Franklin BSP Realty Trust's (NYSE:FBRT) investors will be pleased with their 0.009% return over the last year

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Franklin BSP Realty Trust, Inc. (NYSE:FBRT) have tasted that bitter downside in the last year, as the share price dropped 10%. That falls noticeably short of the market return of around 25%. Franklin BSP Realty Trust hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Franklin BSP Realty Trust

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Franklin BSP Realty Trust share price fell, it actually saw its earnings per share (EPS) improve by 107%. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

We don't see any weakness in the Franklin BSP Realty Trust's dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Unless, of course, the market was expecting a revenue uptick.

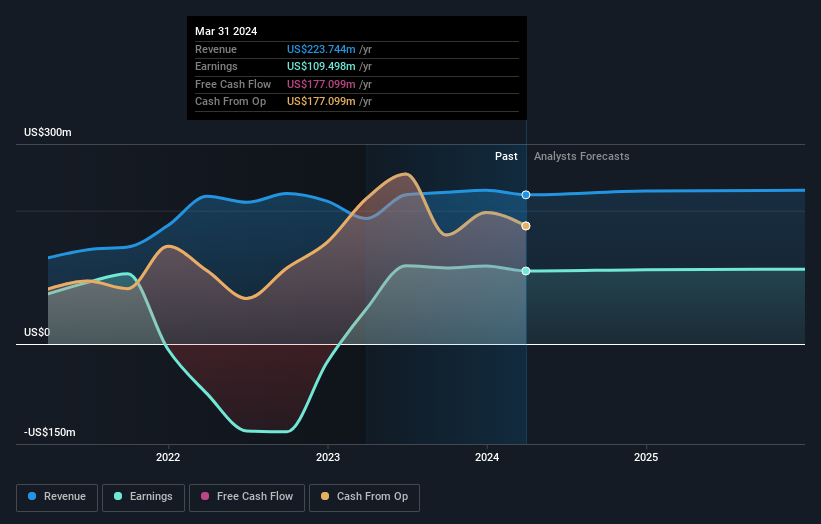

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Franklin BSP Realty Trust's TSR for the last 1 year was 0.009%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Franklin BSP Realty Trust shareholders have gained 0.009% for the year (even including dividends). The bad news is that's no better than the average market return, which was roughly 25%. The stock trailed the market by 8.2% in that time, testament to the power of passive investing. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). It's always interesting to track share price performance over the longer term. But to understand Franklin BSP Realty Trust better, we need to consider many other factors. For instance, we've identified 2 warning signs for Franklin BSP Realty Trust (1 can't be ignored) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance