First Solar (FSLR) to Start 5th Production Facility in Louisiana

First Solar, Inc. FSLR recently unveiled plans to construct its fifth manufacturing facility at the Acadiana Regional Airport in Iberia Parish, LA. As part of its expansion plans, First Solar intends to invest up to $1.1 billion in this facility, which is projected to boost FSLR’s solar module manufacturing capacity by 3.5 gigawatts (GW).

The construction of the facility is expected to reach completion in the first half of 2026.

First Solar’s Expansion Plans in the United States

The recently enacted Inflation Reduction Act of 2022 highlights tax credits for solar modules and solar module components manufactured in the United States. This, along with the strong demand First Solar enjoys for its solar modules in the U.S. solar market, offers the company solid incentives to invest heftily in the production ramp-up to expand its manufacturing capacity.

FSLR is currently on track to expand and upgrade its Ohio Series 6 factories to achieve an additional aggregate annual throughput of 0.9 GW, with the additional capacity expected to come online in 2024.

Similarly, its new Alabama facility is also on the schedule for completion by the end of 2024, with commercial operations ramping through 2025. This facility is expected to add 3.5 GW of annual nameplate capacity once fully ramped. When fully operational, these expansions in Ohio and Alabama are expected to increase its annual nameplate capacity in the United States to more than 10 GW by 2025.

The latest investment in Louisiana puts First Solar on track to grow its manufacturing footprint to approximately 14 GW in the United States. This should enable First Solar to maintain its position as the largest U.S. solar module manufacturer.

Peers Focus on Boosting Manufacturing Base

Per the report from the Solar Energy Industries Association, the total capacity of the solar industry in the United States is likely to triple by 2028. This unfolds immense opportunities for major solar players in the industry to expand their manufacturing base and capitalize on the probable high demand in the days ahead.

In this context, apart from First Solar, solar companies that are also boosting their manufacturing capacity in the United States are as follows:

Enphase Energy ENPH: The company is actively looking at expanding manufacturing capacity in the United States. It plans to open four to six manufacturing lines in this nation by the second half of 2023.

Enphase boasts a long-term earnings growth rate of 23.2%. The Zacks Consensus Estimate for ENPH’s 2023 sales suggests a growth rate of 19% from the prior-year reported figure.

Canadian Solar CSIQ: The company announced in June 2023 that it is building its first manufacturing facility in the United States for producing solar photovoltaic modules. The company has picked up Mesquite, TX, as the location for its first-ever manufacturing base in the nation.

The Zacks Consensus Estimate for Canadian Solar’s 2023 earnings calls for a growth rate of 67.4% from the prior-year reported figure. The Zacks Consensus Estimate for CSIQ’s 2023 sales implies a growth rate of 24.4% from the prior-year reported figure.

SolarEdge SEDG: The company is currently planning to establish manufacturing capabilities in the United States by using contract manufacturers and establishing its manufacturing facility. SEDG expects to ramp up the shipments of inverters from a contract manufacturer's U.S. manufacturing site toward the end of 2023.

The long-term earnings growth rate of SolarEdge is 30.5%. The Zacks Consensus Estimate for its 2023 sales suggests a growth rate of 24.5% from the prior-year reported figure.

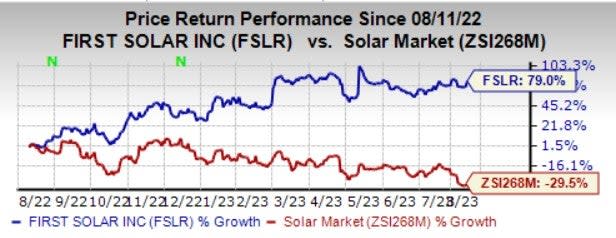

Price Movement

In the past year, shares of First Solar have surged 79% against the industry’s decline of 29.5%.

Image Source: Zacks Investment Research

Zacks Rank

First Solar currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance