FMC & Optibrium Partner for Crop Protection Technologies

FMC Corporation FMC has announced a partnership with Optibrium, a leading provider of software and artificial intelligence (AI) solutions for small molecule discovery. The collaboration is part of FMC's strategic objective to accelerate the discovery and commercialization of its pipeline.

FMC's Discovery process will be expanded to include Optibrium's novel Augmented Chemistry AI technology, allowing speedier delivery of novel solutions to growers. Machine learning and AI approaches will be used to find potential compounds, optimize their properties and maintain the company's focus on sustainable solutions.

FMC will use Optibrium's Cerella and StarDrop technologies to expand its internal research and development. Cerella is an AI platform that uses deep learning to accelerate molecular discovery, allowing more accurate predictions and better experimental prioritizing, ultimately increasing return on investment. StarDrop adds to this by designing and optimizing small molecules, as well as collaborating with Cerella to use AI for better data analysis in discovery.

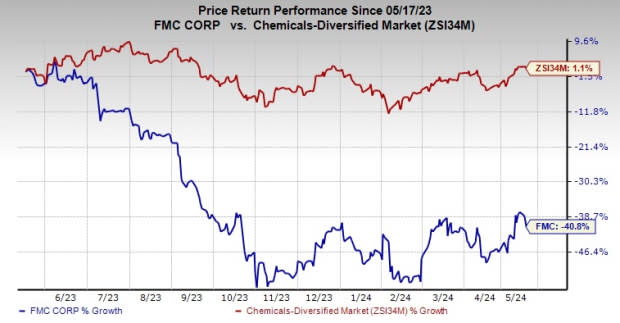

Shares of FMC have lost 40.8% over the past year against 1.1% rise of its industry.

Image Source: Zacks Investment Research

FMC, on its first-quarter call, said that it sees full-year 2024 revenues between $4.50 billion and $4.70 billion, indicating a 2.5% increase at the midpoint from 2023. Adjusted EBITDA is expected in the range of $900 million to $1.05 billion, flat at the midpoint year over year. Adjusted earnings are forecast between $3.23 and $4.41 per share, up 1% year over year at the midpoint. Full-year free cash flow is anticipated to be $400-$600 million.

FMC forecasts second-quarter revenues to be between $1 billion and $1.15 billion, suggesting a 6% increase at the midpoint from the second quarter of 2023. Adjusted EBITDA is forecast in the band of $170-$210 million, essentially flat year over year. Adjusted earnings are expected in the range of 43-72 cents for the second quarter, implying a 15% rise at the midpoint .

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Zacks Rank & Key Picks

FMC currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI has a Zacks Rank #2 (Buy), at present. ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 76.2% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Carpenter Technology currently sports a Zacks Rank of 1, at present. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 111.3% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, which currently carries a Zacks Rank #2, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 33.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance