Freehold vs leasehold properties: what are the differences?

When you buy a house in the UK, you pay your money and then you own the house, right? Unfortunately, it’s not quite that simple.

Unlike in other countries, property ownership in England is multi-layered, with a range of different structures including freehold, leasehold, or sometimes a combination of the two.

Leaseholds have become more common over time. More than half of homes in London are leaseholds while Manchester too is approaching a similar figure.

There were nearly five million leasehold properties in the UK in 2023 which – although a small drop from the year before – is a significant increase from the early 1990s when, according to Hansard, only around a million people lived in such homes.

In recent years, leaseholders have campaigned for extra rights and the Government enshrined some of these – including a ban on the sale of new leasehold houses (but not flats) – into law in 2024.

Michael Gove, the Levelling Up secretary, has described leasehold as a “feudal” system and expressed support for the establishing of a “commonhold” model used in other countries.

This guide will explain what the main differences are between freehold and leasehold properties, and everything you should consider before buying one.

What is a freehold property?

A freehold property is one which you own outright – including the building and any land on which it sits.

There is no other freeholder to pay ground rent too (more on that later) and you are solely responsible for any maintenance that needs to be carried out within its boundaries.

Most houses in the UK are sold on a freehold basis. It is possible that this might not be the case, particularly in the case of houses which have been subdivided into flats – common in major cities – and those sold through shared ownership schemes.

Freehold flats are relatively rare.

What is a leasehold property?

A leasehold property is one in which, rather than buying the property outright, you buy the right to own for a fixed time period – usually 99, 125 or 999 years.

You do not own the land or building in which your property is located. This means you do not have much control over any common areas, although you are also not directly responsible for its maintenance.

Leasehold properties will come with additional ground rents and service fees to cover the maintenance and other potential issues. Some leaseholders have found themselves facing huge bills for unscheduled maintenance in recent years, particularly following the Grenfell fire and subsequent fire safety requirements.

What are the key differences between freehold and leasehold properties?

The main difference between leasehold and freehold properties is the length of ownership. With a freehold property, you own the building and the land it stands on outright. With a leasehold, you purchase the right to own the property for a set period of time.

Freehold properties do not come with any additional costs as a condition of ownership, although you will need to budget for maintenance and other similar things yourself.

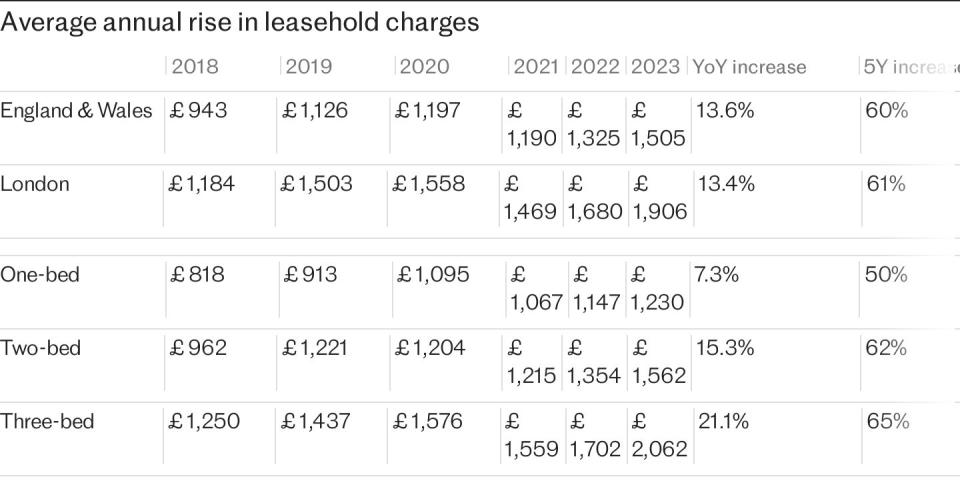

With leasehold properties, you will be required to pay a ground rent – an annual fee paid to the freeholder – and sometimes also a service fee, to cover things like maintenance or electricity bills for common areas. This can also be used to pay for major repairs, which can lead to sudden high increases in service charges paid by freeholders.

Your lease is also for a set period of time. This is almost always well into the decades and sometimes for more than a century, but you should be wary of properties with a relatively short lease. It can be extended – for a fee.

Below is a table showing some of the benefits and downsides of both types of ownership.

What is ground rent?

Ground rent is the charge for leasing the land on which your property is located. While your lease covers your property, it is very unlikely that it covers the land.

You will need to pay the ground rent according to the terms of your lease, but it will usually be due once or twice a year – or occasionally paid per quarter – to the freeholder.

Ground rent has become a point of controversy in recent years. Starting in the early 2000s, many freeholds were sold to companies seeking to make a profit. Some of these were sold on as an investment on the basis of escalating ground rents and there have been cases where leaseholders have been faced with ground rents which double over a set period of time.

The Competition and Markets Authority has taken some action to prevent this, but you should make sure you understand any ground rents on a property before making an offer.

What are service fees?

Service fees are similar to ground rents, but they are intended to cover things like building maintenance, electricity bills for common areas and any other communal features. They are paid to a management company, which has been appointed by a freeholder, to run a housing development or block of flats.

Service charges can change from year to year, as they are based on the cost of work carried out, but you have the right as a leaseholder to see a breakdown of how they are calculated.

This should split out how much money is being paid to manage the building and how much is being paid as regards maintaining the building. You can also ask for receipts to prove the work has been done as stated.

The freeholder must also consult you for any major work costing more than £250 or lasting for more than a year.

Since the Grenfell Tower fire in 2017, there have been highly publicised cases of leaseholders being quoted astronomical service fees to remove flammable cladding from the exterior of their building. These cases have been subject to court litigation, and the Government has intervened.

Nevertheless, you should make sure you understand the terms around service fees before purchasing a leasehold property.

How does building maintenance work?

If you are a freeholder, then you are responsible for any maintenance which needs to be done to your property – whether to the building itself or the land.

You will need to budget for this to avoid unexpected costs cropping up that you cannot afford. You will not need to ask permission to make any changes to your property, although of course major work like extensions will be subject to planning permission.

Leaseholders are not responsible for organising maintenance or cleaning of communal areas, although they are financially liable via service fees. You are still responsible for maintenance to your own property.

You will need to ask the freeholder’s permission to make major changes.

How can you extend a lease?

You can ask the freeholder if you can extend the lease at any point in your ownership. As long as you qualify, you can extend the lease on a flat by up to 90 years and the lease on a house by up to 50 years.

You can also attempt to negotiate changes to the lease. If you cannot agree on changes it is possible to take the case to a tribunal.

There will be a cost involved in extending your lease. You can calculate the estimated cost using the Lease Advisory Service’s calculator.

As part of the Government’s Leasehold and Freehold Reform Act, it should become easier and cheaper to extend a lease. A requirement for a new leaseholder to wait two years after buying a property to buy or extend a lease has also been scrapped.

Are there other options for ownership?

There are a couple of other property ownership options, although they are very rare.

Share of freehold means that all of the leaseholders in a property jointly own the freehold. This has a number of benefits, including complete control over maintenance costs and the ability to extend leases to up to 990 years.

Leaseholders can purchase the freehold if more than half agree, but the cost is likely to be very high and a management company would need to be established.

Commonhold is an obscure ownership option meant to be an alternative to leasehold. The leaseholders hold the freehold in common. It operates in a similar way to leasehold, but there is no expiring lease.

Yahoo Finance

Yahoo Finance