First Mover Americas: Investors Pile Into Bitcoin ETPs Following BlackRock ETF Filing

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

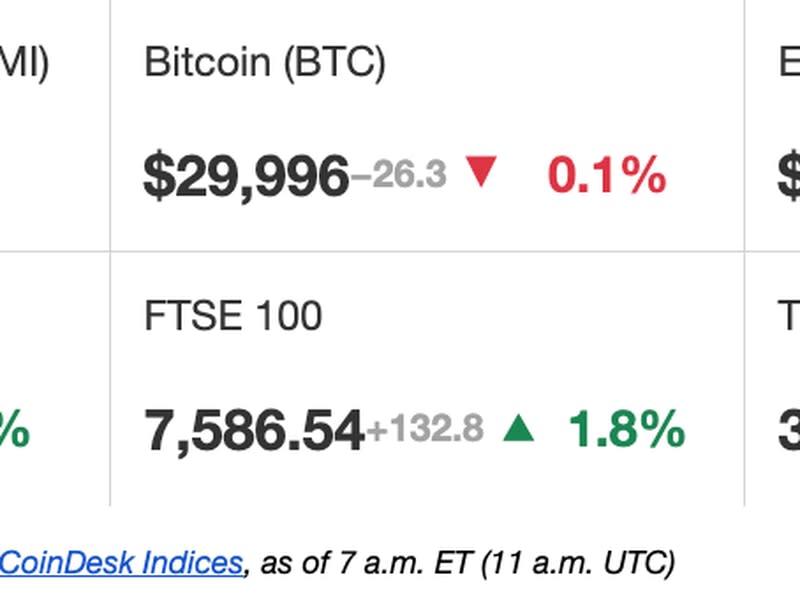

Latest Prices

Top Stories

Crypto investors have poured money into bitcoin exchange-traded products at a record pace ever since BlackRock filed for a spot-based ETF on June 15. New data from K33 Research shows the BTC-equivalent exposure of ETPs listed worldwide increased by 25,202 BTC ($757 million) to 196,824 BTC in the four weeks to July 16. That's the second-highest monthly net inflow, surpassed only by inflows seen following the launch of ProShares’ futures-based ETF and other futures-based ETFs in October 2021, according to K33 Research’s Vetle Lunde.

Societe Generale's (GLE) cryptocurrency division, SG Forge, has become the first company to receive a license to offer crypto services in France from the country's financial regulator. SG Forge is licensed to provide buying and selling, exchange and custody of digital assets as of July 18, according to the Autorité des Marchés Financiers (AMF)'s website. While dozens of crypto firms, including the world's largest cryptocurrency exchange, Binance, are registered with the AMF, SocGen's crypto division is the first to receive a license.

Messaging platform Telegram issued $270 million in bonds this week to fund its growth until "we reach the break-even point," CEO Pavel Durov announced Tuesday. The platform is not yet profitable and has rising expenses due to its "massive growth," Durov said. It’s onboarding 2.5 million new users a day and earlier this year hit 800 million monthly active users. "I personally bought about a quarter of the new Telegram bonds, investing tens of millions into Telegram's growth. This comes in addition to the hundreds of millions I spent over the last 10 years to keep Telegram operational," Durov said. The alternative messaging platform has long been a favorite among crypto enthusiasts. That's partly attributable to the company's defunct efforts to launch its own crypto token, GRAM.

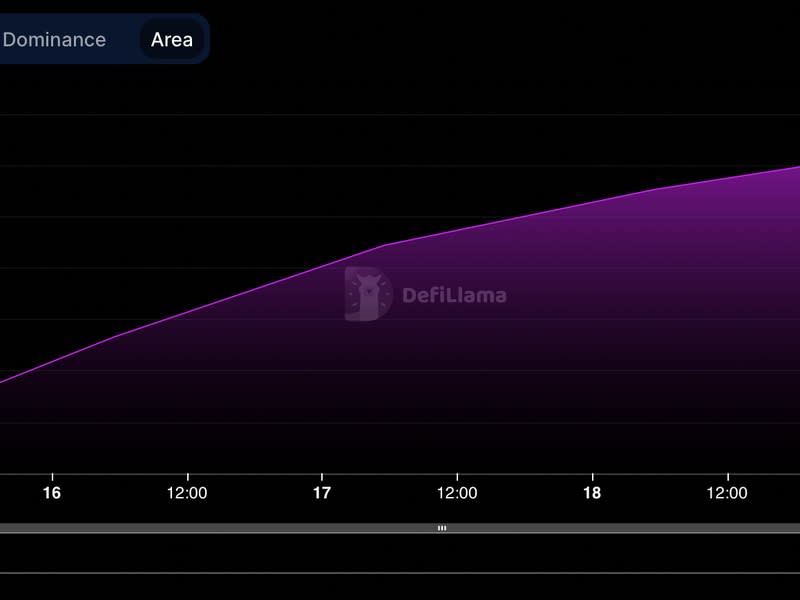

Chart of the Day

The chart shows DeFi lender Aave's algorithmic dollar-pegged stablecoin GHO has crossed $3 million in market capitalization within four days from the launch.

The stablecoin can be minted by locking AAVE, ETH, USDT, USDC and DAO as collateral on Aave V3.

Source: DeFiLlama

- Omkar Godbole

Trending Posts

Arkham's Token Debuts at $0.75 After Being Sold for $0.05 in Binance Launchpad

Crypto VC Firm Polychain Capital Raises $200M for Fourth Fund: Fortune

XRP’s 60% Weekly Gain Defies Broader Crypto Slump as Bitcoin Stalls Below $30K

Yahoo Finance

Yahoo Finance