Focus remains on rising risk-free rates as equities flounder

Developed markets equities likely to be pressured by rising risk free rates which are higher for longer

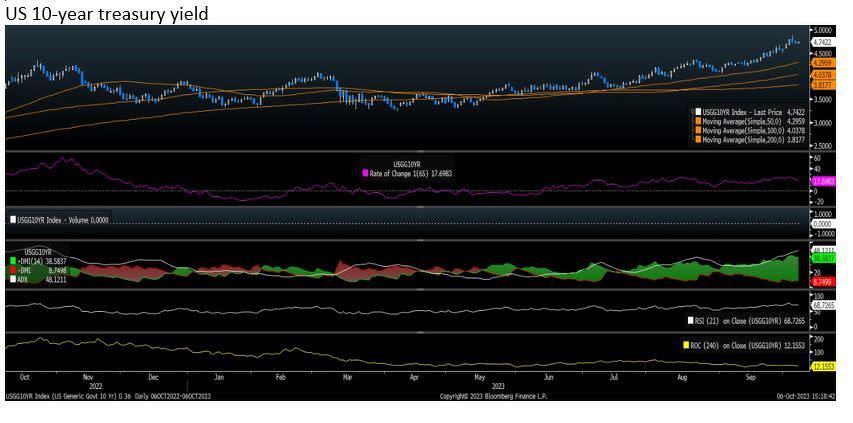

The 10-year US treasury yield (10Y) is at its highest level since the global financial crisis. The technical chart shows a very clear uptrend. If the uptrend accelerates, then it is likely to end soon, in exhaustion. But this is not the case currently.

Directional movement indicators, on the other hand, do look a trifle over-extended. ADX is at 48, which is high. The DIs are positively placed, suggesting that this indicator is becoming overbought. On the other hand, quarterly momentum is not overbought, and neither is 21-day RSI which is at 68.

In sum, technical indicators are mixed, and on balance they appear to be on the high side but not particularly overbought. This suggests that the 10Y could ease a bit, but would resume the uptrend following any temporary pause or pull-back.

RHB Bank economist Barnabas Gan says the 10Y is set to move towards 5%. “Our end-2023 UST10YR yield forecast remains unchanged at around 5.0% as investors digest the higher-for-longer US Fed Fund Rates into end 2023. In 1H2024, we do not discount the possibility for the UST10YR yield to rise further to 5.5%, with the balance of risks tilted towards 6.0%.”

According to Gan, US core PCE inflation remains elevated and is unlikely to get back to the Fed’s 2% target in 1H2024. Instead, core inflation could rise towards the year-end. “We keep to our forecasts for the Fed Funds Rate to rise to 5.5 – 5.75% in 4Q2023, with the balance of risks tilted towards 5.75 – 6.0% in 1Q2024. The risk-to-reward ratio for UST10YR is hinged upon the widening US federal budget (expected to balloon further vs 2022's US$996 billion deficit),” Gan says in an update on Oct 6.

Apart from the political machinations in the US House of Representatives that is currently without a House Speaker, the news out of China doesn’t instill confidence. “We remain negative on China given its property market woes and its recovery (if any) appears precarious, while global investors weigh on higher global inflation and a tighter US monetary policy approach,” Gan says.

The Straits Times Index fell 43 points week-on-week to end at 3,174 on Oct 6. Although the index experienced a sell-off mid-week, it rebounded from a low of 3,147, which is a tad below the support area around 3,150. The STI could attempt to move a little higher, but resistance is likely to appear at the flat 100-day moving average at 3,225. Since the STI’s ADX is in the low teens, its movements are likely to be within a range of 3,150 and 3,225.

In past years, October was a skittish month for both stocks and bonds, with notable sell-offs in both. Although the hope is that this time is different, the month hasn’t started well.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

STI's 'sideways volatility' to stay but earnings growth and turnaround plays exist

A mild retreat by risk-free rates won’t help equities to rally

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance