Flowers Foods (FLO) Q1 Earnings Missed Estimates, Sales Up Y/Y

Flowers Foods, Inc. FLO reported mixed first-quarter fiscal 2024 results, with the bottom line missing the Zacks Consensus Estimate and staying in line year over year. The top line missed the consensus mark but increased from the year-ago quarter’s reported level.

Results gained from effective implementation of portfolio strategy and investments in marketing and innovation. Despite challenging market conditions, the company’s brands flourished, gaining market share and achieving growth in branded retail volumes. Efforts to enhance profitability in away-from-home and private label segments are also yielding positive results, notably expanding margins.

Management is maintaining its 2024 outlook, anticipating continued volume improvement while being apprehensive of ongoing economic uncertainty and its potential effects on consumer behavior and promotional activities.

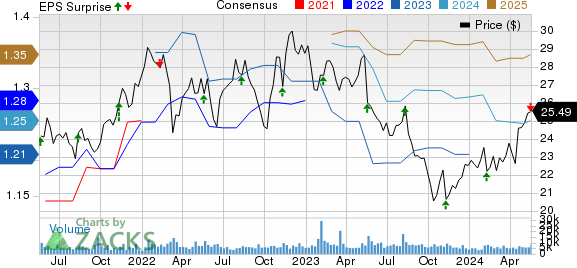

Flowers Foods, Inc. Price, Consensus and EPS Surprise

Flowers Foods, Inc. price-consensus-eps-surprise-chart | Flowers Foods, Inc. Quote

Q1 Highlights

Adjusted earnings per share (EPS) of 38 cents missed the Zacks Consensus Estimate of 40 cents. The bottom line came in line with the year-ago quarter’s reported figure.

Sales increased 2.8% year over year to $1,576.8 million. The top line missed the Zacks Consensus Estimate of $1,578.4 million. The pricing/mix remained favorable by 3.1%, while volumes fell by 0.8%. The Papa Pita acquisition contributed to sales growth by 0.5%. We had estimated the price/mix to be up 3.8% and volumes to decline 1.8% in the first quarter.

Branded Retail sales rose 3.5% to $1,014.9 million due to improved prices undertaken last year, a favorable mix from more branded organic product sales and gains from the acquisition.

Other sales inched up 1.4% to $561.9 million due to improved prices and gains from acquisitions, somewhat countered by lower volumes.

Our model suggested Branded Retail sales growth of 2.5% and Other sales appreciation of 2.3% for the quarter under review.

Costs & Margins

Materials, supplies, labor and other production costs (exclusive of depreciation and amortization) contracted 160 basis points (bps) to 50.6% of sales on moderating ingredient and packaging costs and inflation-induced pricing actions undertaken last year. This was partly negated by a rise in labor costs.

Selling, distribution and administrative (SD&A) expenses came in at 39.7% of sales, up 110 bps. This can mainly be attributed to higher labor and technology expenses. Nevertheless, reduced distributor distribution fees as a percentage of sales offered some respite.

Adjusted EBITDA climbed 5.5% to $159.4 million. The adjusted EBITDA margin was 10.1%, expanding 30 bps.

Financial Aspects

Flowers Foods ended its fiscal first quarter with cash and cash equivalents of $15.8 million and long-term debt of $1,043.50 million. Stockholders’ equity amounted to $1,375.9 million.

For the quarter ended Apr 20, 2024, cash flow from operating activities amounted to $105.1 million, and capital expenditures were $33.3 million. The company paid out dividends worth $51.1 million.

Image Source: Zacks Investment Research

Fiscal 2024 Guidance

The company expects sales in the range of $5.091-5.172 billion, suggesting flat to a 1.6% increase year over year.

Adjusted EBITDA is likely to be in the range of $524-$553 million compared with the $501.7 million recorded in the fiscal 2023. For the fiscal 2024, the adjusted EPS is envisioned in the range of $1.20-$1.30 compared with $1.20 delivered in the fiscal 2023.

Management expects depreciation and amortization in the range of $160-$165 million, while net interest expenses are likely to be $22-$26 million. For the fiscal 2024, capital expenditures are projected in the range of $145-$155 million.

This Zacks Rank #3 (Hold) stock has rallied 13.7% in the past three months compared with the industry’s growth of 3.7%.

Top 3 Picks

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

The J. M. Smucker Company SJM, a branded food and beverage product company, currently carries a Zacks Rank #2 (Buy). SJM has a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for J. M. Smucker’s current fiscal year earnings indicates growth of 7.6% from the year-ago reported figure.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 24.6% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance