected a week ago.

ITM Power beats revenue expectations, but still makes £94m loss

11:27 , Daniel O'Boyle

Green hydrogen firm ITM Power’s revenue more than doubled expectations at £5.2 million, but the business still made a loss of £94 million.

Revenue expectations had been just £2 million, but the business easily beat that mark.

Shares are up 4.4% to 91p, but are still down more than 87% from their peak in 2021.

CEO Dennis Schulz said: “I have been at ITM for just over half a year, joining the company at a time of challenging operational and financial performance, and it is encouraging to see the amount of progress we have been making against our 12-month plan laid out in January 2023.

“The implementation, which is moving at pace, will strengthen our operational and commercial capabilities, and steer a successful path to becoming a highly efficient and reliable volume manufacturing company.

“Whilst some revenues related to product deployments have yet to be recognised at customer site acceptance testing, I am very proud that more products have left the ITM factory over the past six months than in the previous 22 years of its history. This is a testament to tangible progress on our transformation journey.”

‘Still hope’ for Wilko employees with administrators’ decision expected next week

10:44 , Daniel O'Boyle

There is “still hope” for Wilko’s more than 12,000 employees, as administrators pore over bids to save the collapsed retailer and hope to reach a decision next week.

Administrators at PwC set a cut-off date of Wednesday for prospective buyers to submit bids for all or part of Wilko. It is understood that they are currently weighing up bids that came in yesterday, and are likely to decide the fate of the chain next week.

Previous management couldn’t find a buyer for the entire chain in the days before it was declared insolvent. However, administration would allow parts of the business to be sold, meaning more profitable stores could be saved while others may be forced to close.

US rate rise fears hit markets, FTSE 100 down again

10:18 , Graeme Evans

Pressure on the FTSE 100 index continued today as traders reacted to the prospect of US interest rates staying higher for longer.

Minutes of the Federal Reserve’s July meeting made it clear that America is not yet out of the inflation woods, meaning further policy tightening may be needed.

The 10 year US Treasury yield, used as the benchmark for global borrowing costs, rose to near a 15-year high at 4.31% as Wall Street increased bets on a rate rise by November.

With US stock markets in the red last night, the developments meant a poor session in London as the FTSE 100 index fell another 29.13 points at 7327.75.

Deutsche Bank analyst Henry Allen said: “It’s clear that investors are adjusting to the fact that rates could remain at a higher level for some time.”

He added that futures contracts for the US interest rate in December 2024 are now at their highest level so far this cycle at 4.34%. The current level is between 5.25% and 5.5% after July’s 0.25% increase.

The FTSE 100 index has fallen 5% so far in August, erasing the gains of the previous month amid evidence of stubbornly high core inflation and unease over China and its debt-laden property sector.

Despite the demand uncertainty, mining stocks were the best performers in London’s top flight as Rio Tinto rose 53.5p to 4612.5p and Glencore added 3.55p to 423.05p.

On the fallers board, GSK shares fell 22.6p to 1348p after the drugs giant began trading without the value of its forthcoming dividend.

The FTSE 250 index dropped 104.95 points to 18,475.83, with the US-focused pair of digital publisher Future and corporate merchandise firm 4imprint down more than 2%.

Bank of Georgia delivered the stand-out performance, jumping 13% or 410p to 3620p after reporting forecast-beating half-year results.

Among small caps, Sheffield-based green hydrogen firm ITM Power rose 3.88p to 90.5p as annual revenues of £5.2 million came in more than double City forecasts. Underlying losses, however, were at the top end of guidance at £94.2 million.

‘Tourist Tax’ holds back Grosvenor Casinos London recovery

09:46 , Daniel O'Boyle

The boss of Grosvenor Casinos owner Rank Group said Middle Eastern high-rollers are choosing Paris and Milan over London, holding its venues in the capital back even as the rest of the country recovers.

Revenue for the year to 30 June came to £306.3 million for Rank, which also owns Mecca Bingo. This was up on the previous year but still 15% below pre-pandemic levels, mostly due to London revenue still being 26% below 2019.

Over the past six weeks, performance continued to pick up across most of the UK, but London revenue ticked up by only 5%.

Sunak signals state pension could rise by almost 8% as he commits to triple lock

09:02 , Daniel O'Boyle

Rishi Sunak has signalled that state pensions could go up next year by almost 8% as he committed to maintaining the “triple lock”.

Under the triple lock, the state pension is uprated in April by inflation, wages or 2.5%, whichever is higher.

Wage growth is currently the highest of the three metrics, reaching 7.8% in June compared with the same period 12 months earlier.

FTSE 100 remains under pressure, Rio Tinto higher

08:29 , Graeme Evans

Shares in BAE Systems are among the biggest FTSE 100 fallers, down 3% or 30.2p to 972.3p after it unveiled plans to buy Colorado-based Ball Aerospace in a deal worth $5.6 billion (£4.4 billion).

The fallers board also includes a number of ex-dividend stocks, with fund management business Abrdn down 7.8p to 166.15p and GSK off 28p to 1342.6p.

The FTSE 100 index tracked overnight losses on Wall Street and in Asia after market sentiment was hit by fears over a further tightening of US monetary policy.

London’s top flight lost 35.26 points to 7321.62, despite a recovery for the mining sector as Rio Tinto lifted 68.5p to 4627.5p and Glencore rose 4.4p to 423.9p.

The FTSE 250 index weakened 81.36 points to 18,499.42, with the best performing stock being Bank of Georgia. The lender jumped 340p to 3550p after announcing a further share buyback programme alongside half-year results.

BAE shares slide after blockbuster merger

08:20 , Simon Hunt

BAE shares have fallen as much as 3.1% in the opening minutes of trading in London after the defence firm unveiled its blockbuster deal to buy Ball Aerospace.

Here’s a look at your key markets data this morning.

Tech consultancy Kin + Carta offers good news for beleaguered shareholders

08:11 , Daniel O'Boyle

“Digital transformation” consultancy Kin & Carta said profit for 2023 should beat expectations, in a relief to investors after shares lost more than 70% so far this year.

Revenue is set to be flat and in line with expectations, but the business said cost-cutting measures will help ensure it makes a profit of around £18 million, beating expectations by more than 10%.

Chief executive Kelly Manthey said: "We executed through a challenging second half to return to modest quarterly growth with an improved cost base. While macro challenges remain across the sector, I am encouraged by the start to Q1 underpinned by a solid foundation of enterprise clients."

Shares rose by 11% this morning, but are still down 67% for the year, mostly due to a dramatic fall ater a February profit warning.

Fears grow over higher for longer US rates

07:50 , Graeme Evans

Expectations of another interest rate hike by the Federal Reserve last night lifted the 10 year US Treasury yield to its highest closing level since 2008 at 4.25%.

The move followed minutes from the central bank’s July meeting, when there was broad agreement on a 0.25% increase to a range of 5.25%-5.5%.

The majority of participants also “continued to see significant upside risks to inflation” that could require further tightening of monetary policy.

Deutsche Bank strategist Henry Allen said markets are taking the prospect of another hike from the Fed increasingly seriously, with futures now pricing in a 45% chance of a further hike by the November meeting.

He said: “As well as the upcoming decisions, it’s clear that investors are adjusting to the fact that rates could remain at a higher level for some time.”

He added that futures for the interest rate at the Fed’s December 2024 meeting are now at their highest level so far this cycle at 4.34%

London holding back Grosvenor Casinos owner Rank Group

07:49 , Daniel O'Boyle

Casino and bingo hall owner Rank Group has seen strong growth for its Grosvenor casino brand outside of London this summer, but "softer" performance in the capital due to slow return of overseas visitors.

In the last six weeks, revenue outside of London had been up by 25%. However, performance in London was much weaker, rising by only 5%.

That comes as revenue for the year to 30 June fell to £306.3 million, down 15%. Again, this was mostly driven by a decline in London, where revenue fell by 26%.

CEO John O’Reilly said: “The return of customers to our Grosvenor and Mecca venues continues to pick up and our second half numbers give cause for optimism after a very challenging couple of years.

“During that time, our UK venues have faced a surge in energy costs, high wage inflation, a tightening in the regulatory environment, the slow return of overseas visitors to London’s casinos and the more general pressures on the consumer’s discretionary expenditure.”

The business has faced labour challenges, especially in terms of hiring croupiers, as before Brexit most of these staff came from the EU. This led to higher wage costs for the business.

Between the lower revenue and higher wage costs, profit halved to £20.3 million.

FTSE 100 seen lower after Federal Reserve inflation warning

07:14 , Graeme Evans

This week’s downbeat run for global markets is continuing after minutes of July’s US Federal Reserve meeting hinted at the need for further interest rate rises.

Whereas traders had hoped last month’s 0.25% increase to a range of 5.25%-5.5%would be the last in the cycle, the hawkish message from policymakers was that more action may be required due to significant upside risks to inflation.

The minutes put downward pressure on US shares to leave the S&P 500 index 0.8% lower and the Dow Jones Industrial Average down 0.5%. The tech-focused Nasdaq Composite lost 1.1%, with the selling continuing during Asia trading hours after the Hang Seng index declined by almost 1%.

The FTSE 100 index, which is heading for its worst weekly decline in over a month, fell by 0.4% yesterday and is forecast by CMC Markets to open 37 points lower at 7320.

BAE Systems to acquire Ball Aerospace for $5.6 billion

07:12 , Simon Hunt

Defence company BAE systems has reached an agreement to buy US firm Ball Aerospace from the Ball Corporation in a $5.6 billion deal.

BAE said the acquisition would be funded by a combination of new external debt and existing cash resources.

Colorado-based Ball Aerospace designs spacecraft and defense systems for national governments. The firm has more than 5,200 employees, of whom over 60% hold US security clearances.

CEO Charles Woodburn said: "The strategic and financial rationale is compelling, as we continue to focus on areas of high priority defence and Intelligence spending, strengthening our world class multi-domain portfolio and enhancing our value compounding model of top line growth, margin expansion and high cash generation.”

Recap: yesterday’s headlines

06:52 , Simon Hunt

Good morning. Here’s a summary of our headlines from yesterday:

UK’s largest contractor Balfour Beatty defies gloom from high inflation and interest rates to report 9% sales hike to £4.5m and higher profits

Landscaping and paving slabs specialist Marshalls lays off 250 staff after hit by housebuilding slump with first half sales down 13%

Jamie Oliver’s company pays £5 million dividend as profits rise from £6.5 million to £7.7 million

Yahoo Finance

Yahoo Finance