Francis Chou's Strategic Move into Liberty SiriusXM Group Marks a Notable Portfolio Shift

Insights from the Latest 13F Filing for Q1 2024

Francis Chou (Trades, Portfolio), a renowned value investor and the fund manager of Chou America Mutual Funds, has once again demonstrated his investment acumen in the first quarter of 2024. Starting his career in Canada with a modest beginning, Chou has built a reputation over the decades for his deep value investment philosophy, heavily influenced by Benjamin Graham. His approach focuses on long-term gains through investments in undervalued stocks, emphasizing strong balance sheets and potential for future growth.

Summary of New Buys

Francis Chou (Trades, Portfolio) strategically expanded his portfolio by adding two new stocks during this period. Notably, he invested in:

Liberty SiriusXM Group (NASDAQ:LSXMK), purchasing 15,032 shares. This addition makes up 0.51% of his portfolio, with a total value of $456,540 million.

Imperial Oil Ltd (IMO), acquiring 5,000 shares, which represents about 0.4% of the portfolio, valued at $352,550 million.

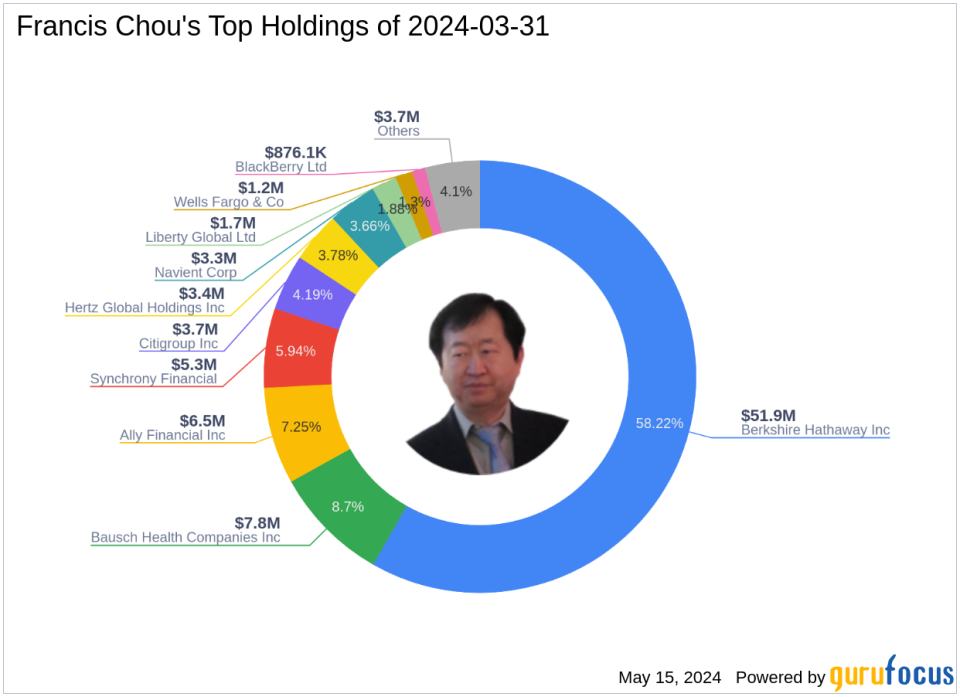

Portfolio Overview

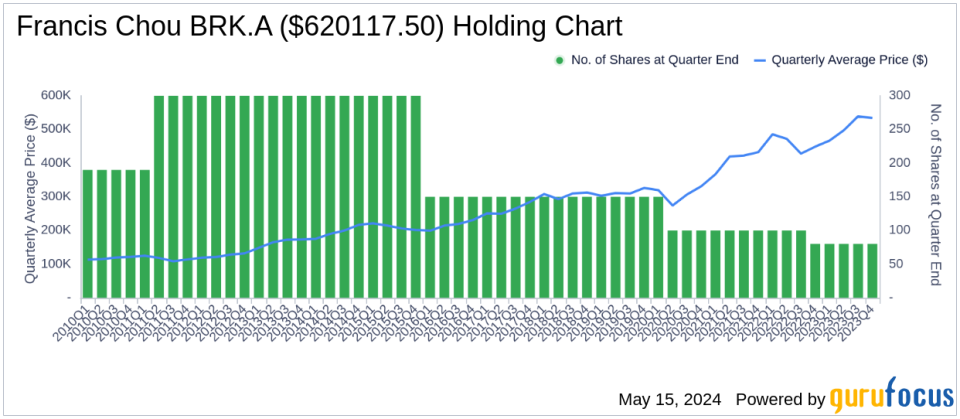

As of the first quarter of 2024, Francis Chou (Trades, Portfolio)'s investment portfolio includes 18 stocks. His major holdings are concentrated in several key sectors, reflecting a diverse range of industries. The portfolio is heavily weighted with 58.22% in Berkshire Hathaway Inc (NYSE:BRK.A), followed by significant positions in Bausch Health Companies Inc (NYSE:BHC), Ally Financial Inc (NYSE:ALLY), Synchrony Financial (NYSE:SYF), and Citigroup Inc (NYSE:C). These investments span across various industries including Financial Services, Healthcare, Industrials, Consumer Cyclical, Communication Services, Technology, Energy, and Basic Materials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance