Fresh Off The Block: Singapore amongst top most impacted countries by FTX’s collapse alongside South Korea and Japan

Fresh Off The Block: Singapore, along with South Korea and Japan, is one of the hardest hit countries by FTX's collapse and more

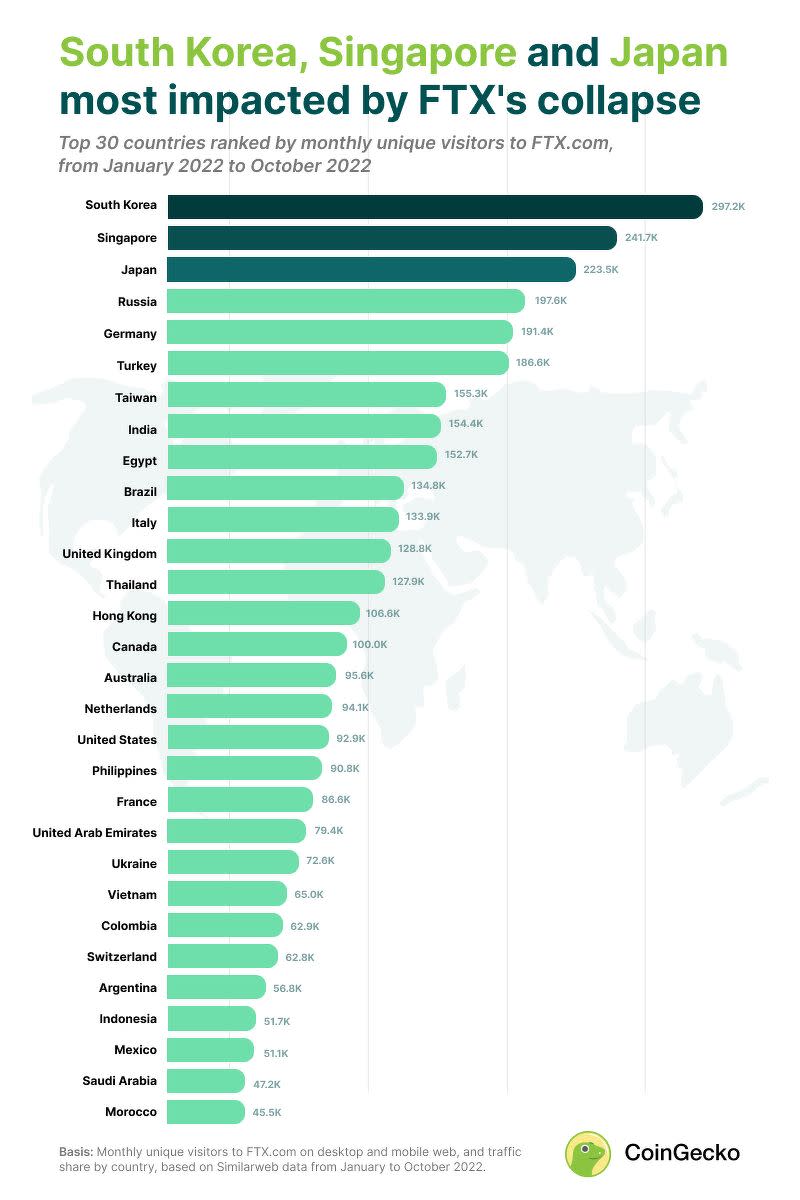

Singapore is one of the hardest hit countries by the recent fall of the second largest cryptocurrency exchange FTX, along with other countries such as South Korea and Japan, according to data from crypto analytics firm CoinGecko.

Singapore makes up 5% of FTX’s global traffic with 241,675 monthly average unique users on the exchange and is the second most impacted country by the exchange’s demise. In recent times, Singapore state holding investment company Temasek also wrote off their US$275 million ($379 million) investment in FTX.

The most impacted country by FTX’s collapse is South Korea, with the country witnessing the highest traffic share of 6.1% on the exchange, representing 297,229 unique users on average visiting the exchange per month. In third place, Japan represents 223,513 monthly average unique users visiting FTX and 4.6% of the exchange’s global traffic share.

Image Credit: CoinGecko

The collapse of FTX caused its token, FTT’s, market capitalisation to fall by 90%, wiping out US$2.6 billion of the market from Nov 1 to Nov 16. On Nov 28, FTT is trading at US$1.29, down 98.5% from its all-time high of US$84.18 on Sept 9, 2021.

Earlier on Nov 22, cryptocurrency exchange Independent Reserve issued a call for “urgent and practical regulatory action to be taken to protect Singapore’s crypto investors,” particularly in the wake of FTX’s collapse.

Adrian Przelozny, CEO of Independent Reserve says “responsible advertising” would allow licensed and regulated entities to responsibly convey critical security-related information to Singapore’s crypto investors in a more transparent and open manner moving forward.

“The FTX situation has been a major setback for the whole industry. It highlights the need for greater transparency and accountability, and for a regulatory framework that actually protects consumers,” says Przelozny,

Earlier this year on Jan 17, the Monetary Authority of Singapore (MAS) released guidelines preventing cryptocurrency or digital payment token (DPT) service providers from promoting or advertising themselves to the general public.

However, according to Przelozny, allowing regulated industry players who have undergone the necessary checks and balances to communicate with consumers would better drive awareness of safer options for investors genuinely interested in cryptocurrency.

“We have repeatedly expressed that the silence hurts consumers the most. More importantly, it is imperative that we look at practical steps to ensure that we are able to responsibly communicate with investors in Singapore as a licensed and regulated exchange,” he adds. “This will prevent investors from being exposed to and trading with unlicensed entities, and avoid a potential repeat of the recent FTX events.”

Meanwhile, MAS-licensed payments institution StraitsX announced its partnership with global fintech firm and issuer of USD Coin (USDC) and Euro Coin (EUROC) Circle on Nov 24.

The collaboration will allow users with either personal or business accounts to deposit and receive US Dollars (USD)/USDC via StraitsX’s platform. StraitsX account holders will now also be able to mint USDC by depositing USD into their StraitsX accounts, and redeem USDC to receive USD in their StraitsX accounts.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Bitcoin drops as tremors from China unrest spook global markets

Temasek's failed investment in FTX is a 'pain' but let's 'fry other fishes', says Ho Ching

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance