FTSE 100 Live 03 July: Paramount shares rocket, US rate cut hopes boost stocks, Vodafone in VMO2 network deal

Optimism that US interest rates will be cut in September has given a boost to global markets.

Mining heavyweights are among the beneficiaries in London amid an improved FTSE 100 session.

A Vodafone network deal with VMO2 is in the corporate spotlight, while Topps Tiles has reported more tough trading conditions.

FTSE 100 Live Wednesday

Vodafone and VMO2 in network deal

Keywords Studios backs £2.1bn takeover

Topps Tiles hit by tough conditions

FTSE finishes higher

16:51

At the end of the day’s trading session in London, the FTSE 100 has closed up 50 points to 8,171.

JD Sports was one of the worst performers today, with its shares down 4% to 113p. The stock has now sunk more than 15% over the past month.

Russ Mould, investment director at AJ Bell, said: “JD Sports was subject to broker coverage, except this time it wasn’t favourable commentary. Barclays downgraded its rating on the stock to ‘underweight’ which triggered a share price decline in the retailer.

“JD Sports is one of the worst performing FTSE 100 stocks this year as investors worry that demand is weakening for athleisure and expensive trainers. It hasn’t helped that trainers giant Nike keeps issuing gloomy updates, spelling out the problems in the industry.”

Biden weighs leaving presidential race: NYT

16:07

Joe Biden has told an ally he is considering whether to pull out of the US presidential race, according to an explosive story just released by the New York Times.

Biden reportedly acknowledged that repeat performances of the kind he put on during last week’s TV debate with Donald Trump would mean “we’re in a different place,” according to the Times, in news that could prompt markets to reevaluate the chances of a Democratic presidential victory in November’s election.

A White House spokesperson has denied Biden said this.

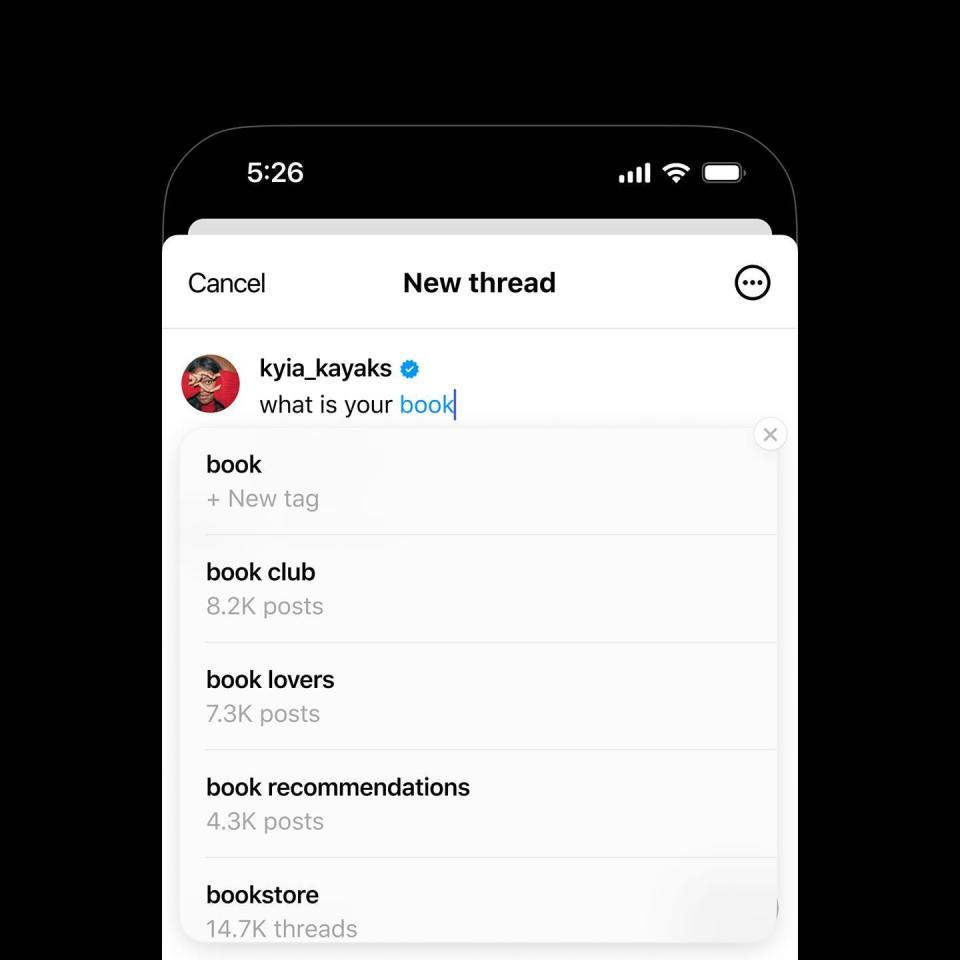

Meta's Threads mulls ads as it hits 175 million users

15:54 , Simon Hunt

A year on from its launch, Meta’s Threads, designed as a rival to X, formerly Twitter, is exploring selling ads on the platform after its monthly user numbers hit 175 million, up from 150 million three months ago.

In an interview with US tech website Platformer, Threads chief Adam Mosseri said: “ It has been a wild year. Given that we had 100 million registrations in the first four and a half days, expectations went through the roof immediately.

“Then, the product went through what every new product does, which is a novelty phase where everyone tries it out. After a couple of weeks, the numbers went down in terms of actual daily users. Then all of a sudden, we were a complete failure in everyone's eyes. And then...we started to really grow again, and actually get significantly bigger than even those initial registration numbers.”

Charlie Mayfield: Fixing apprenticeships rules should be a priority

15:14

The former boss of John Lewis writes in today’s Standard.

I welcome the proposal to reform the Apprenticeship Levy. Its problems have been discussed for some years now – indeed, last year the British Retail Consortium, UKHospitality, techUK, and the Recruitment & Employment Confederation, sent an urgent joint letter urging the Government to increase the flexibility of how that money could be spent.

Shockingly, over £3.5bn has been wasted so far due to rules such as preventing Levy money being spent on courses that take less than a year to complete. In its current form, the Levy is out of step with the needs of businesses and workers. Its transformation into a Growth and Skills Levy will allow people to enter apprenticeships and boot camps in formats which work for them, and help employers upskill from within their organisations.

Labour’s localism angle is also welcome – empowering Combined Authorities to manage their adult skills education budgets will allow regional decision-makers to work with local businesses and ensure people develop skills aligned with the needs of local economies.

Paramount shares surge on Wall Street open

14:45 , Simon Hunt

US stocks were largely flat in the opening minutes of trade on Wall Street. The S&P 500 opened higher by 0.1% points at 5,514, while the Nasdaq rose 0.1% to 20,033 after the opening bell.

But shares in Paramount jumped as much as 12% amid reports film and TV producer Skydance Media has reached a deal to merger with National Amusements, the company that controls Paramount.

Previous discussions between the two firms had fallen apart, but Skydance has reportedly returned with an offer of better terms including a higher valuation for National Amusements.

Hawksmoor eyes sale deal worth reported £100m

14:04

Restaurant group Hawksmoor is considering a sale which could be reportedly worth around £100 million.

The upmarket steakhouse chain has hired investment bank Stephens to assess interest from potential buyers.

The Financial Times, which first reported the process, said co-founders, chief executive Will Beckett and Huw Gott, plan to retain their shareholding and continue to lead the company.

UK private equity firm Graphite Capital has owned a 51% stake in Hawksmoor since 2013 after it supported a management buyout deal for the group.

Lunchtime update: FTSE higher as Bitcoin sinks

12:30 , Simon Hunt

Midway through the day’s trading session in London the FTSE 100 has continued to make gains and is up 0.6% to 8,167 points.

British Airways owner IAG is the biggest gainer, up more than 4%, while Sainsbury’s has reversed some of the losses its shares made yesterday. Meanwhile, Bitcoin prices have continued their decline, falling around 12% over the past month.

Susannah Streeter, head of money and markets, Hargreaves Lansdown, said: “’The FTSE 100 has opened higher, riding on the coattails of the fresh enthusiasm which swept over Wall Street, with any political uncertainty pushed into the background.

“Stocks have largely been driven upwards by hopes that interest rate cuts are on the horizon and a soft landing is in sight, thanks to encouraging comments from the chair of the Federal Reserve. Jerome Powell said that the US is back on a disinflationary path due to recent weaker inflation readings.”

Billionaire Nik Storonsky builds side quant bet to Revolut -- Bloomberg reports

11:45 , Bloomberg News

Nik Storonsky spent the past decade shaking up banking with his financial services firm Revolut. Now the billionaire former Lehman Brothers trader is looking to pull off a similar feat in venture capital.

Storonsky has built a quantitative investment firm for early-stage companies that relies on algorithms and artificial intelligence over human input to source deals.

Founded in 2022, QuantumLight has invested in almost a dozen startups in the past year after raising about $200 million for a debut fund that Storonsky anchored.

City Comment: Vodafone's deal is a landmark moment

11:17 , Jonathan Prynn

It may not be the sexiest headline ever seen but today’s agreement over 5G network sharing between Vodafone and Virgin Media 02 may be one of the most important pro-growth business deal sealed in this country for a long while.

Typically, it comes on the wave of an election that will see power transferred from a Conservative party led by “unlucky general” Rishi Sunak who will not get to reap any of the benefit.

The smart piece of corporate footwork cleverly takes away one of the key potential regulatory objections to Vodafone’s planned merger with its UK competitor Three by giving VM02 the right to buy more network spectrum if the combination goes ahead.

That should unlock around £11 billion of investment in a network that is in danger of falling dangerously behind those of other major economies. The UK was one of the first countries to start the roll-out of 5G in 2019.

But by last year it had fallen to 39th among 56 advanced and developing markets for 5G availability, and 21st out of 25 developed markets for download speed with France. Germany and the Netherlands all ahead.

There is little chance of the UK returning to the 2% growth rates that was seen as par before the financial crisis without the technology infrastructure that underpins modern economies just as much as roads or railways being fir for purpose.

Successive Vodafone bosses have been making the case for consolidation in the sector for years now - and if course it suits their book. But in this case, for once, the interests of the corporate entity and the common weal are aligned.

The CMA will rightly take a close look at whether the consumer is protected if this merger goes through but most other developed countries manage with three rather than four major competing players. After the years of chaos and drift the UK simply cannot afford to lose any more ground on its rivals in an area so vital to future prosperity.

Vodafone strikes network pact with VMO2

10:02 , Simon Hunt

Vodafone’s blockbuster £15 billion merger with Three edged a step closer to completion today after the telecoms giant signed a fresh network deal with its biggest British rival, Virgin Media O2.

The pact, which is set to last for more than a decade, extends the two firms’ existing network sharing arrangement while also allowing VMO2 to acquire more network spectrum in the event that the merger goes ahead.

That would ensure that Vodafone’s combination with Three would not dominate the UK’s mobile network infrastructure, a move that it is hoped will placate competition regulators’ concerns over the size of the merged entity, ahead of a final decision on whether to approve the deal scheduled for later this year.

Miners lead FTSE 100 recovery, Baltic Classifieds up 4% in FTSE 250

09:38 , Graeme Evans

Glencore and Rio Tinto shares today rose 2% and silver miner Fresnillo by 3% as the sector rallied on hopes that lower US rates could soon boost demand.

The upturn followed comments by Federal Reserve chair Jerome Powell suggesting that the central bank is becoming more confident about the downward path of inflation.

With US traders now seeing a 75% chance of a cut by September, the S&P 500 index and Nasdaq Composite set fresh records at last night’s closing bell.

The strong US handover helped the Hang Seng index up 1.1% and Tokyo’s Nikkei 225 above 40,000 for the first time in three months after a 1.4% improvement.

The FTSE 100 index recovered from recent losses by adding 31.43 points to 8152.63, with BetMGM partner Entain among the other risers with a gain of 12.2p to 630.8p.

On the fallers board, JD Sports Fashion dropped another 3.1p to 114.5p after analysts at Barclays downgraded their recommendation to “underweight” with 110p target price.

The shares were among the FTSE 100’s worst performers during the first half of 2024, falling 28% after the company issued a profit warning in January.

In the FTSE 250, an upbeat Baltic Classifieds rose 4% or 9p to 250p as the online advertising firm reported a 38% rise in annual profits to 32 million euros (£27.1 million). Revenues were 19% higher at 72.1 million euros (£61.1 million).

He is guiding towards 15% revenue growth for the current year, reflecting continued strong demand in the auto, property and recruitment sectors.

Among the small caps, a strategic investment by Rio Tinto lifted shares in Sovereign Metals by 3.6p to 37.1p.

Proceeds from the $18.5 million (£9.7 million) move, which increases Rio’s stake to 19.8%, will be used to advance Sovereign’s Kasiya rutile and graphite project in Malawi.

The company hopes to develop a world-class mine capable of supplying critical minerals to the titanium pigment, titanium metal and lithium-ion battery industries.

Tile market in slump

08:39 , Simon English

Sluggish consumer confidence is making life hard for Topps Tiles, the tile maker that has been around since 1963.

There is “subdued demand” for home repair sales “especially for bigger ticket projects” as potential customers battle an ongoing financial squeeze.

Sales in the third quarter fell 6.9%. The company think it is doing better than the wider tile market, which is down 10% -15% this year.

CEO Rob Parker thinks things may turn soon. He said: “Positive macroeconomic data on inflation, real wage growth, improving consumer confidence and increased activity in the housing market provides some confidence in a cyclical recovery, and the Group is well-positioned to benefit from this due to its growing market share, leading brands, specialist expertise and world-class service.”

The shares fell 2p to 39p.

Miners lead FTSE 100 rebound, JD Sports lower after downgrade

08:36 , Graeme Evans

Mining stocks are behind a stronger session for the London market, with shares in Antofagasta, Rio Tinto and Glencore all up by 2% or more.

Their performances, which reflected optimism that the Federal Reserve will cut interest rates in September, helped the FTSE 100 improve 0.5% or 40.46 points to 8161.66.

Heavily-sold Burberry and Diageo also showed signs of recovery, lifting 57.5p to 2521p and 10p to 857.6p.

On the fallers board, JD Sports Fashion came under fresh pressure after Barclays downgraded its recommendation to “underweight”. The shares lost 4.1p to 113.5p.

The FTSE 250 index rose 75.64 points to 20,270.11, with Baltic Classifieds up 4p to 245p on the back of the online advertising platform’s annual results.

Vodafone strikes fresh network deal with Virgin Media O2

07:21 , Simon Hunt

Vodafone has struck a fresh network sharing agreement with Virgin Media O2 in a boost to the firm’s hopes of winning approval for its merger deal with Three.

The operators have agreed to extent a partnership that was due to expire in 2025, while Virgin Media O2 will acquire more spectrum to better align spectrum holding between different operators in anticipation of the takeover being waived through. The acquisition is conditional upon the merger being completed.

Vodafone’s planned merger with Three is under investigation by the UK’s competition regulator with a decision expected before the end of the year.

Lutz Schüler, CEO of Virgin Media O2 said: "We are extending and bolstering elements of our existing network sharing arrangement, while also ensuring there is a robust, balanced and functional structure in place for the long-term should Vodafone and Three's proposed merger gain consent.”

Keywords Studios backs lower, £2.1 billion bid from private equity firm EQT

07:21 , Michael Hunter

Keywords Studios, the video game services firm, has backed a lowered, £2/1 billion takeover offer from private equity firm EQT.

The 2450p per share cash price means the bid is about £100 million lower. The cut comes due to delays with key projects at the Dublin-based firm, which were identified during the due diligence process.

Keywords provides “technical and creative solutions” used in games from Fortnight to Subway Surfers.

The deal means it will become the latest firm to leave the London Stock Exchange, as its new owners take it private.

It has also worked with some of the biggest names in the tech sector, including Apple and Google as well as Netflix and Activision Blizzard.

But a drop in industry spending means some current revenue projections have been pushed back.

Keywords said today the offer was “fair and reasonable”, at a premium of alomost 67% to where the share price was in mid-May before the approach was first made. The stock closed at 2318p yesterday

Keywords was advised by Deutsche Numis and Robey Warshaw.

Recap: Yesterday's top headlines

07:12 , Simon Hunt

Good morning from the Standard City desk.

The aisles might be full at Sainsbury’s but buried in the supermarket’s first quarter trading update were pretty grim numbers from its Argos operation.

Like-for-like sales were down a painful 7.7% with our old friends, “unseasonal” weather and “softer demand” from consumers, blamed for the decline.

Of course the rotten weather did not help sales of outdoor furniture but do these figures tell us something more interesting about the state of mind of the consumer in the middle of 2024 as we approach election day? And it could partly help to explain the landslide that is inevitably coming on Thursday.

A 15-year squeeze on living standards that has left households virtually no better off than they were before the financial crisis shattered the comfy assumption that, economically speaking — “things can only get better” — as the old song has it.`

Argos was not the only high street retailer with disappointing numbers today. Shoe Zone, which has 330 stores around the UK, also dropped a profit warning that sent its shares tumbling. Official retail sales data have been on a bit of a rollercoaster this year. The deteriorating numbers from Argos — and many others — suggest that the high street is far from out of the woods yet.

~

Here’s a summary of our top headlines from yesterday:

Rachel Reeves talks of “huge potential” of the City as she puts sealing a deal with Brussels on mutual recognition of qualifications as a top priority

Sainsbury’s sees 4.8% growth in first quarter and gains market share but stock sinks

Shoe Zone issues profit warning over shipping costs and weak demand during for summer ranges during wet weather

Canary Wharf fintech Revolut’s revenues surpass $2.2bn, with record profits of $545m in 2023 in boost for UK bank license bid

Ryanair flies 19 million pax in a month for the first time as post-covid travel boom continues

Stansted’s owner Manchester Airport group makes £240 million profit in post-covid bounce back

FTSE 100 seen higher, US markets lifted by interest rate outlook

07:12 , Graeme Evans

The FTSE 100 index is set for an improved session after US markets were boosted yesterday by optimism on the near-term outlook for interest rates.

Comments by Federal Reserve chair Jerome Powell reassured investors that the central bank is becoming more confident about the path of inflation.

With markets now pricing a 75% chance of a cut by September, the S&P 500 index and Nasdaq Composite rose by 0.6% and 0.8% respectively.

Asia shares benefited, leaving the Hang Seng index up 1.2% and the Nikkei 225 above 40,000 for the first time in three months following a 1.3% rise.

London’s FTSE 100 index is set to open about 50 points higher at 8171, having drifted to a two-month low over recent sessions.

Yahoo Finance

Yahoo Finance