FLEX Augments Portfolio With the Acquisition of FreeFlow

Flex Inc FLEX recently announced the buyout of FreeFlow, which is renowned for its services in global secondary markets, specializing in asset disposition, digital circular economy tracking and reporting capabilities.

The initiative is likely to augment FLEX’s service footprint across emerging markets, such as data center, enterprise and lifestyle, unlocking new sources of revenues and fostering sustainability through second life products.

With more than two decades of experience, FreeFlow has effectively revamped product lifecycle profitability by leveraging its profound understanding of circularity and offering a scalable, cloud-based B2B secondary marketplace for asset disposition. FreeFlow's B2B digital marketplace platform is the hub of its operations, empowering customers to efficiently sell surplus and returned inventory while safeguarding primary channel strategies.

By integrating FreeFlow's capabilities into its existing portfolio, FLEX enhances its product lifecycle services, comprising design, supply chain management, advanced manufacturing, vertical integration, post-production and post-sale support. Also, the acquisition strengthens its reverse logistics and circular economy capabilities (as part of its after-sale services), incorporating repair, refurbishment, asset recovery, sustainability analytics and recycling services.

By leveraging FreeFlow's platform, Flex aims to offer a comprehensive suite of services, catering to a broad spectrum of clients from cloud computing to lifestyle brands, enabling them to embrace second-life products and execute their environmental commitments, added FLEX.

Headquartered in Singapore, FLEX has a global presence spanning 30 countries. The company offers advanced manufacturing solutions and additional value to customers through a robust range of services, including design and engineering, component services, rapid prototyping, fulfillment and circular economy solutions.

FLEX’s acquisition strategies over time have been instrumental in expanding its manufacturing footprint as well as driving growth across multiple end markets. It has acquired many companies over the years, including Mirror Controls International (Apr 29, 2015), Olio Devices (Jun 01, 2017), AGM Automotive (Feb 21, 2017) and Nextracker (Sep 8, 2015). The latest acquisition was Anord Mardix (Dec 1, 2021).

Nextracker has been a key contributor to company’s financial performance. However, in order to unleash its true potential, Flex has separated its primary operations from Nextracker. In October, the company announced its plan to spin off roughly 51.47% interest in Nextracker to Flex shareholders on a pro-rata basis. Following the spin-off of Nextracker in fourth-quarter fiscal 2024, its historical financials are now reported under discontinued operations.

However, softness across the Agility and Reliability Solutions segments has impeded its revenue growth in the last reported quarter. Revenues (excluding Nextracker) declined 11.7% year over year to $6.2 billion, beating the Zacks Consensus mark by 1.1%.

Management expects macro headwinds to persist throughout 2024, negatively impacting various end markets. An increase in global tax rates remains an additional concern.

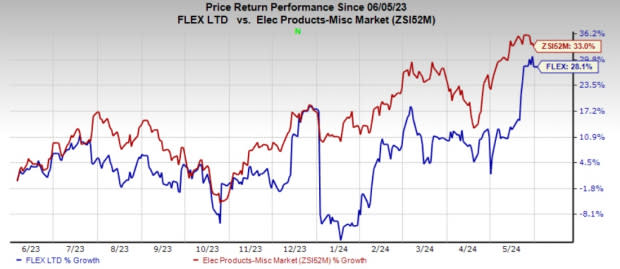

At present, FLEX has a Zacks Rank #4 (Sell). Shares of the company have gained 28.1% in the past year compared with the sub-industry’s growth of 33%.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience.

Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy) at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

NVIDIA Corporation NVDA, sporting a Zacks Rank #1, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance